Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

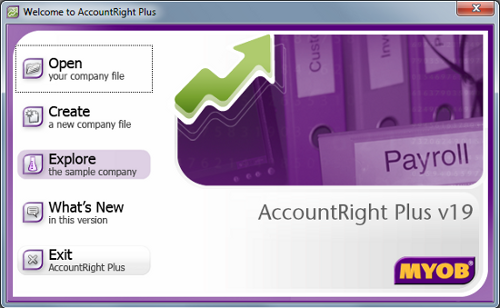

MYOB Support Q&A: Entering Employee Payments Manually using Journal Entries

If you are a micro-business but you’ve want to pay yourself wages for tax reasons you don’t need to buy MYOB AccountRight Plus. You can enter the information into the system using Spend Money and Journal Entries.

The most important aspect of performing the staff payment task is knowing how much money you owe to the employee, the ATO and the employees Superannuation company. We created a simple spreadsheet to calculate the amount of PAYG, Super, and other Levys that are owed when you pay a staff member. This spreadsheet is freely available to all of our Microsoft Excel Course students.

Once you have this information you can take advantage of our MYOB Q&A Guide that we’ve just added to our MYOB online Payroll Course.

Please note that our MYOB Q&A service is designed to take questions from students about specific topics which may not be included in our course. We take these questions to our software specialists and produce a short instructional guide to help you with your real life need using Microsoft Excel, MYOB and WordPress.

If you want to receive regular updates about when this information is released, please subscribe to our EzyLearn Blog.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.