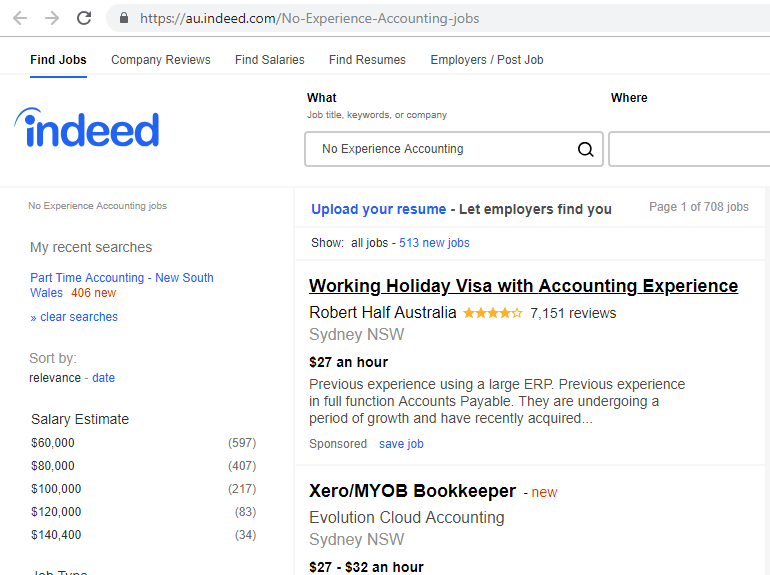

This is a fantastic new offer that is available for a limited time AND available on ALL our Payroll Training Courses in Xero, MYOB AccountRight, MYOB Essentials and QuickBooks Online.

Confidence performing Payroll tasks can kick-start your accounts career and make you more valuable to your current employer. If you are a job seeker it’s even more important to have payroll administration knowledge. Continue reading Learn Payroll Administration in 1 day for $99 – Limited Time Course Offer