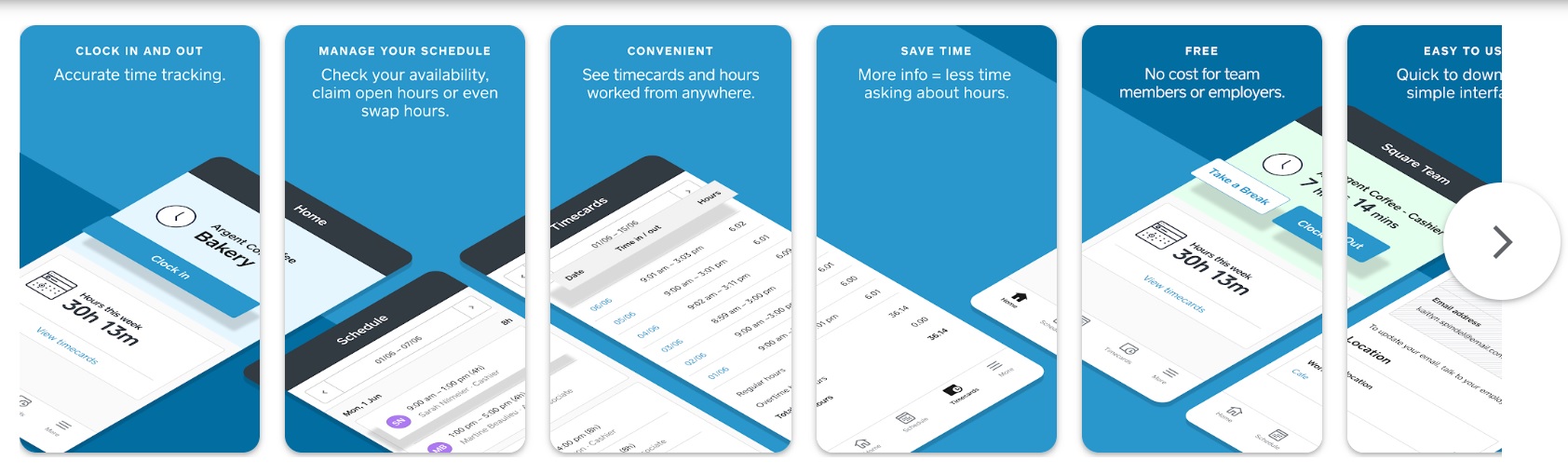

These are the market leading workforce management integrations for rostering, scheduling and time and attendance monitoring. Deputy was one of the first but the major accounting software companies are now snapping them up.

The most interesting story here has been KeyPay. I’ve loved the fact that Intuit partnered with the Australian company KeyPay to provide all of the local Australian payroll functionality in their QuickBooks Online software. Tsheets would also have been in this list but you know what happened to them..

Continue reading Deputy, KeyPay, Square Teams, QuickBooks Time Training Course NOW Available