LinkedIn, Job recruiters and the Internet

Toward the end of 2012, LinkedIn, the social media platform for professionals, reported that their stock had jumped a massive 20 percent in just one day, taking their annual revenue to $860 million. The results were impressive. Forbes magazine was speculating that the company, which was first publically just two years earlier, could soon outpace the revenues of employment website giant, Monster.com. It even looked as though LinkedIn could achieve what other employment websites hadn’t: combining job ads with the art of recruitment.

Toward the end of 2012, LinkedIn, the social media platform for professionals, reported that their stock had jumped a massive 20 percent in just one day, taking their annual revenue to $860 million. The results were impressive. Forbes magazine was speculating that the company, which was first publically just two years earlier, could soon outpace the revenues of employment website giant, Monster.com. It even looked as though LinkedIn could achieve what other employment websites hadn’t: combining job ads with the art of recruitment.

The main driver of LinkedIn’s success – and indeed the company’s main focus – is its Talent Solutions service, which allows companies to market itself and target talent directly, without the need for a middleman, like a recruiter. This, many have speculated, sounds the death knell for an already wounded recruitment industry, which has been about as secretive about the talent procuring process as Colonel Sanders was about those 11 herbs and spices.

Great For Jobseekers and Entrepreneurs

LinkedIn is a fantastic networking tool for businesses and individuals alike and an equally fantastic online resume for independent contractors and jobseekers; both are topics we’ve written about quite extensively on this very blog. But to truly determine how useful it is to jobseekers, we thought we should look at how useful it is for businesses.

The usefulness of something, particularly for a business, is usually determined in monetary terms – in other words, how much does it cost and how much time or money (though both time and money are synonymous in business) will it save us?

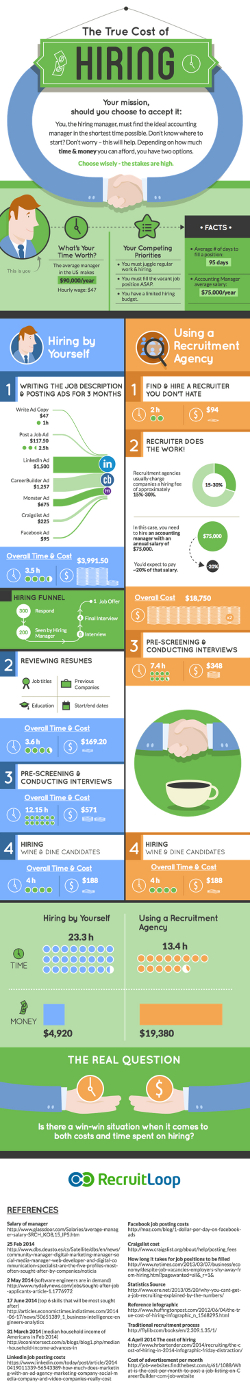

Fortunately, Aussie start-up, RecruitLoop, which is now based in both Sydney and San Francisco after opening offices there when they secured venture capital in 2013 for their new kind of online recruitment agency, ran the numbers for us. (they’ve subsequently grown via acquisition!)

The Old Recruitment Process

Traditionally, if you wanted to locate top-tier talent for your organisation, you had little choice but to hire a recruitment agency. They possessed the secret formula for procuring the right candidates and charged handsomely for it, usually in the vicinity of 15-30 percent of the salary on offer, per hire. RecruitLoop says you should expect to pay about 20 percent.

But first you have to find a recruiter you like. Conservatively speaking, this could take about two hours, including the time it takes to brief the recruiter on the position and candidate you’re looking for. Then it’s over to them – for now.

The recruiter may weed out the good candidates from the bad, but that’s literally it. You still need to interview each candidate, whether it’s two or three or more. After a customary 30 minute pre-interview phone call, it’s standard practice for a candidate to meet with the hiring manager at a company at least twice, sometimes three times. That’s a minimum of 7.5 hours.

RecruitLoop also pencils in time to wine and dine candidates. I don’t know about you, but I rarely hear of a junior or mid-level executive being wined and dined by an employer. This is a practice usually reserved for the top brass, so I’m going to reassign that time to checking out each candidates’ references.

Yes, this is the recruiter’s responsibility and it’s what you’re paying the big bucks for, but it’s precisely because you’re shelling out those big bucks that you should do your due diligence and check out each candidates’ references yourself. (I give you two good reasons why in this blog post.)

Altogether, you’d have spent 13.5 hours on the hiring process, in addition to the 20 percent finders fee you pay to the recruiter. Assuming the candidate’s salary is $75k, and your salary is around $90k (or $47 an hour), you’ve just spent $19k.

The New DIY Recruitment Process

In the RecruitLoop example, they listed multiple employment websites to advertise a job vacancy, but we reckon you only need to use two websites: LinkedIn, which they estimate costs around $1,500 an ad, and Gumtree, which is free.

It should take you about an hour to write your job advertisement, perhaps two if you’re a little rusty or the position is not quite straight forward, which in small business it rarely is. We’ll note down two hours for ad writing, and thirty minutes to post them both.

The average corporate job advertisement yields about 200-300 resumes from jobseekers, but as a small business you may receive less than that. Even if you receive as little as twenty resumes, you still need to cull that down to two or three candidates. That should take you about 3.5 hours.

Then comes the interview process. This shouldn’t take any longer than it would if you were using a recruitment agency, which RecruitLoop estimated would take about 7.5 hours (though they estimated 12.5 hours in their info graphic). Then tag on 4 hours to check each candidates’ references.

You’re looking at about 17.5 hours of your time, plus the cost of advertising on LinkedIn. Assuming your salary is around $90k per year (or $47 an hour), altogether the new DIY hiring process has cost you just under $2,500, though it could cost you as much as $4,900, according to RecruitLoop.

Accessing What’s Behind the Curtain

Since hiring a recruitment agency only saves you about four hours, but costs exponentially more in agency fees, it would seem that the only reason to go with a recruiter is to access to that secret Talent Procuring Process.

But given that the majority of recruiters are now using LinkedIn to target new talent, in addition to their existing database – and who cares about one recruiter’s database when LinkedIn has the biggest in the world? – wouldn’t you rather save your money, invest the time, and go behind the curtain yourself? I would.

The key, of course, is to ensure you’re using LinkedIn correctly, in the first place. After that, the rest is up to you. Next time you’re looking to hire a new staff member – or maybe even an independent contractor – I encourage you to think about the DIY way.

Like this:

Like Loading...

Don’t forget that, while a business loan to cover payroll for 12 months will be easy to repay initially, your business’s profits will need to improve substantially over the next year so that you can continue to meet your loan repayments AND your payroll obligations for that year.

Don’t forget that, while a business loan to cover payroll for 12 months will be easy to repay initially, your business’s profits will need to improve substantially over the next year so that you can continue to meet your loan repayments AND your payroll obligations for that year.

If you’ve ever fiddled around with PowerPoint, you’d notice there are a few audio sounds you can use insert into your slides. They’re mostly generic sound effects, like the sound of waves or a bird chirping. To be honest with you, none of these are ever appropriate in a PowerPoint presentation, except in some really obscure instances. Or less obscure ones, like a training course teaching you how to insert pre-recorded audio into PowerPoint!

If you’ve ever fiddled around with PowerPoint, you’d notice there are a few audio sounds you can use insert into your slides. They’re mostly generic sound effects, like the sound of waves or a bird chirping. To be honest with you, none of these are ever appropriate in a PowerPoint presentation, except in some really obscure instances. Or less obscure ones, like a training course teaching you how to insert pre-recorded audio into PowerPoint!

A business’s balance sheet is a snapshot of its financial position at a particular period of time,

A business’s balance sheet is a snapshot of its financial position at a particular period of time,