I’VE TALKED ABOUT CASHFLOW on this blog before, particularly as it relates to good credit management processes.

I’VE TALKED ABOUT CASHFLOW on this blog before, particularly as it relates to good credit management processes.

This time, however, we’re going to look at how profit differs from cashflow, even though the two are intimately related.

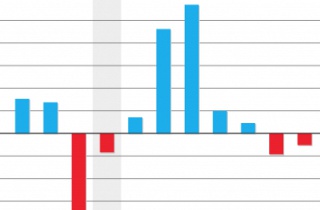

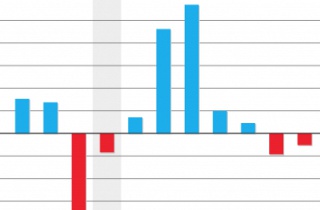

There is the perception that a profitable business can’t suffer from poor cashflow, but this is incorrect. There are plenty of profitable businesses that don’t have enough money in the bank at a given time to pay their outgoings because cashflow is lumpy.

We’re in business to make a profit, and yet the term ‘profit’ is really just an accounting concept. Profit is revenue minus expenses, but it doesn’t reflect our investment in capital assets, such as equipment or vehicles, nor does it take into account the liabilities we have funding our business (loans and hire purchases).

Cashflow is the true indicator of success

Cashflow, unlike profit, is about timing. Specifically, it’s about having money before you have to pay out money, something not identified by profit. Managing cash flow is one of the most stressful things about running a business, because many variables affect it.

Sure, not earning enough money or not having processes in place to make sure that money flows into your business in a timely fashion are part of it, but there are other factors too, such as:

- Incorrectly priced products or services

- High overheads

- Holding too much stock

- Large bills (tax bills)

- Seasonal cycles

- Large projects

- Growing pains (putting on more staff, increasing stock levels)

- Unrealistic forecasts.

P&L reports help determine causes of poor cashflow

Quite a few of the things that adversely affect a business’s cashflow can be determined by running regular Running Multi-Period Profit and Loss Statements], while others can be managed (or avoided) by implementing better processes or procedures for doing business.

Product based business which keep inventory can have their cashflow affected by:

- incorrectly priced products and services

- holding too much stock

- seasonal sales cycles

and this evidence will show up when you run your P&L reports, as well as your inventory sales and stock-on-hand reports. If, for example, you identify that May, June and July is your busiest quarter, while November, December and January is your quietest, and where you struggle to meet your outgoings, you should implement strategies to better plan for that leaner period.

A seasonal period of downturn is common among most businesses. It’s how you manage and plan for that downturn that separates successful businesses from ones that aren’t. For example, it’s unwise for a sole trader to take a holiday March, a seasonally busy period for his business, when he could wait until June when it’s much quieter.

Your bookkeeper will play a key role in how you plan and manage your cashflow. Ask them to run reports that will help you to identify any inefficiencies in your business that’s causing poor cashflow, and implement strategies to better manage it.

Bookkeeper, BAS Agent or Finance Manager

If you’re looking for a reliable bookkeeper to manage your daily or weekly bookkeeping and accounts, either remotely or in-person, Tracey from Rockingham is a highly qualified bookkeeper, who also has the practical experience of having operated her own business in the past. Tracey has a lot of experience in the day-to-day accounting functions of a small business and you can contact her directly as a fully licensed member from her profile page.

If you’re looking for a reliable bookkeeper to manage your daily or weekly bookkeeping and accounts, either remotely or in-person, Tracey from Rockingham is a highly qualified bookkeeper, who also has the practical experience of having operated her own business in the past. Tracey has a lot of experience in the day-to-day accounting functions of a small business and you can contact her directly as a fully licensed member from her profile page.

Our National Bookkeeping website has recently gone through a significant upgrade so watch out for more stories about featured bookkeepers in forthcoming blogs! Join and we can feature YOU in our articles too. Subscribe and stay tuned to learn about some new members who have moved from the corporate world to focus as Finance Managers for small to medium businesses.

Xero for LIVE data and Accurate Reports

Xero for LIVE data and Accurate Reports

Xero enables business owners and their bookkeepers and financial managers to see what is going on RIGHT NOW and because it’s popularity is growing we’ve created a NEW Xero course which goes through a great example of the business decisions that a business owner makes about buying an investment property, figuring out which products/services provide a better Return On Investment (ROI) and more.

Check it out at Xero Cashflow Course and remember that existing EzyLearn students can get access to this course by just sending an email request to student support.

Like this:

Like Loading...

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents.

So let’s get to it: there’s work to be done. And this work generally requires some rudimentary knowledge of Australian tax law, copyright law, trademarks and patents. And as a gift to you, remember our

And as a gift to you, remember our

IF YOU’VE DECIDED THAT this will be the year you start your new business, don’t wait until January to begin your journey to becoming the head honcho.

IF YOU’VE DECIDED THAT this will be the year you start your new business, don’t wait until January to begin your journey to becoming the head honcho.