Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

The recent bad news about MYOB AccountRight 2011 demonstrates the risks involved when you borrow money for any venture (MYOB have a $575M loan that they need to repay). The money needs to be paid back and luckily you can use MYOB software to keep track of what is owed to you. It also brings up the question of rather than having a debt to repay can you pre sell what you do (at a large discount)?

The recent bad news about MYOB AccountRight 2011 demonstrates the risks involved when you borrow money for any venture (MYOB have a $575M loan that they need to repay). The money needs to be paid back and luckily you can use MYOB software to keep track of what is owed to you. It also brings up the question of rather than having a debt to repay can you pre sell what you do (at a large discount)?

We are asked many questions in our MYOB online training course support service we call “EzyLearn ANSWERS” and one of the recent questions was “what is the best way of keeping track of Prepayments”. We took the question to our Registered BAS Agent and MYOB Tutor as well as our Microsoft Excel Expert and we’ve come up with two scenarios, one using MYOB and one using Microsoft Excel.

What is the best solution?

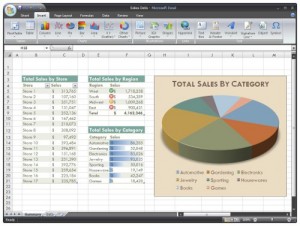

You could use MYOB to handle pre-payments, or you could use it as a simple track of the lump sum payment you’ve received into your bank account and use Excel to enter the day to day information about how and when that prepayment is used.

We’ve created an Excel “Handy file” for you and we’ve putting the finishing touches on the workbook that explains how to do it using both Excel and MYOB so stay tuned to this blog or subscribe to receive these blog posts via email as they are published.

Need something created in Excel? Enrol into the online Microsoft Excel course and use EzyLearn ANSWERS to put it to our Excel guru.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.