Have you ever been in that situation? There’s lots going on and you have a lot on your mind yet you just can’t think of something to say? It’s like that with content marketing too.

It can be challenging but if you are in sales and marketing you MUST find something to say.

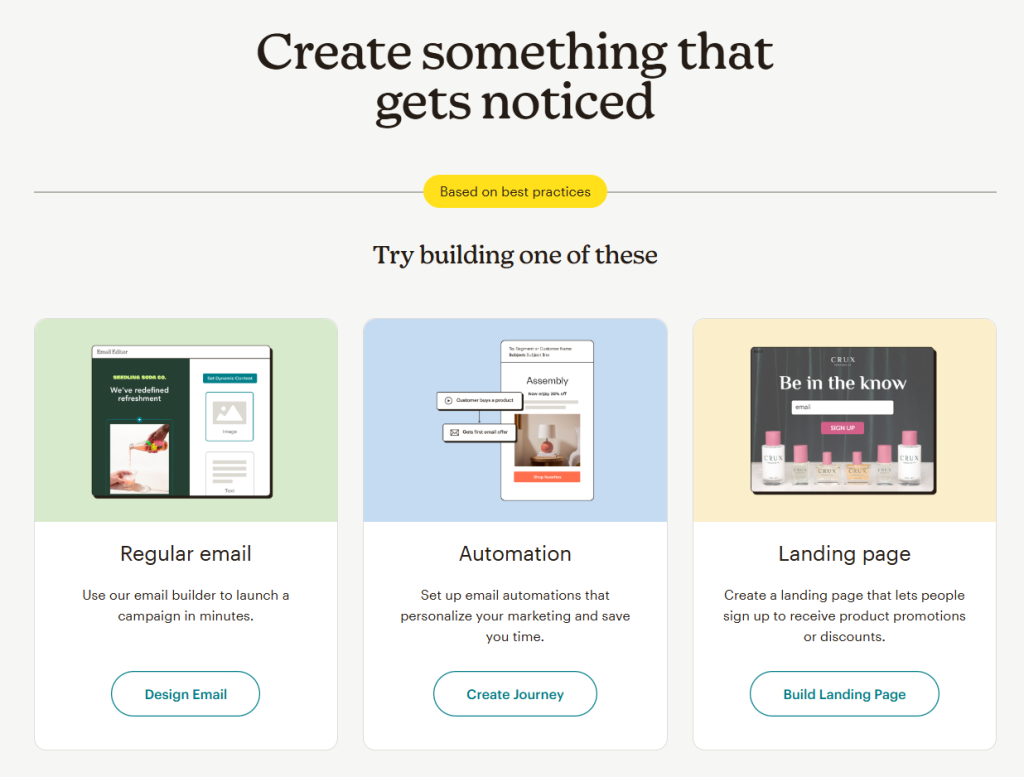

I was reviewing some of the recent updates to our Mailchimp Course for Email Marketing and realised that most content marketing is based around what is happening at the business.

It might have something to do with suppliers or products and changes to features or it can simply be about a success story or what one of your clients did.

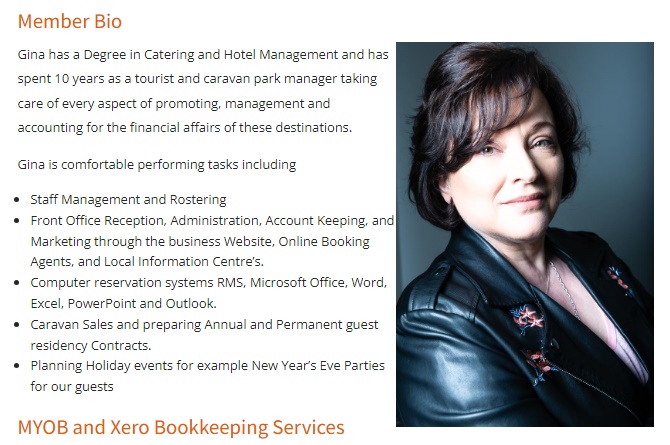

When the Mailchimp course is ready it will be available at a discounted price to our Bookkeeping Academy members and can form part of your CPD Points.

Explore the Bookkeeping Academy and Inquire to learn more

PS. A new member recently understood how affiliate marketing works and was able to earn someone money just by referring someone to our courses. We’d rather pay you for introducing a new client than give the money away to Google Ads to get new students!