Are you earning $50 per hour at the moment? If you aren’t it can seem almost impossible to believe that you could, particularly when you look at your boss and imagine yourself asking them for a pay rise.

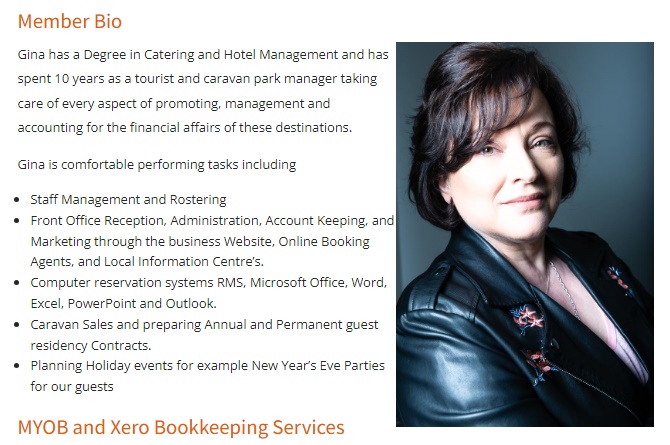

I searched online to see who earns $50 per hour and most of the search results in Seek and Indeed showed up saying you have to be a doctor, pharmacist or HR Manager but bookkeepers earning this much regularly.

Continue reading How to earn $50 per hour