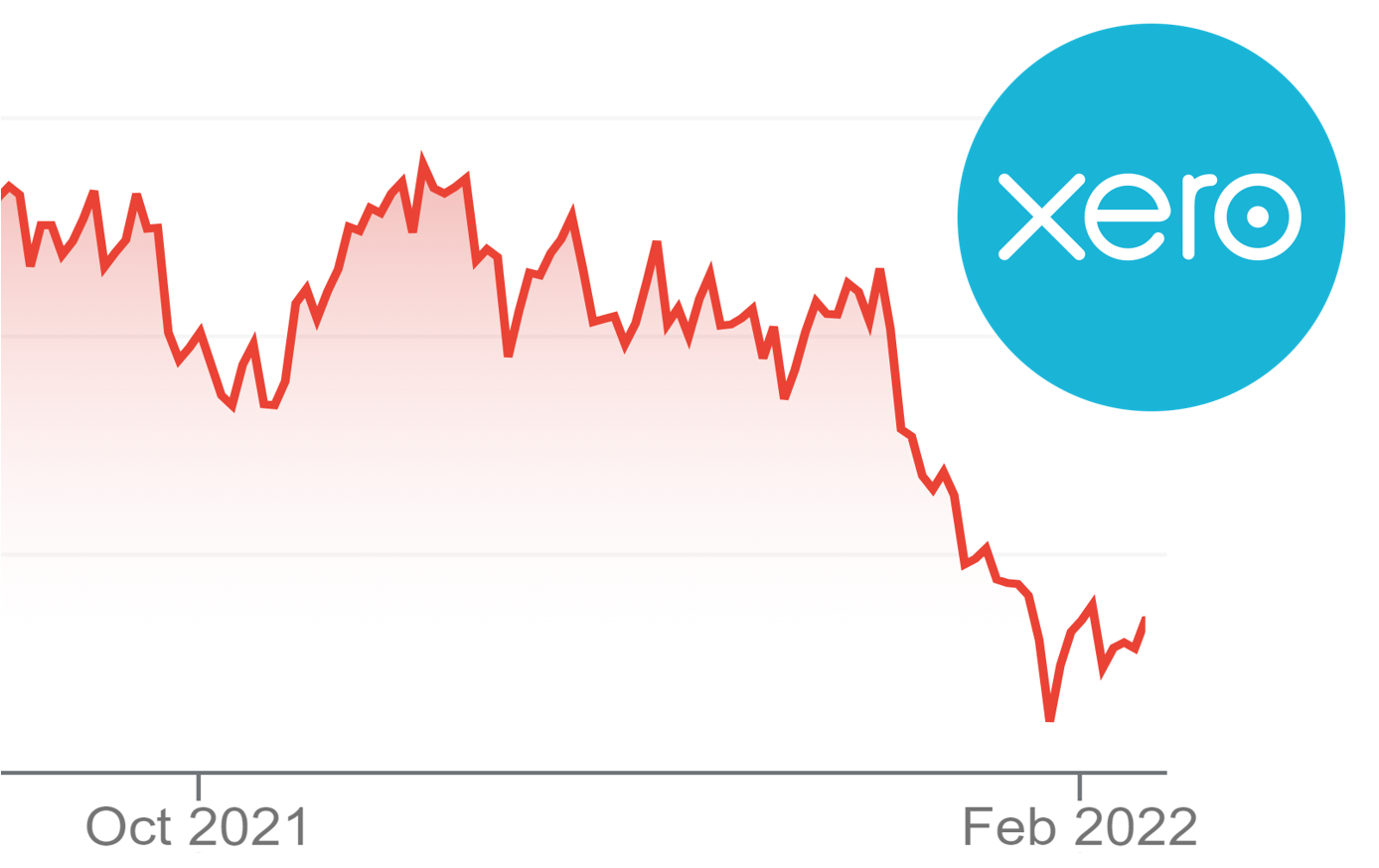

Xero led the way in online cloud accounting software that enables anyone to access their accounting software from anywhere. This means that small business owners, staff and their bookkeeping advisors can all access different parts of the software at anytime to perform their work. A far cry from the clunky way that MYOB AccountRight managed multiple users in an office environment a decade ago.

This amazing flexibility enables contract bookkeepers to perform credit control and end of month bank reconciliation tasks working from home, will office support staff are working on quotes, invoices and payments to suppliers. All of these transactions can add up very quickly and soon you can have hundreds of transactions. What if you had to find something, fix something that was entered incorrectly? That’s when you need an audit trail.

Xero just announced Payroll History and it’s designed to keep track of what happens with your payroll records.

Continue reading Payroll Training Course: Employee changes are being trackedLike this:

Like Loading...