You don’t need to subscribe to expensive accounting software like Xero if you only have one or two staff members. Business owners have been processing payroll manually for years and these basics are taught in our BAS Course with the Ad hoc payroll spreadsheet.

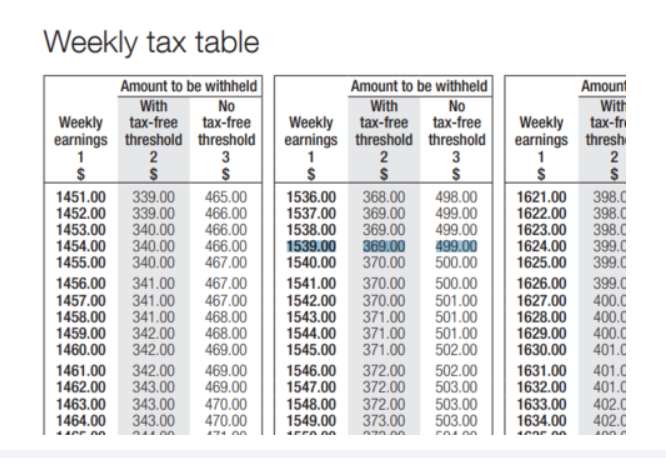

I was speaking with a hairdressing salon owner last year and she mentioned that she uses the manual weekly pay tables provided by the ATO and a spreadsheet program to pay all her staff.

We use these pay tables to introduce students to the foundation concepts about payroll.

Every business owner collects GST and taxes on behalf of the ATO from the money they pay their staff. This money is a liability payable to the ATO as part of their quarterly or monthly Business Activity Statements.

As part of the BAS Course you’ll be introduced to the process to enter payroll transactions as journal entries.

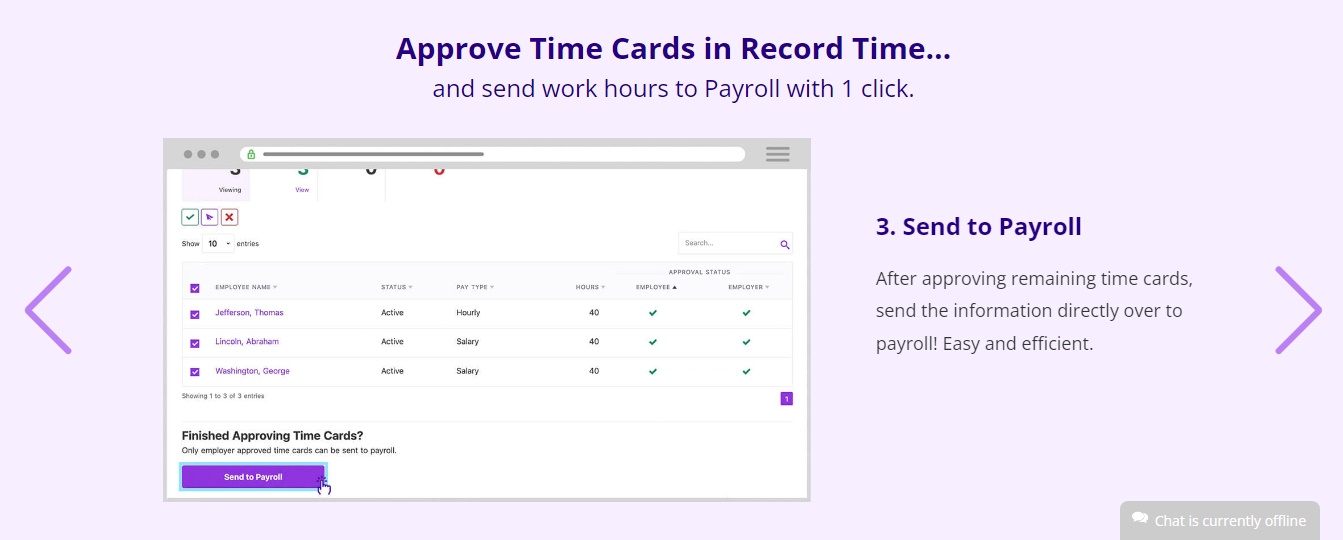

It’s a great introduction to basic payroll skills and leads beautifully into the Advanced Certificate in Payroll Courses using QuickBooks, MYOB and Xero.

In July last year, EzyLearn published

In July last year, EzyLearn published