If you’ve been following what has happened with Mentor Education you probably also have a strong interest in the integrity of Australia’s accredited training industry.

We’ve had a lot of Mentor Education students make contact just to learn more about what they can do about their courses because they hadn’t heard from Mentor Education, nor the receivers. Some students were counting on their qualifications to find work, others were promised a wage increase with a qualification and others have been through several different training providers while they juggle work, family and study.

There appears to be some good news though you wouldn’t know it by any official announcements

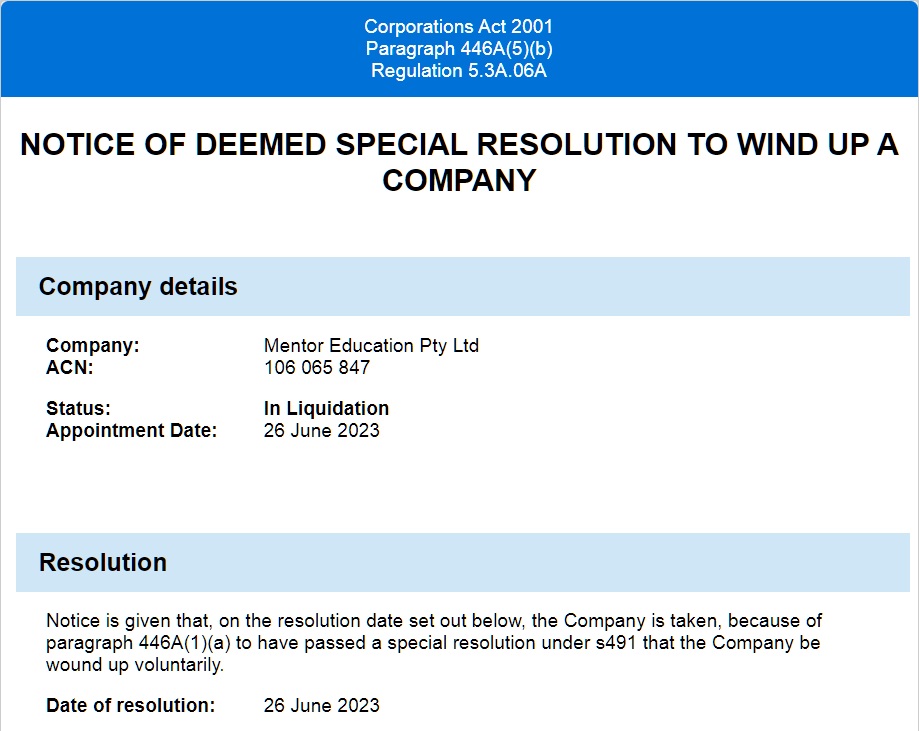

Continue reading Mentor Education: Company Wound Up, but… Too Big to Fail? EzyLearn’s OFFER