Is Business Quiet? Need More Money/Sales? Use a Database!

Cloud accounting programs like MYOB AccountRight Live, Xero, Freshbooks, Reach Accounting and Quickbooks

I’m excited to be delving deeper into a micro course specifically targeting how you can manage on-the-job costs and track your project. This will be included in all of our Xero, MYOB and Quickbooks online accounting courses.

Our team did a little research into job sites for accounting jobs and thought we’d explore a bit about why people like using the major job board in Australia.

The biggest reason is that they are the biggest job board in Australia so most advertisers spend the little bit extra to promote their positions available at the site. But there are some great tools for job seekers to be registered on the site. Continue reading Reasons Why Seek is Number 1 for Accounting Job Search

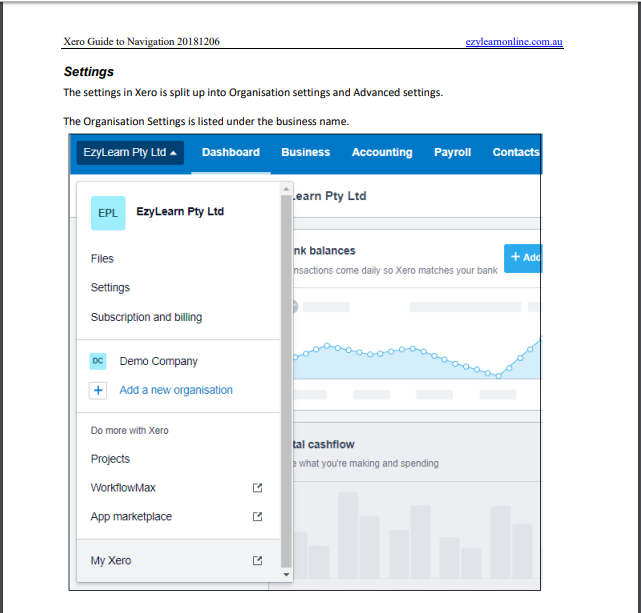

My first thought when a software company changes its navigation (in a significant way) is that there were issues with the previous version.

THIS BLOG POST comes in the wake of Xero promising to improve their navigation in October 2018. Xero has now subsequently released those changes and our online support team are receiving lots of requests for help!

First and foremost, if you’re an EzyLearn student, please note that we’ve already created an update addressing the navigational updates and this is available in all of our online Xero Training Courses.

Continue reading Are You Finding Xero’s New Navigation a Pain in the Proverbial?

THE ULTIMATE GOAL of a job site (and they are not all created equal!) is to deliver the highest volume of candidate applications to the job poster (the recruiter or employer), while also providing candidates (job-seekers) with access to the highest volume of top-quality job listings.

Since recruitment classifieds moved online more than two decades ago, the ease with which job-seekers could apply for jobs increased.

Job posters went from getting a handful of applications over the course of a few weeks to hundreds all at once. This spawned the need for businesses to best manage and dare I say it, automate and systemise the hiring process. Continue reading What Do Employers Want From Bookkeeping Job Sites?

I’VE WRITTEN MUCH ABOUT accredited training in the past, relating particularly to the use of the term “Diploma”. Just recently, I discovered more murky marketing by a newcomer to the bookkeeping short courses industry.

What’s scary about these training course providers is that they make claims to offer a Diploma, and then after 2 years in business, they apologise for “something beyond their control” like a change in legislation which tells them to stop calling their courses Diplomas, when they are NOT and NEVER WERE IN THE FIRST PLACE!

Continue reading Watch out for FAKE Statements of Attainment for Xero & MYOB Short Courses

But when you look at some industries, like Bookkeeping, the numbers are massively swayed towards the female gender and one of the reasons is it can be the perfect business to run from home.

Continue reading How Aussie Mums are Starting their Own Businesses

The Internet has spawned several cloud accounting software program all over the world including:

Continue reading SPECIAL OFFER: MYOB, Xero & QuickBooks Online Courses ALL for One Low Price

ERPs, or Enterprise Reporting Planning systems, are divided into three categories or tiers. Xero, MYOB, QuickBooks and other cloud accounting software used by small businesses, sit at the low end of the scale; they’re tier three ERPs.

Xero is using it’s 3rd party app integrations and its API to climb up the ERP food chain and some good bookkeepers are being dragged up along with it.

Continue reading Xero, MYOB, ERPs and Supply Chain Tools

THIS JULY A NEW ACCOUNTING SYSTEM is attempting to lure Aussie businesses away from the incumbent cloud accounting majors MYOB, Xero and QuickBooks, with the promise of “access to big-end-of-town technology,” according to a report in The Australian Financial Review.

Wiise, which is owned by the deep pockets of KPMG and will operate under a strategic partnership with Microsoft and the Commonwealth Bank, will combine cloud accounting, job costing, workflow scheduling and inventory management, payroll, sales and marketing and customer relationship management into one system.

Pricing hasn’t been confirmed, but it’s understood Wiise will operate a tiered model, costing businesses between $60 and $200 a month.

The software will integrate with all major Australian banks, but added functionality will be given to CBA customers, such as access to working capital and financing options.

Although Wiise will target SMEs; founders KPMG, Microsoft and CBA say the software isn’t competing with MYOB, Xero or QuickBooks for customers.

Rather, the Wiise software will suit complex businesses that have outgrown traditional cloud accounting systems, because their business operates in more than one location, has a complex supply chain, various legal entities or high transaction volumes.

The Wiise software will suit complex businesses that have outgrown traditional cloud accounting systems.

Wiise will also appeal to businesses that want to use one piece of business software, rather than multiple separate systems or cloud-accounting add-ons.

That said, it’s probably a worry to MYOB, which signalled it would grow market share by pursuing bigger and more complicated businesses; acquiring the enterprise reporting system Greentree in 2016.

So while contract bookkeepers should remain competitive by keeping abreast of new technologies, is Wiise yet another cloud accounting system bookkeepers, tax agents and accountants will need to learn how to use? Well, that depends on how quickly it penetrates the market. And if it penetrates the small business market in any significant way.

As a general rule, most small businesses want to spend as little time worrying about compliance as possible, which is as it should be. Simple businesses with straightforward tax and compliance requirements typically stick with simple cloud accounting systems.

So there’s value in bookkeepers that typically services larger, more complicated businesses learning more about Wiise, but probably not for bookkeepers that look after smaller, straightforward businesses.

If you’re a business owner trying to decide on an accounting system, speak with your bookkeeper or tax agent to determine the best option for your business.

If you’re a business owner trying to decide on an accounting system, speak with your bookkeeper or tax agent to determine the best option for your business.

If you’re looking for a reliable bookkeeper or tax agent to manage your business accounts, visit the National Bookkeeping website to find someone professional, able to work in your office, or remotely, to suit the needs of your business.

When I made the decision to convert EzyLearn from a Bricks and Mortar training centre to an online only provider of training courses I realised that we were going to have to get good at:

When I made the decision to convert EzyLearn from a Bricks and Mortar training centre to an online only provider of training courses I realised that we were going to have to get good at:

EzyLearn has been in business helping job seekers, business owners, managers and clients of rehabilitation providers learn how to use software for over 20 years. Read our story here..

I’m lucky today to have a professional team who’s sole focus is on getting better at all of these tasks – every week! I guess this post is as much a thank you to all of them for their help as it is an announcement that ALL of our XERO courses have recently been updated!

Beginners and Advanced Xero Training Course updates

Beginners and Advanced Xero Training Course updatesAlmost every course has been touched in our latest updates but here is a summary:

One reason that students choose EzyLearn for their online training courses is because they receive access to new added content and course updates.

The usual time to finish the COMPLETE set of Beginners to Advanced Xero Courses is 3 weeks but one of the reasons we offer 12 months course access (and the LIFETIME Xero Course Access) is so that students can go back and review the contents when they need it in their business or job.

Get all the Xero Course details at our FAQ’s.

Get all the Xero Course details at our FAQ’s.

If you’re interested in enrolling into a Xero course take a look at the current special offers and subscribe to our Discount Voucher program to receive the discount codes.

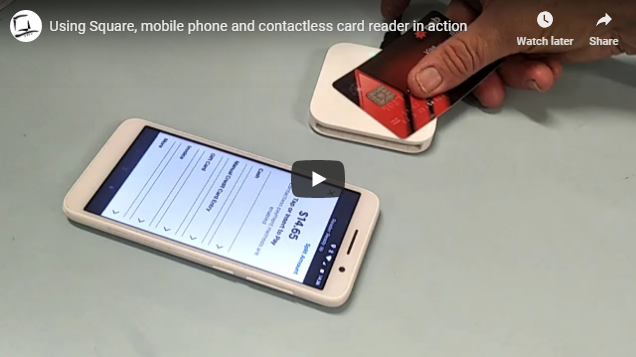

TSheets, THE TIME MANAGEMENT SOFTWARE, is a great way for independent and remote contractors to manage their client’s projects. It’s especially useful for contractors who are collaborating remotely with other contractors and businesses on one project.

TSheets, THE TIME MANAGEMENT SOFTWARE, is a great way for independent and remote contractors to manage their client’s projects. It’s especially useful for contractors who are collaborating remotely with other contractors and businesses on one project.

There are a bunch of other handy tools contractors and sole traders can use for expense tracking and forecasting too.

But back to TSheets. TSheets was recently acquired by Intuit, the parent company of QuickBooks. Both TSheets and QuickBooks shared 12,000 customers in common and the time management system had been developed to work specifically with QuickBooks. Deeper integration with QuickBooks can be expected now, following the acquisition.

The acquisition is part of the push into the cloud accounting ecosystem that’s being led by the major cloud accounting companies. (Read: EzyLearn’s explainer on the TSheets acquisition and the cloud accounting ecosystem.)

If you were to think about the top three cloud accounting apps in terms of the types of businesses they appeal to, QuickBooks would appeal most to micro businesses and independent contractors. Check out an earlier blog post where we assess two main factors: User Experience & Ease of Use, and Reporting Tools in a comparison between MYOB and Quickbooks for small businesses.

If you were to think about the top three cloud accounting apps in terms of the types of businesses they appeal to, QuickBooks would appeal most to micro businesses and independent contractors. Check out an earlier blog post where we assess two main factors: User Experience & Ease of Use, and Reporting Tools in a comparison between MYOB and Quickbooks for small businesses.

The popularity of Quickbooks for contractors and the like is not just because it’s by far the cheaper system compared with Xero and MYOB. QuickBooks has also spent a lot of time simplifying the process of managing business accounts so that, while it may not be the most robust program, it’s by far the most accessible.

TSheets has been built the same way. It’s also one of the most inexpensive time tracking systems — at a minimum of $30 per month for two users, while it’s free for one user to use TSheets for unlimited projects.

New content is being added to our Bookkeeping Academy “Academic Development Program” to include using TSheets with QuickBooks (or Xero and any other cloud accounting system it integrates with). The Bookkeeping Academy is where you can purchase online training via short courses that you can use for Continuing Professional Development (CPD) or Continuing Professional Education (CPE) or to upskill or re-train in one particular area. You can earn CPD points with our cloud accounting packages.

Read more about why continuing education for bookkeepers is so important in this ever-changing industry.

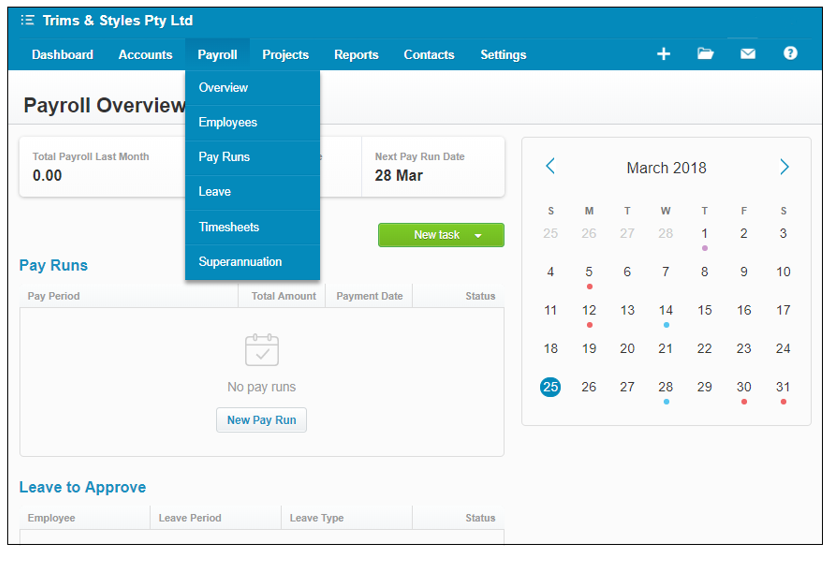

LAST WEEK, MYOB LAUNCHED a beta trial of its single touch payroll (STP) product, as it gears up for the July 1, 2018 compliance deadline.

Businesses with 20 or more employees need to have transitioned to the ATO’s Single Touch Payroll initiative by July.

Businesses with fewer than 20 employees have until July 1, 2019 to be compliant but for these small business owners and contractors the ATO has a new free app. Continue reading MYOB Launches Single Touch Payroll Trial Product

XERO HAS BECOME ONE of the major accounting software players in Australia. Like the other two major cloud accounting programs, Xero offers a partner program (officially, the Xero Partner Program), in which bookkeepers and accountants “partner” with Xero to exclusively offer Xero-based bookkeeping and accounting services to clients. Continue reading Is Xero’s Partner Program Really Affiliate Marketing?