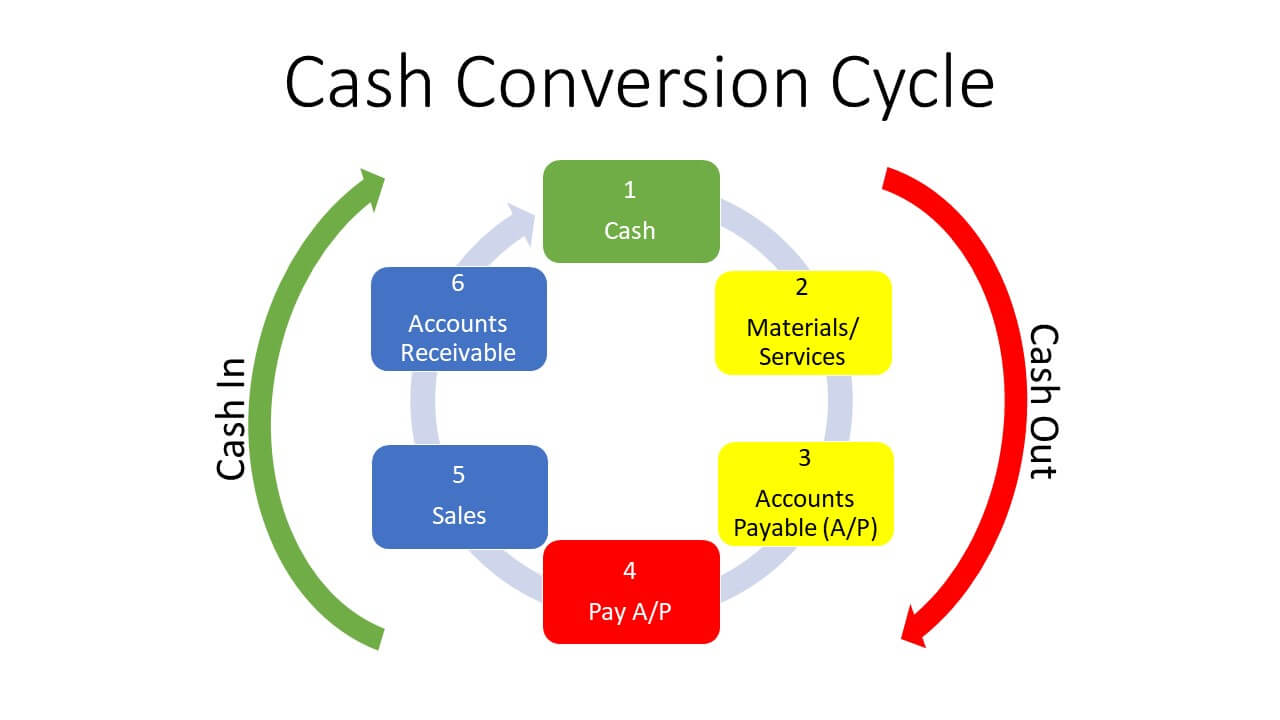

There are a lot of things that contribute to a successful business, but there’s no doubt that cash is a pretty significant one. Whether or not a business can generate enough revenue to not only stay afloat, but make a profit, determines whether or not that business can continue to operate.

But collecting that cash is not as simple as swiping a customer’s credit card. From the first cent a business spends in buying its stock, to the final cent the business receives in payment from a customer, the cash conversion cycle can tell a lot about just how efficient and effective a business is.

Continue reading Here’s What You Need to Know About the Cash Conversion Cycle