Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

My 7 year old son lent me $5 (which I then lent to his 12 year old brother) and then he lent his brother a further $10 directly so the older brother could buy something he really wanted at the time. Is it getting complicated already!?

This lending happened over a month ago and a conflict is brewing over the $10 he lent to the 12 year old because it was underwritten by his pocket money which had not been paid at the time.

So simple isn’t it. All this credit offered and accepted and it seems less relevant because it relates to my kids but these lessons last a lifetime so it’s important to explain credit risk and recourse.

Credit Management Questions

- Who did the 7 year old have the lending arrangement with?

- What were the conditions?

- Is interest payable?

- Is there any evidence of the loan?

- Has too much time passed to really get into the details?

- How much time will we spend talking about it?

- Will it end up being a bad debt or will the underwriter settle the dispute?

This might seem like a lot of questions for a small problem but what if there were a couple extra zeros at the end of each dollar figure? These issues are important not only if you lend someone money but also if you provide services and products to a client and give them credit to pay for it after it has been completed.

Terms of Trade

I love using real life examples to explain how to use accounting software because we can all relate to them. See how we create training courses in accounting and bookkeeping software.

I love using real life examples to explain how to use accounting software because we can all relate to them. See how we create training courses in accounting and bookkeeping software.

This particular topic is something every person in business should understand, particularly if they are giving their clients credit and have to buy their products wholesale and pay wages to staff to do the work.

Here’s information about some of the terms in a terms of trade agreement.

The agreements, transactions and debts I mentioned above are safe because they are underwritten by parents and they ARE small amounts of money but what if there was a serious risk of default – not getting your money at all? What would you do? What is your recourse? Do you have to take someone to court?

Your Terms of Trade is the starting point for a good Credit Management Policy because it lays out your terms that customers agree to when they engage your services. The biggest question is “Did they acknowledge and agree with your terms of trade” and what do you do if they default?

Trade Debtors Procedures

One reason more businesses are using Xero Accounting (and other cloud accounting programs MYOB Essentials and QuickBooks Online) is that any quotes that are send from the system can be used as evidence of your terms and acknowledgement of a customers agreement.

One reason more businesses are using Xero Accounting (and other cloud accounting programs MYOB Essentials and QuickBooks Online) is that any quotes that are send from the system can be used as evidence of your terms and acknowledgement of a customers agreement.

A further step is to get the acknowledgement in writing and sometimes that can be done over a couple emails or text messages. It’s important to do it in writing because that is evidence of your customer knowing about and accepting your terms of trade.

Read some of our other blogs about Credit Risk and Credit Management

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

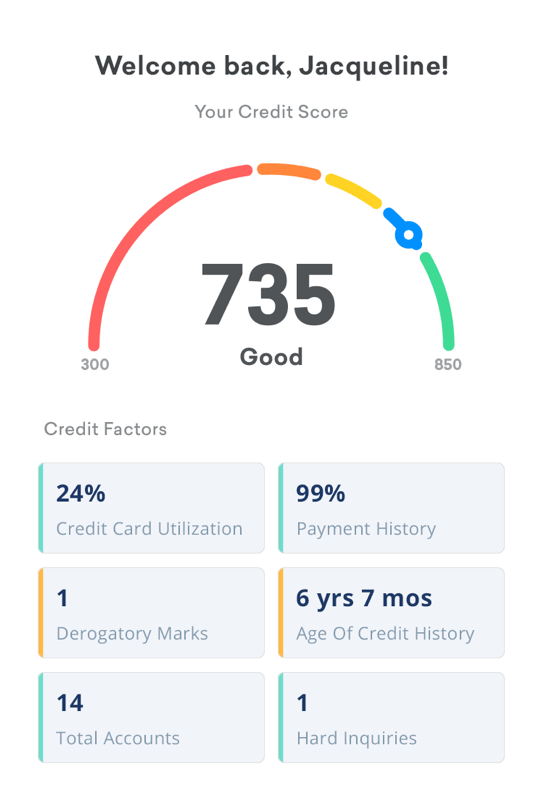

[…] the management and enforcement aspects of the process. For instance, an important part of the assessment stage is obtaining a credit check for the client, but this isn’t a main feature of the […]