EzyLearn has been an online training company for Office Admin and Business Admin courses since the Internet appeared and geez I could tell you some stories about what I’ve seen.

Something frustrating is happening at the moment and it pits the developing countries again rich countries like Australia.

If you’re reading this because you received an email notification then you’re a subscriber to our blog – WELCOME!

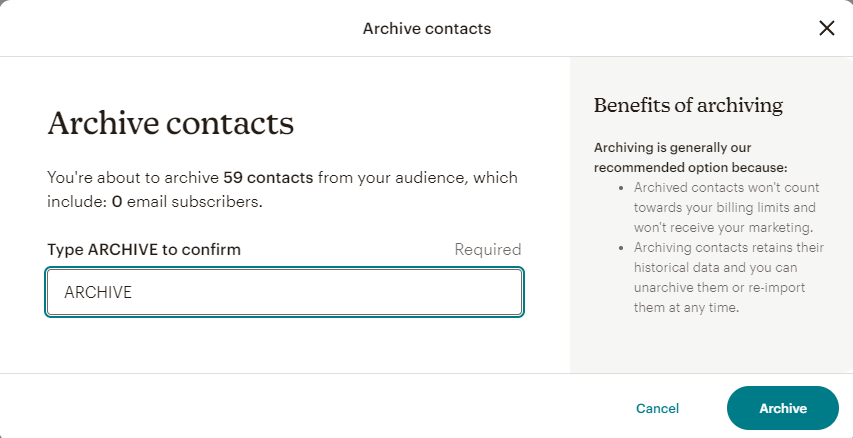

We manage this list using MailChimp because it helps us to be compliant for AntiSPAM requirements but it doesn’t stop people entering all sorts of information into our “Lead Capture Pages”.

PS. Did you know that QuickBooks Online owner, Intuit, now owns MailChimp?

Check out these entries

Continue reading I wish you could see this