All the marketing messages I hear is how much better Xero is than MYOB but that isn’t always the case.

MYOB and QuickBooks both had more in-build inventory features than Xero but Xero has always promoted their integrations to fill gaps in their core software. I wrote about this several times:

- Is Xero now more appealing because of Inventory Management?

- Inventory and Stock is more beautiful using QuickBooks than Xero

- Finally, Xero Acquires an Inventory Management Software Add-on in the US

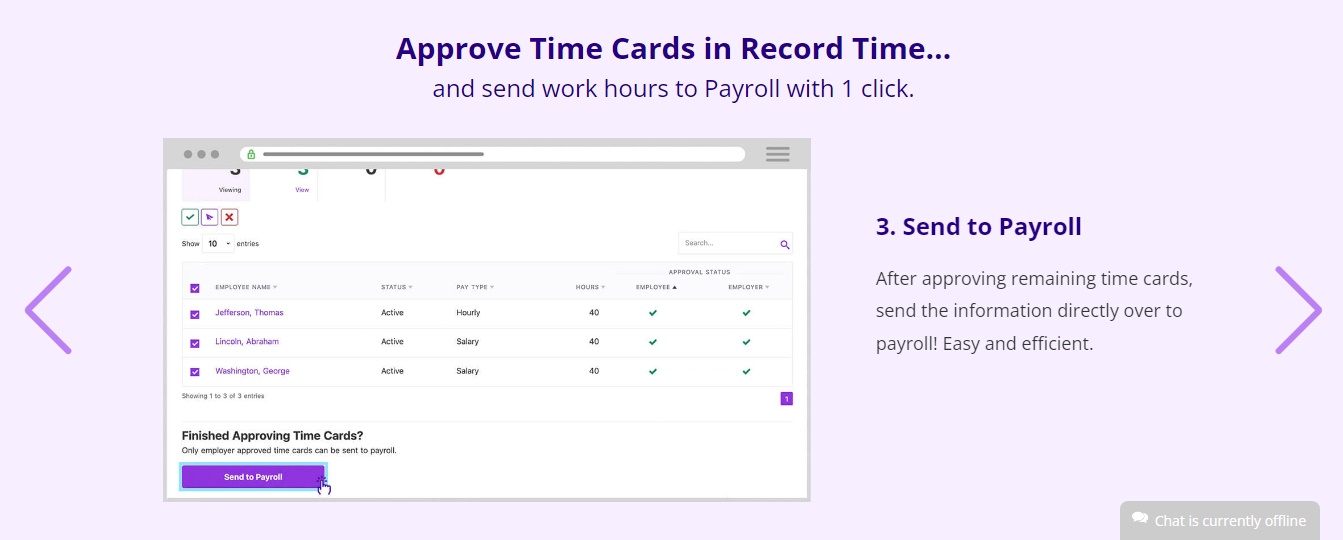

The Integrations for Xero Courses reveals some of the powerful features that other companies do better than the accounting software companies!

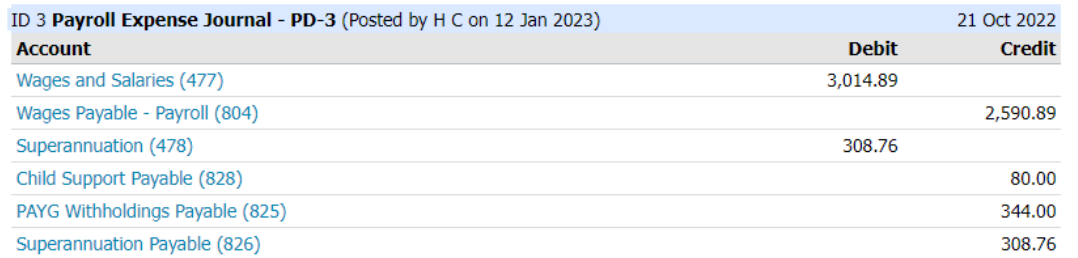

Continue reading MYOB is better than Xero Payroll for some things