Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

A Cert IV in Bookkeeping and Accounting is the same as any other Cert IV in Bookkeeping and Accounting, right? Wrong.

One of the biggest issues that ex Mentor Education students face in trying to transfer their credits to another training organisation AND continuing their studies is that EVERY RTO can choose some of their own subjects.

So a Cert IV in Bookkeeping can be different from one RTO and TAFE to another even though they’re the same qualification – does that makes sense. Let me demonstrate.

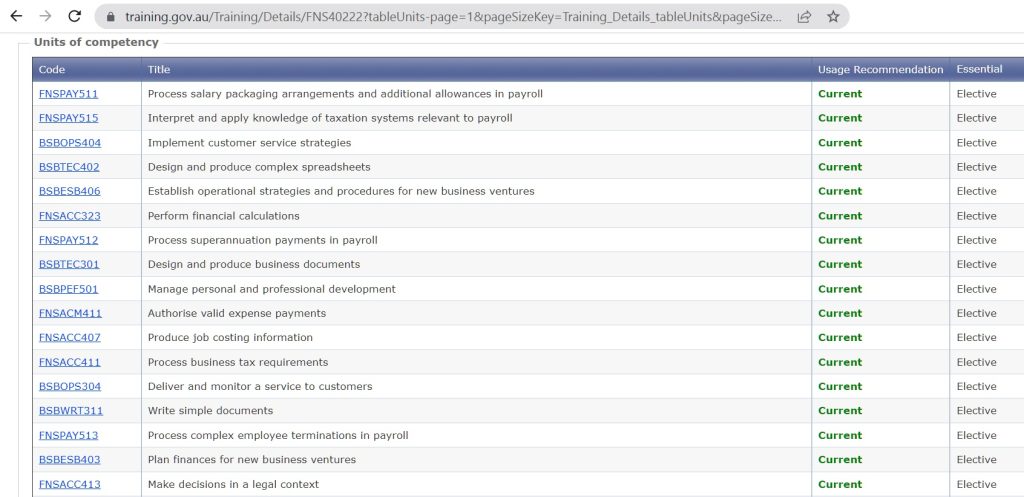

The list of potential subjects within a Cert IV in Bookkeeping is available at training.gov.au. There are 10 core subjects that every Registered Training Organisation needs to deliver and assess and 23 electives or specialist subjects and THAT is where Mentor Education students are getting stuck!

Each of these subjects is called a Unit of Competency (UOC) and when a students passes each of these subjects there is a record on their student transcript. The biggest issue that arises when we’ve tried to help a Mentor Education student since they went into Administration earlier this year is incorrect mapping.

Specialist Subjects for Cert IV Accounting and Bookkeeping

We researched the market and found only one organisation that makes every one of those 23 elective subjects available – but we didn’t check on their timetable or schedule to see if it is class-based or online. That organisation was TAFE NSW and my prediction is that each state TAFE’s will help existing Mentor Education students complete their studies – but who really knows!?

PROMOTION: A LOW COST MYOB & Xero Training Alternative

A lot of students can get the training and skills they need without having to complete a Cert IV in Accounting and Bookkeeping. Our Bookkeeping Academy course packages teaches students how to perform bookkeeping tasks using MYOB and Xero faster and for less cost – and EVEN using better examples and case studies!

Membership to the Bookkeeping Academy will give you practical knowledge and confidence in specialist areas like:

- Introduction to Apps and Integrations

- Receipt Capture and Storage

- Credit Management

- Rostering and Workforce Management

- Financial Reporting

RTO’s Competing for Certificate IV in Accounting and Bookkeeping

Most of these organisations are paying to be in the top position in Google Search Results using Google Ads. It costs a lot of money to maintain a high position in the paid results area so you’re guaranteed that the course fees will be high. Let’s hope other don’t follow the same fate as Mentor Education.

The TAFE websites below didn’t advertise but have a good organic ranking and we included them because they are a solid last resort. Some of the organisations use some advanced digital marketing techniques to capture the name and contact details of as many prospects as possible and I’ve made a note of some of their techniques if you’re interested.

The training companies that we’ve compared are:

- Monarch Institute

- TAFE QLD

- TAFE NSW

- Open Colleges

- Applied Education

- Swinburne University (Open Education)

- Think Academy of Business and Technology

When you go through this information you might consider that it gets even more complex for Diploma and Advanced Diploma subjects and we haven’t even gotten into the different qualifications that Mentor Education offered.

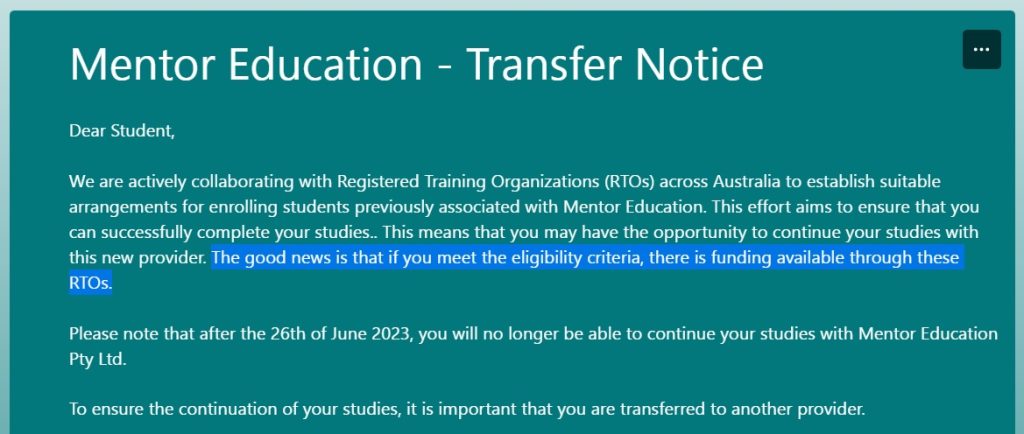

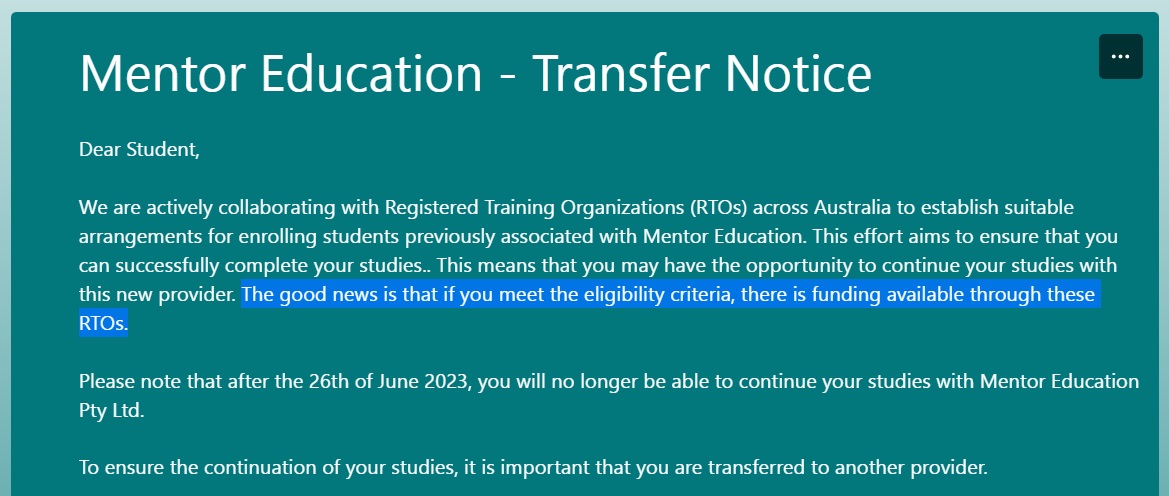

Oh and just a quick note that if you are a Mentor Education student you most like WILL HAVE TO PAY EXTRA to transfer to a new training provider. They now show a Google Forms page on their website which says “The good news is that if you meet the eligibility criteria, there is funding available through these RTOs”

It’s not really good news though, is it!?

What can you do?

If you are a Mentor Education student please contact us and learn some bookkeeping skills by learning how to use MYOB and Xero.

Industry-Endorsed Short Courses in MYOB & Xero can give you the skills and confidence to apply for accounts jobs as well as perform better in your current job and they are usually much cheaper than accredited courses.

Here’s a summary of the training companies competing for students for the Cert IV in Accounting and Bookkeeping.

Monarch Institute

In total, you need to complete 13 nationally recognised units of competency to be awarded the FNS40222 Certificate IV in Accounting and Bookkeeping.

Module 1

Establishing solid foundations: accounting fundamentals

- BSBPEF501 Manage personal and professional development

- FNSACC321 Process financial transactions and extract interim reports

- FNSACC322 Administer subsidiary accounts and ledgers

- FNSACC421 Prepare financial reports

Module 2

Work like a pro…effective work practices

- FNSACC414 Prepare financial statements for non-reporting entities

- BSBTEC302 Design and produce spreadsheets

- BSBTEC402 Design and produce complex spreadsheets

Module 3

Financial essentials: budget, financing and working effectively

- FNSACC412 Prepare operational budgets

- BSBESB403 Plan finances for new business ventures

- FNSACC418 Work effectively in the accounting and bookkeeping industry

Module 4

Big bucks for business: using Xero, payroll and activity statements

- FNSACC426 Set up and operate computerised accounting systems

- FNSTPB412 Establish and maintain payroll systems (TBP code: MPA001 Payroll Administration)

- FNSTPB411 Complete business activity and instalment activity statements (TBP code: MPA001 Payroll Administration)

Please note Module 1 and 2 of this course uses a clustered unit delivery model so please speak to a Course Consultant about how this could affect any RPL or CT granted.

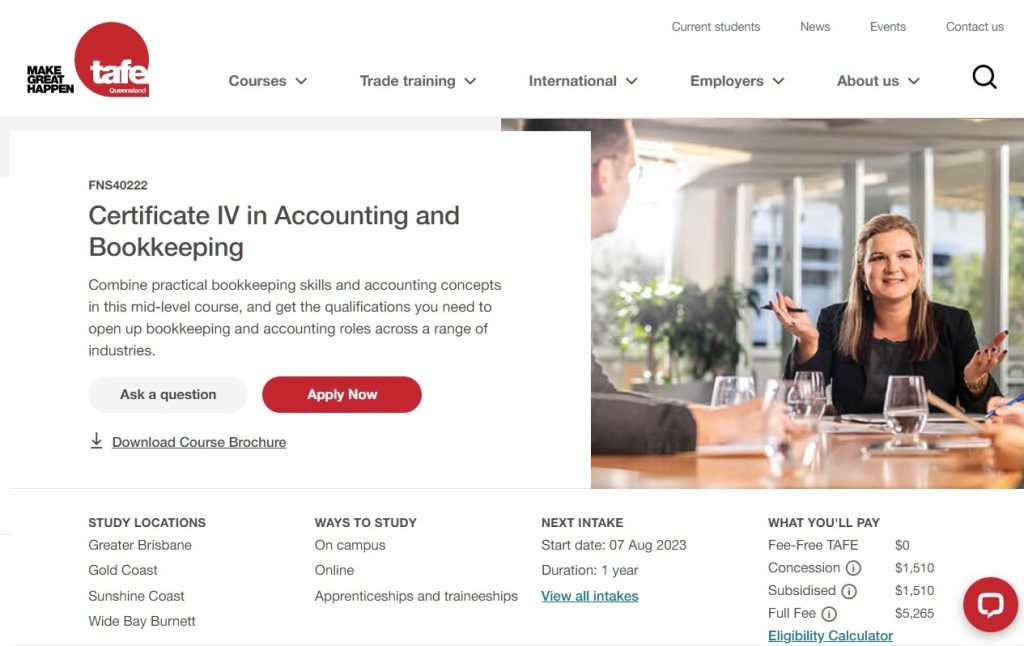

TAFE Queensland

TAFE QLD seem to be the most transparent in showing as much information, including pricing on their information landing page.

Core Units

UNIT CODE

UNIT NAME

BSBTEC302

Design and produce spreadsheets

FNSACC321

Process financial transactions and extract interim reports

FNSACC322

Administer subsidiary accounts and ledgers

FNSACC412

Prepare operational budgets

FNSACC414

Prepare financial statements for non-reporting entities

FNSACC418

Work effectively in the accounting and bookkeeping industry

FNSACC421

Prepare financial reports

FNSACC426

Set up and operate computerised accounting systems

FNSTPB411

Complete business activity and instalment activity statements

FNSTPB412

Establish and maintain payroll systems

Elective Units

UNIT CODE

UNIT NAME

BSBTEC301

Design and produce business documents

BSBTEC402

Design and produce complex spreadsheets

BSBTEC404

Use digital technologies to collaborate in a work environment

BSBWRT311

Write simple documents

FNSACC323

Perform financial calculations

FNSACC413

Make decisions in a legal context

FNSACC523

Manage budgets and forecasts

Note: For some courses, not all electives are available at all campuses.

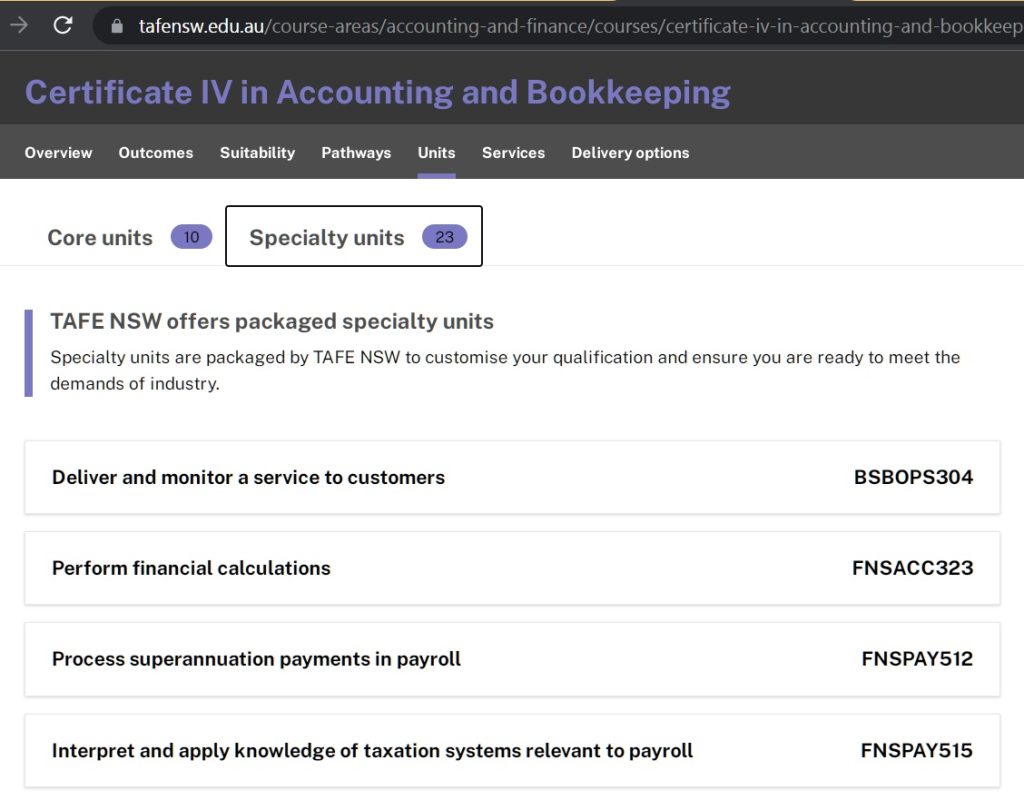

TAFE NSW

The interesting thing about studying the Cert IV in Accounting and Bookkeeping with TAFE NSW is the number of specialty units available! 23 is a massive number that exactly matches the training.gov.au website of elective subjects. Why they don’t just use the same term is confusing, but that is what marketing people do to make their courses more attractive.

Core Subjects in Cert IV in Bookkeeping and Accounting with TAFE NSW

Work effectively in the accounting and bookkeeping industry

FNSACC418

Set up and operate computerised accounting systems

FNSACC426

Administer subsidiary accounts and ledgers

FNSACC322

Process financial transactions and extract interim reports

FNSACC321

Prepare financial reports

FNSACC421

Complete business activity and instalment activity statements

FNSTPB411

Establish and maintain payroll systems

FNSTPB412

Prepare financial statements for non-reporting entities

FNSACC414

Prepare operational budgets

FNSACC412

Design and produce spreadsheets

BSBTEC302

Open Colleges

Digital Marketing Strategy

- Google Ads

- Landing page with limited information

- Lead Capture Form to get more details

- Thank you page that gives you a download link to their course information guide

- Personalised calendly form to organise a time for a phone call

This training organisation regularly advertises using Google Ads with a landing page which doesn’t provide a lot of information. This is a popular lead generation tactic used by companies who understand the value of savvy digital marketing. Essentially by entering your details into the form you give Open Colleges “consent” to send you marketing messages and advertising messages.

This strategy also gives the company a sales pipeline of potential students that they can contact in the future and “nurture” them to build their own brand. When you do get to their course information they have a good amount of detail and bullet points which give a little more insight into the topics included and the main outcomes.

Foundations in accounting and bookkeeping

| FNSACC321 | Process financial transactions and extract interim reports |

- Check and verify supporting documentation

- Prepare and process banking and petty cash documents

- Prepare and process payable and received invoices

- Prepare journals

- Update financial data and systems

- Prepare deposit facility and lodge flows

- Finalise trial balance and interim reports

Preparing ledgers

| FNSACC322 | Administer subsidiary accounts and ledgers |

- Review accounts receivable requirements

- Identify bad and doubtful debts

- Review client compliance with terms and conditions and plan recovery action

- Prepare reports and file documentation

- Distribute creditor invoices for authorisation

- Remit payments to creditors

- Reconcile outstanding balances

Financial reporting

| FNSACC421 | Prepare financial reports |

- Maintain asset register

- Record general journal entries for balance day adjustments

- Prepare final general ledger accounts

- Prepare end of period financial reports

Requirements for non-reporting entities

| FNSACC414 | Prepare financial statements for non-reporting entities |

- Compile data required for preparing financial statements for non-reporting entities

- Prepare financial statements for non-reporting entities

Cloud-based computing

| BSBSMB412 | Introduce cloud computing into business operations |

- Review computing needs in the business

- Investigate cloud computing services to meet business needs

- Develop a plan to introduce cloud computing

- Support implementation of the plan

Computerised accounting systems

| FNSACC426 | Set up and operate a computerised accounting system |

- Implement integrated accounting system

- Process transactions in system

- Maintain system

- Produce reports

Managing payroll

This unit is designed to meet the education requirements of the Tax Practitioner Board (TPB). Where registration with the TPB is sought, assessment must reflect the conditions described by the regulator which stipulate that a significant amount (at least 40%) must be completed under some form of independent supervision.

| FNSTPB402 | Establish and maintain payroll systems |

- Establish payroll requirements

- Record payroll data

- Prepare and process payroll

- Handle payroll enquiries

- Maintain payroll

This unit is designed to meet the education requirements of the Tax Practitioner Board (TPB). Where registration with the TPB is sought, assessment must reflect the conditions described by the regulator which stipulate that a significant amount (at least 40%) must be completed under some form of independent supervision.

Managing business activity statements

This unit is designed to meet the education requirements of the Tax Practitioner Board (TPB). Where registration with the TPB is sought, assessment must reflect the conditions described by the regulator which stipulate that a significant amount (at least 40%) must be completed under some form of independent supervision.

| FNSTPB411 | Complete business activity and instalment activity statements |

- Identify compliance and other requirements applicable to business activity

- Analyse and apply industry codes of conduct associated with work activities

- Review and apply goods and services tax (GST) implications and code transactions

- Report on payroll activities and amounts withheld

- Reconcile and prepare activity statement

- Lodge activity statement

This unit is designed to meet the education requirements of the Tax Practitioner Board (TPB). Where registration with the TPB is sought, assessment must reflect the conditions described by the regulator which stipulate that a significant amount (at least 40%) must be completed under some form of independent supervision.

Implement Customer Service Standards

| BSBCUS403 | Implement customer service standards |

- Contribute to quality customer service standards

- Implement customer service systems

- Implement team customer service standards

Working effectively in financial services

| FNSACC418 | Work effectively in the accounting and bookkeeping industry |

- Develop professional working relationships

- Identify compliance requirements and support materials

- Set up and maintain systems to meet compliance requirements

- Work autonomously or in a team to complete work activities

- Develop and maintain own competency

Designing business documents

| BSBITU306 | Design and produce business documents |

- Select and prepare resources

- Design document

- Produce document

- Finalise document

Operational budgets

| FNSACC412 | Prepare operational budgets |

- Prepare budget

- Set budget timeframe

- Document budget

Research and develop business plans

| BSBESB401 | Research and develop business plans |

- Prepare to develop business plan

- Draft business plan

- Create a business plan

- Finalise business planning and plan for risk

Applied Education

Applied Education show more relevant information than Swinburne and Open Colleges after someone clicks on their Google Ad, but they offer a FREE course guide after you have been on their website for a short time. This way they are not forcing you to enter your details while still providing you with the information you want.

Applied Education boasts a membership to ICB (Institute of Certified Bookkeepers) which we use to offer when they first arrived in Australia. It is essentially a paid sponsorship of the ICB that any training company can offer. We stopped offering this service because student found little value in being a student member. Read more about Accreditation if you are interested.

Subjects in the Applied Education Cert IV in Accounting & Bookkeeping

FNS40222 Certificate IV in Accounting and Bookkeeping is assessed under the Principles of Competency-based training, students have to demonstrate their ability to do all activities in each Unit of Competency. There are 13 Units of Competency in this course.

- FNSACC323 Perform financial calculations

- BSBTEC302 Design and produce spreadsheets & BSBTEC402 Design and produce complex spreadsheets

- FNSACC426 Set up and operate a computerised accounting system

- FNSACC321 Process financial transactions and extract interim reports

- FNSACC418 Work effectively in the accounting and bookkeeping industry

- FNSACC405 Maintain inventory records

- FNSTPB412 Establish and maintain payroll systems*

- FNSTPB411 Complete business activity and instalment activity statements*

- FNSACC421 Prepare financial reports

- FNSACC414 Prepare financial statements for non-reporting entities

- FNSACC412 Prepare operational budgets

- FNSACC322 Administer subsidiary accounts and ledgers

*Unit part of the FNSSS00004 BAS Agent Registration Skill Set

Swinburne Open Education

Digital Marketing Strategy

- Google Ads

- Landing page with limited information

- Lead Capture Form to get more details

- Thank you page that sells the benefits of doing an online course

- Course Information brochure sent via email

Swinburne use a similar digital marketing technique to Open Colleges, revealing the highlighted information about the course but requiring website visitors to enter their details into a lead capture form to get more information.

The thing is that you can actually just type in their domain name and navigate your way to the information if you want – an remain anonymous (if you prefer).

Unlike Open Colleges, Swinburne don’t give you their course information on the thank you page but sends you the download link via email. They do this because they know that your email address is real and this is important because their are many enquiries that are made for the purpose of “market research” – just like the ones we did!

How students are assessed

Swinburne appear to offer a larger range of assessment methods and these are manual intensive, hence the cost of the course. These are the methods they use:

- Online quizzes, including multiple choice and short answer questions

- Portfolio of evidence

- Written reports

- Direct observation

- Video and audio role plays and demonstrations.

Cert IV in Bookkeeping and Accounting Subjects

CORE Subjects

FNSACC421 Prepare financial reports

BSBTEC302 Design and produce spreadsheets

FNSACC321 Process financial transactions and extract interim reports

FNSACC322 Administer subsidery accounts and ledgers

FNSACC418 Work effectively in the accounting and bookkeeping industry

FNSACC426 Set up and operate a computerised accounting system

FNSTPB411 Complete business activity and instalment activity statements*

FNSTPB412 Establish and maintain payroll systems*

FNSACC412 Prepare operational budgets

FNSACC414 Prepare financial statements for non-reporting entities

ELECTIVE Subjects

BSBTEC402 Design and produce complex spreadsheets

FNSACC413 Make decisions in a legal context

BSBESB403 Plan finances for new business ventures

Course modules

This course contains 14 online modules, which have been designed to cover 13 units of

competency, including 10 core units and 3 elective units. This course contains an introductory

module.

*These units are necessary for BAS Agent Registation. As required by the Tax Practitioners Board (TPB),

assessment of the two units is conducted under supervision via E-Proctoring

Think Academy of Business and Technology

Annie and her team at Think Academy are our RTO partner. We have a combination offer for students who enrol with them that enables them to learn bookkeeping using MYOB (both versions – AccountRight PLUS & Xero) as well as get discounted joining fee to our Bookkeeping Academy.

What can you do?

If you are a Mentor Education student please contact us and learn some bookkeeping skills by learning how to use MYOB and Xero.

Industry-Endorsed Short Courses in MYOB & Xero can give you the skills and confidence to apply for accounts jobs as well as perform better in your current job and they are usually much cheaper than accredited courses.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.