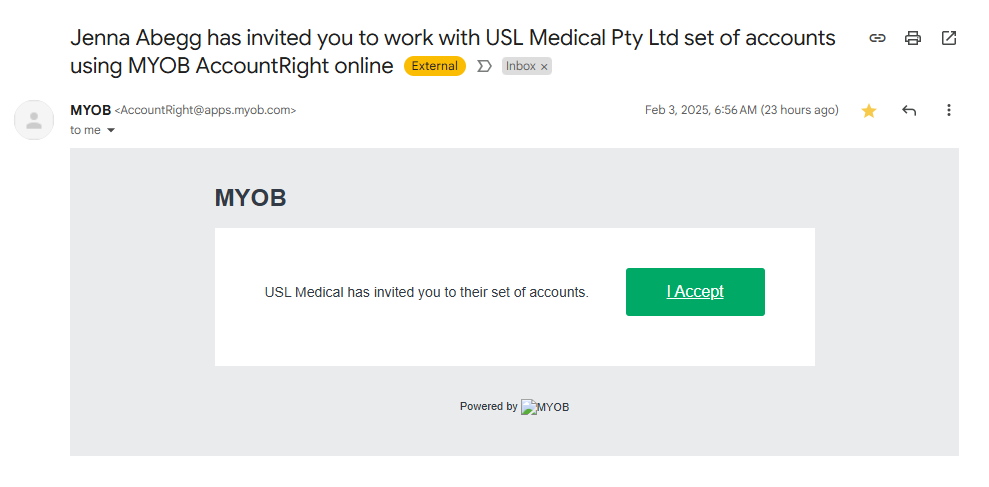

Every contract bookkeeper loves receiving these emails but they can wreak havoc with your computer

Emails like these usually means you have a new client and the client has invited you to start doing the bookkeeping for them on their MYOB file.

Everything about the email looks good but here is what to look for and the steps to take:

Continue reading Cyber Security for Bookkeepers – How are scammers trying to get you