Going beyond merely training and helping you to establish your career

THERE ARE A NUMBER OF industry associations that BAS agents (and aspiring BAS agents) can choose to join. However, as a BAS agent you are not compelled to join an industry association unless you really want to — it’s totally up to you. If you’ve been looking around and comparing the different industry associations you can join, you may have seen the term “recognised employer” or “employer recognised.”

A “recognised employer” is an organisation that’s partnered with an industry association and made a commitment to the professional development of their employees. The CPA, for example, says on its website that becoming a recognised employer will help firms attract top talent and provide training to their staff.

A mutually beneficial relationship

Organisations partner with industry associations to become recognised employers because it gives them access to the association’s members, the majority of which are often looking for work.

In turn, the organisation is attractive to members because it has the association’s endorsement. And the industry association usually gives its recognised employer partners access to discounted training for their staff.

Employer recognised

Because of this relationship between organisations and industry associations, members will often hear or see the term “employer recognised” used by their industry association. It’s basically the inverse of “recognised employer,” and it’s not unique to industry associations.

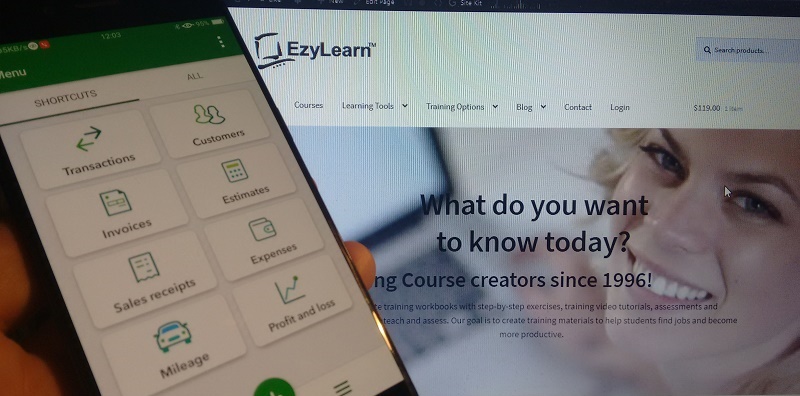

EzyLearn is an employer recognised training organisation, because we are the online training organisation of choice for many well known organisations in the accounting, bookkeeping, finance and related industries. (Plus some unrelated industries too!)

EzyLearn training at small, large and public sector firms

EzyLearn has delivered training to small and large organisations, as well as state and federal government departments, including WorkSafe and WorkCover. We use our online learning management system so people at the companies and organisations we work with can complete training remotely from their workplace or at home.

This gives students and employers the flexibility to choose when training will take place, rather than being restricted to a specific time and place, as occurs with face-to-face training.

It also means, we’re able to deliver lots of different courses, simply by making them available to each organisation and their staff, who can then study multiple courses successively or concurrently. This would prove quite difficult to organise if training was being delivered in person.

Why EzyLearn is employer recognised

It would require multiple training sessions over an extended period of time to make sure each employee who wanted to study got the chance to. And it would be expensive for the company as well. There’d be the cost of paying the trainer, room hire, and a day off work for the employees. This is also why our learning management system is so beneficial for organisations carrying out inductions.

EzyLearn is the preferred choice for dozens of companies because our courses are structured to let students choose when to study and the pace at which they’ll complete the coursework. Students can jump back and forth between the modules, studying the most relevant portions first before going on to complete the rest of the course.

Thousands of students study with EzyLearn to find work

Besides working with employers to help maintain their employees’ professional development, EzyLearn is also the training organisation of choice for thousands of students who wanted to refresh their skills to find work. Nearly all of those students went on to find employment, while many others either started their own businesses or added to their skills while already running a business. Our website has an abundance of testimonials you can view which show how people of all ages, from all backgrounds, have used the EzyLearn online training courses as a springboard to find work, start their own businesses, refresh their training and many other applications.

For students looking to start their own bookkeeping business, it is worthwhile taking a look at EzyLearn’s partnership with National Bookkeeping. Individuals who join National Bookkeeping as a bookkeeper receive help starting their own business — through lead generation, marketing and promotion — in addition to software and digital marketing training to ensure their business’s longevity in the marketplace.

***

Learn more about why EzyLearn is an employer recognised training organisation and view our extensive range of training courses. You can also learn more about becoming a National Bookkeeping bookkeeper at the National Bookkeeping website.