Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

EzyLearn had added Single Touch Payroll (STP) Phase 2 Training to our Xero Payroll Administration Training Course.

As Xero continues to be one of the leading accounting program for Aussie small businesses, we’ve been updating our courses to stay up to date with changes. We’ve also recently added Xero My Payroll content to this course.

The Australian government launched STP in 2016, where employers with over 9 employees must report their payroll information for each pay run to the ATO. When the ATO introduced STP Phase 2 earlier this year, some of the reporting obligations changed.

Here’s what you need to know about STP Phase 2 reporting in Xero, and how EzyLearn’s got you covered with the training.

What is STP Phase 2?

We’ve written more about STP Phase 2 with specific focus on performing these tasks in QuickBooks, but here’s a refresher of some of the key reporting changes:

- Disaggregation of gross income amounts

- Employment and taxation conditions

- Child support garnishees/deductions

- Income types and country codes

The idea of STP to reduce the burden on employers having to report information to multiple government agencies. With STP, employers can report all this information to the ATO through their approved accounting software (like QuickBooks Online, Xero, and MYOB).

Phase 2 introduced further reporting obligations. It does mean that there’s more work involved, but it also reduced the number of agencies to which employers have to report. Now, instead of reporting to multiple agencies like Services Australia, the Departments of Veterans’ Affairs, and the ATO, all the required information can be done through STP Phase 2.

How do I get started in Xero?

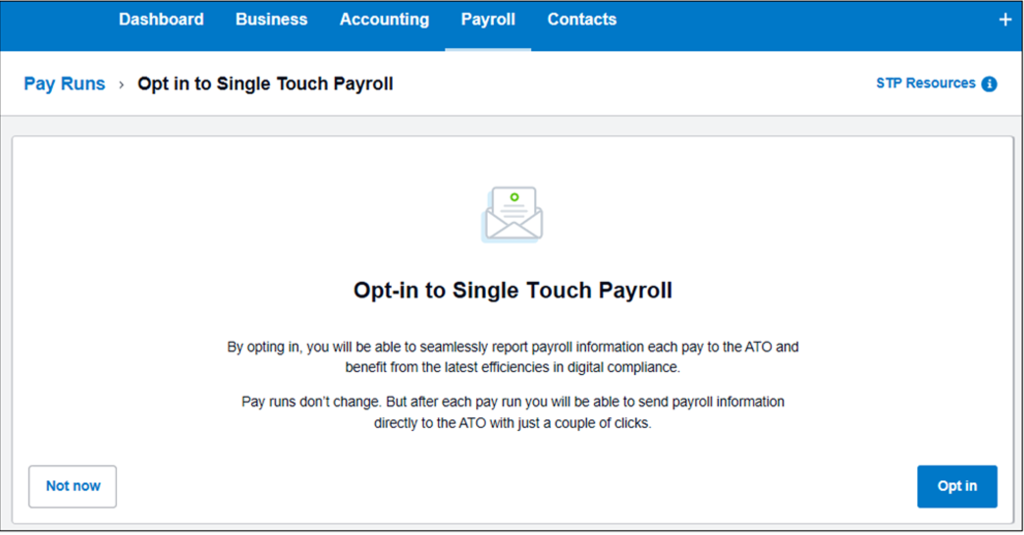

Just a quick note: STP in Xero is available for business with any number of employees. If you’re eligible, you’ll see a message in the Payroll tab about opting in for STP. From there, it’s a pretty simple process of connecting with the ATO and ensuring employee and balance information is all entered and correct.

You are probably already using STP in Xero, but if you’re not, there’s no better time to get started. Not only is it mandatory, but it’s also reduced the reporting burden of businesses and streamlines the whole process.

STP Phase 2 in Xero

Our Payroll Administration courses include training in STP, but we’ve updated them to cover the changes of Phase 2.

Xero has secured a 12-month deferral, which means businesses have until 1 January 2023 to start reporting through STP phase 2.

But there’s no time like the present to get started, so let’s break down some of the key changes and how to comply in Xero:

Disaggregation of gross income

Because multiple government agencies will now be receiving data via your STP reports, gross income amounts will need to be broken down into their individual items (disaggregated).

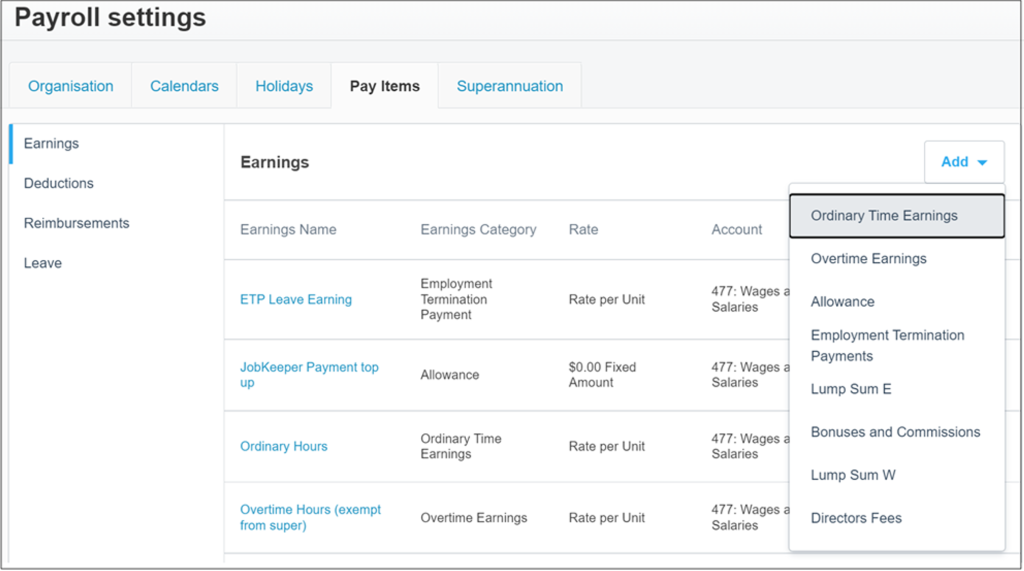

So Xero had added new pay types for pay items in Payroll:

- Lump Sum E payments are lump sum payments for back pay from previous years

- Bonuses and commissions

- Lump Sum W payments are paid to encourage employees to resume work

- Directors Fees

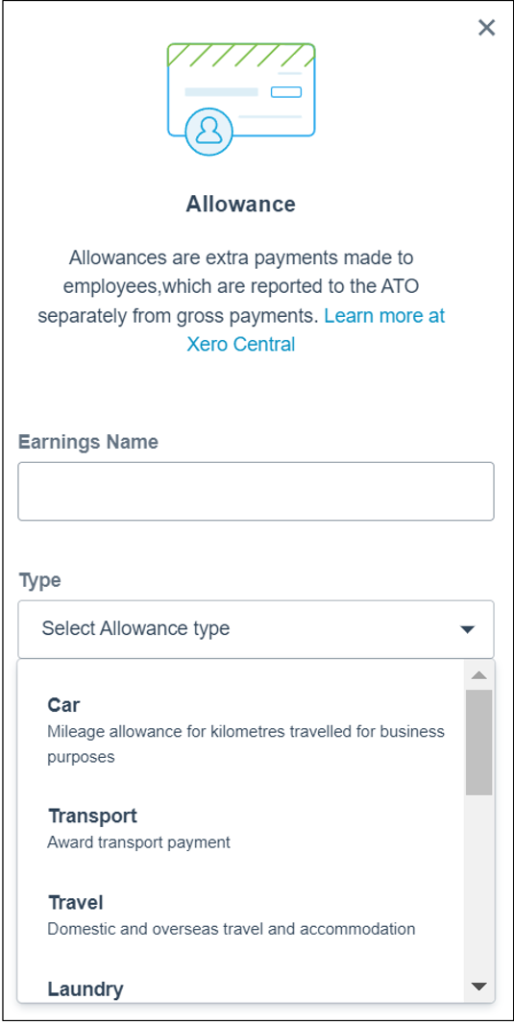

This also means that when you add an allowance, you’ll need to specify its type, which you can do through the following option:

Employee details

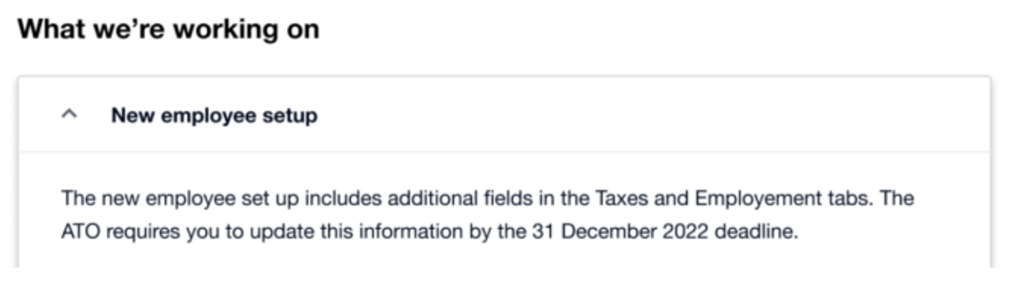

As Xero continues their rollout of changes in line with STP Phase 2, they’ve announced that the employees tab will get a bit of a makeover. Whilst these changes aren’t visible yet, they’re in the works and EzyLearn will update course content to cover them as soon as they’re released.

When you enter employee information into Xero, you’ll now need to specify whether they are an employee or contractor. You’ll also need to list their income type, for employees this means:

- Salary and wages

- Closely held payees (including family members of a family business, directors of a company and shareholders or beneficiaries)

- Seasonal workers or working holiday makers, and add their employment basis (full-time, part-time or casual)

And for contractors:

- Non-employee, an independent contractor

- Labour hire, outsourced labour from a hiring agency

Employee termination

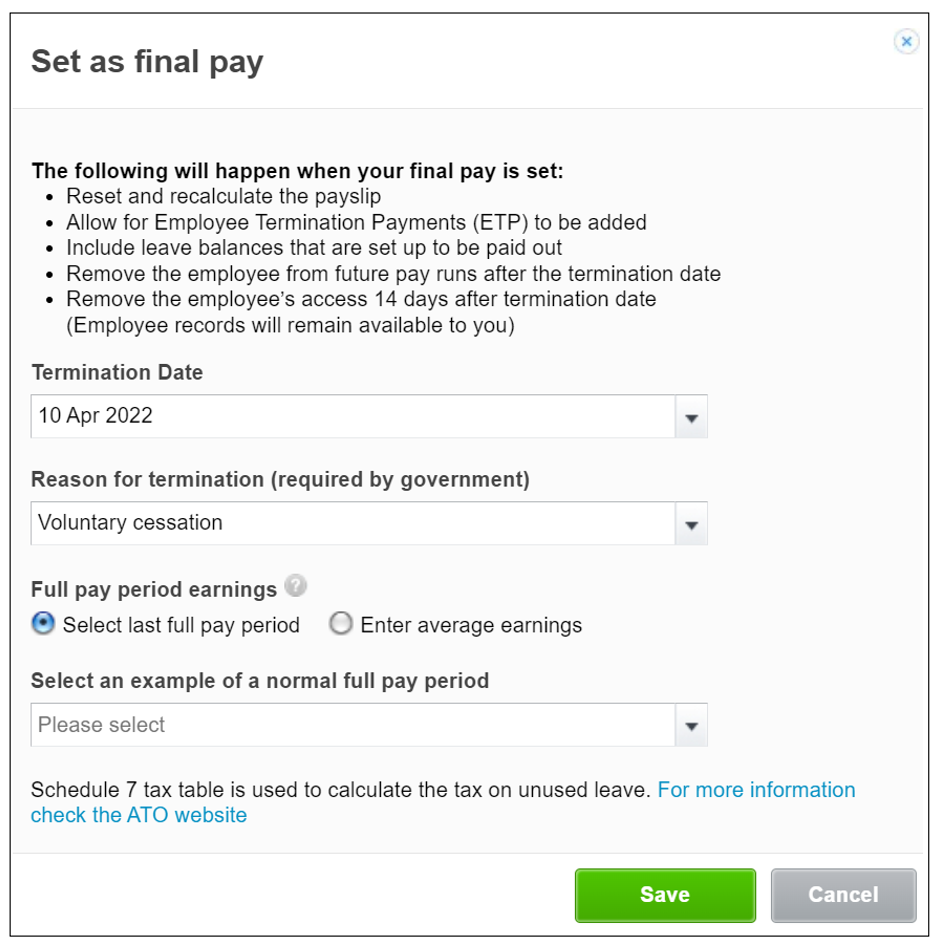

STP Phase 2 also now requires you to provide a reason for employee termination and a normal pay period. This removes the need for an employment separation certificate to be issued. You can do this easily in Xero:

Comply with STP Phase 2 with EzyLearn!

Whether your personal business or your employer uses Xero, staying up to date with STP changes is essential.

We’ve written about STP Phase 2 in QuickBooks and now Xero, but these changes are consistent across all STP-enabled software. So there’s no better time to enrol in the Advanced Certificate in Payroll Administration, which includes all payroll courses for QuickBooks, Xero, MYOB Essentials and AccountRight.

Or, if you’re looking for more training in Xero, have a look at our Xero Complete Training Course Package, which includes the Xero payroll course in addition to six other courses all included under one price!

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.