Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

For small businesses, getting the administrative aspects of payroll and super in order can be stressful and confusing. Things need to be paid by certain dates at certain amounts, and failure to comply can have some serious consequences, PARTICULARY when it comes to employees pay and entitlements.

So what does it mean for a small business or employer if they don’t pay super on time? Here’s what you need to know about the super guarantee charge, and how you can avoid it.

What is the super guarantee charge?

Firstly, let’s distinguish between super guarantee (SG) and the super guarantee charge (SGC). SG is the contribution employers have to make to their employees’ super funds, paid at least quarterly. It’s currently at a minimum rate of 10% of the employee’s earnings, but this will incrementally increase over time:

SGC is a penalty imposed on employers if they’ve failed to pay the SG correctly. What does ‘correctly’ mean? Well, there are a few different aspects that, if not met by employers, can saddle them with an SGC:

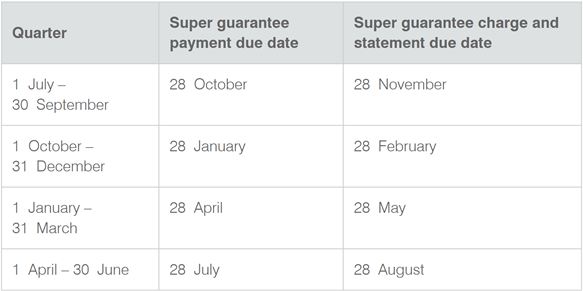

- If super isn’t paid on time by the quarterly due date

- If the amount is not at the rate of 10%, or

- If it is not deposited to the right fund (e.g. employee’s chosen fund)

If one of these conditions is not met, then an employer will need to lodge an SGC statement by the due date and pay the SGC to the ATO.

How much is the super guarantee charge (SGC)?

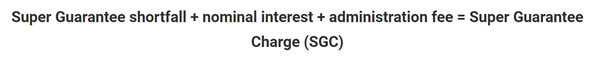

The SGC to be paid by employers is calculated through a few different variables:

- the super guarantee shortfall: unpaid super amount calculated on salary and wages (including any overtime)

- nominal interest of 10% per annum (accrues from the start of the relevant quarter)

- an administration fee of $20 per employee, per quarter

An employer may also need to pay a ‘choice liability penalty’ if they did not give an eligible employee the right to choose their super fund.

It should be noted that the super guarantee shortfall amount is based on salary and wages, whereas the normal super guarantee is based on ordinary time earnings. This means that if you need to pay SGC, it will likely be more than your normal SG contribution.

These factors all form the SGC formula:

The SGC is not tax deductible and – more pressingly – if you fail to lodge the statement and payment by the correct date, you could be charged a maximum penalty of 200% of the SGC!

What does this mean for small businesses?

It means that super payments really need to be made on time. Especially considering the recent change announced to the super guarantee threshold, which means more employees will be eligible for super.

The $450/month super guarantee threshold will be scrapped by July 1, 2022. It no longer matters how much income employees earn per month anymore – employers have to pay superannuation guarantee contributions on all earnings.

Previously, an employee was eligible for super payments if they earned a minimum of $450 per month from one job (before tax).

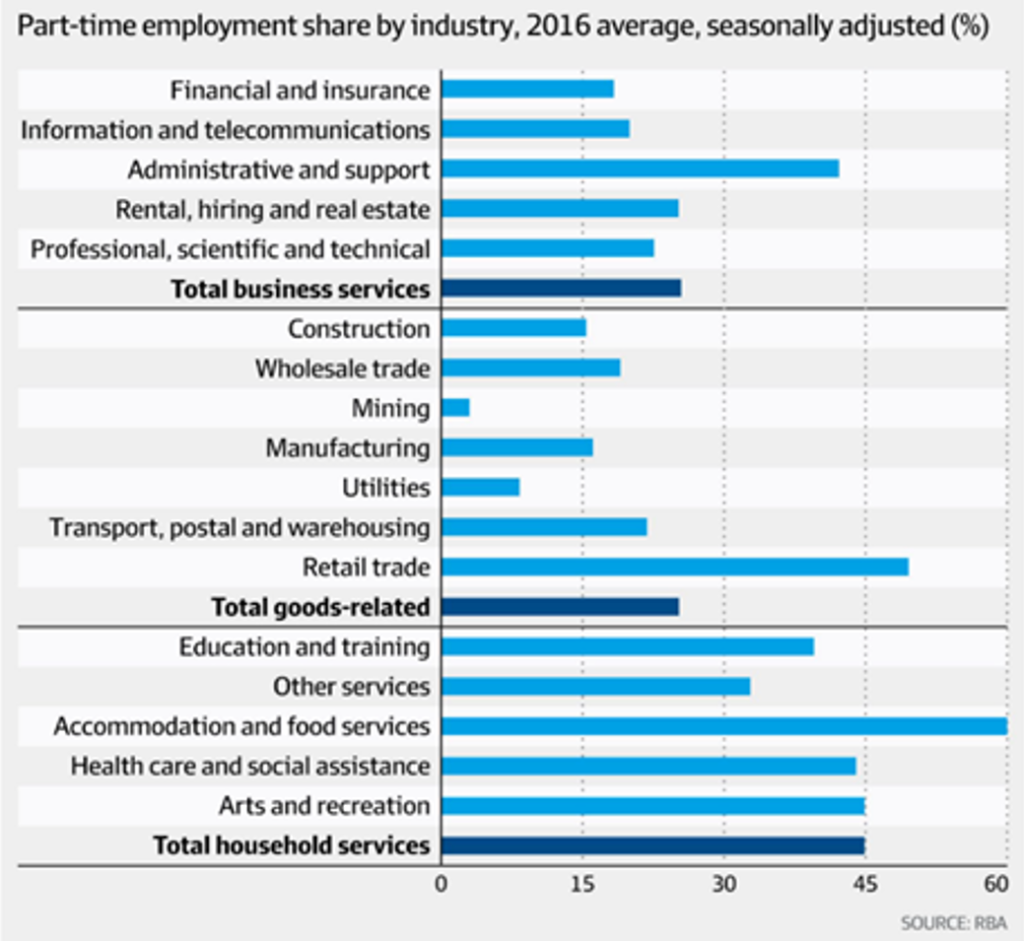

This especially impacted casual and part-time workers (many of whom are young people), who might not make $450/month; or, if they do, derive this income from more than one job.

This change was legislated this month in the Treasury Laws Amendment (Enhancing Superannuation Outcomes For Australians and Helping Australian Businesses Invest) Bill 2021.

The impacts of this will most likely be felt by employers in the accommodation and food services and the retail trade industries, as they are the largest employers of part-time workers, as well as the main employers of workers aged under 24.

A quick note: there does still exist a maximum super guarantee, which is currently $58,920 per quarter. If an employee earns more than this amount per quarter, their employer is not required to pay super guarantee.

Lisa Greig, founder of tax and business advice service Perigee Advisers, also notes that whilst Single Touch Payroll is now compulsory, some businesses still don’t use the system.

This could mean the reporting side of things gets more complex, especially for employees who work short shifts, and mistakes in reporting can add up to a couple hundred dollars by the time its solved.

“It increases the administration burden on small businesses that are trying to do the right thing”

Lisa Greig

Advanced Certificate in Payroll Administration

A great reason to use Xero, MYOB Essentials or QuickBooks Online is to be compliant with the ATO for payroll administration and super – otherwise you could find yourself needing to pay SGC.

Learn everything you need to know about payroll, including superannuation, in popular accounting software like Xero, MYOB Essentials, and Intuit QuickBooks.

Or learn them all in one course with our NEW Advanced Certificate in Payroll Administration Combination Training Course Package

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.