It’s been a bit chilly after the Australian Federal Budget and the stretch to the end of the year seems like miles away, but it’s not.

If you want to learn how to use Microsoft Excel and Xero with the full course and support, including Training Course Manuals but are on a tight budget, take advantage of our Micro Courses for Micro credentials.

Micro Courses in Excel, MYOB and Xero are now available at a discounted retail price.

Every micro course comes with

- the training workbook,

- exercise files and

- case studies as well as

- instructional video tutorials and

- online express support.

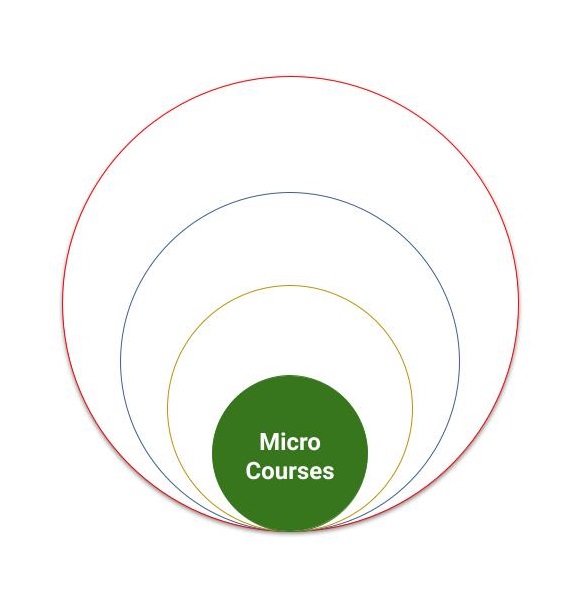

Many Micro Courses make a Complete Course

A micro course is a full course and case study but on a very specific topic.

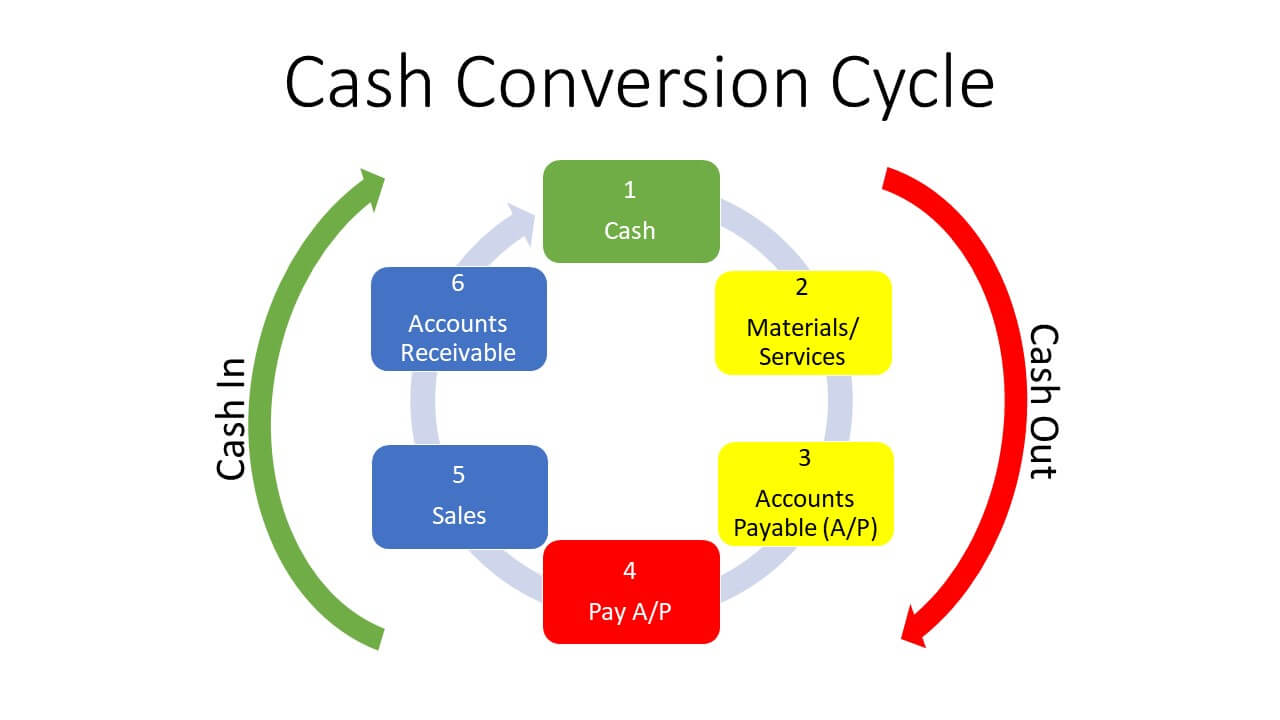

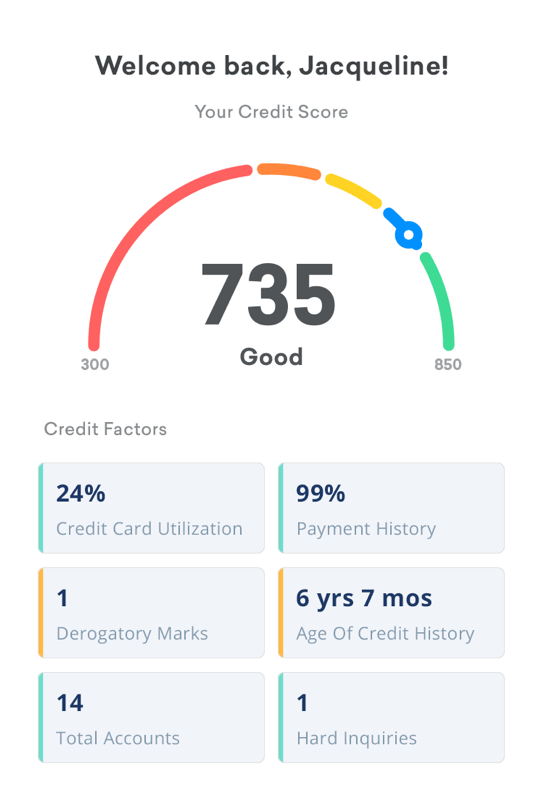

The most popular micro courses are the Daily Transactions courses in Quickbooks, MYOB and Xero because they teach you the most common bookkeeping tasks performed for most office admin jobs, including credit management.

Once you’ve completed the Daily Transactions course you can enrol into the

- End of Month Bank Reconciliation Courses, then

- GST Reporting and BAS and

- Payroll Courses – all available separately.

Enrolling into a Micro course is almost like paying it off one course at a time rather than a bigger initial up front payment.