We’re approaching the end of the financial year and everyone will be reading and trying to understand their annual financial reports, particularly if they have outstanding Superannuation to pay (and claim) or they need funding.

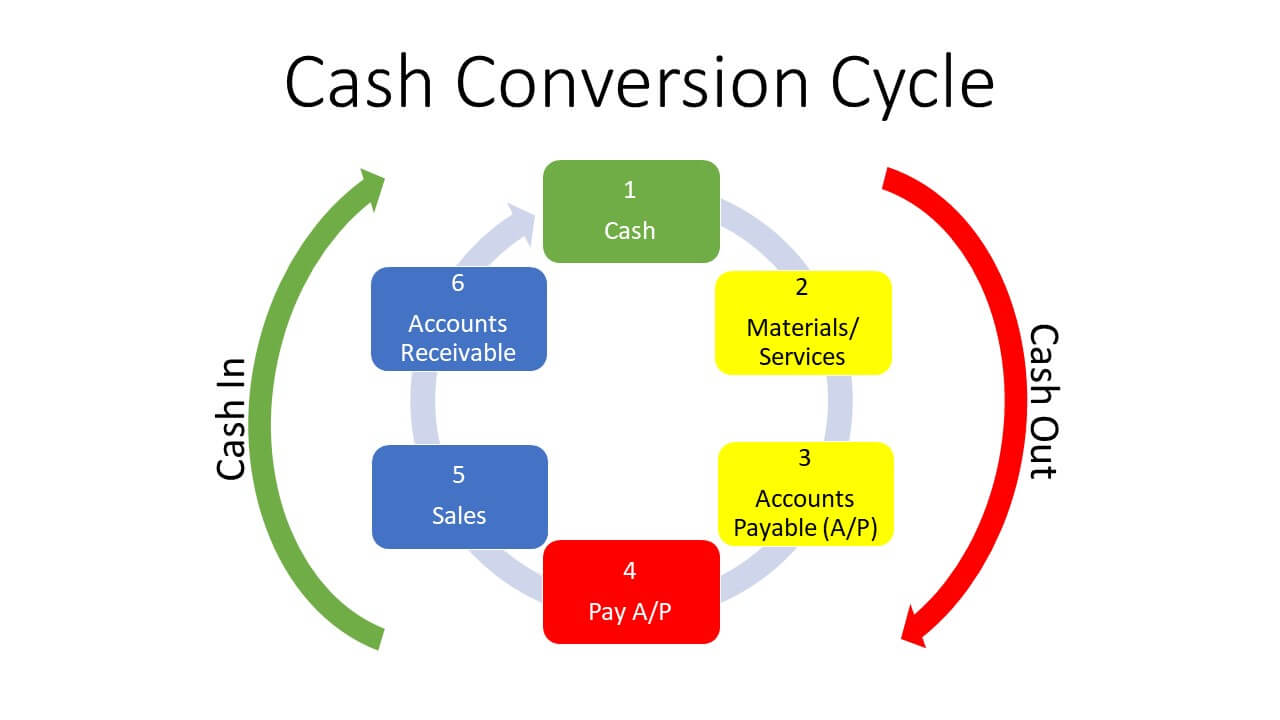

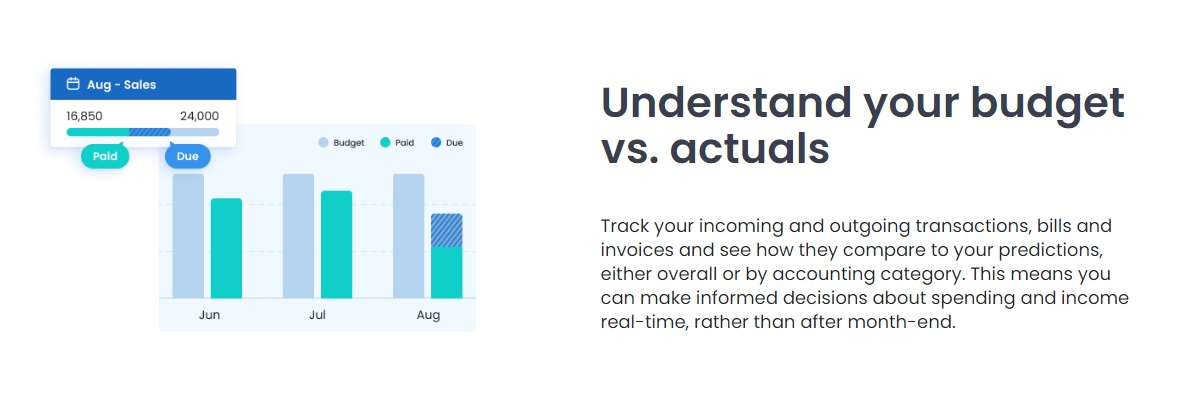

I’ve written in the past about how to create a cashflow forecast using Xero and Excel and this post is a summary of good practices and recommendations when it comes to cashflow reporting

Continue reading Tips for Cash Flow Forecasting using Xero