Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

The worst-case scenario for many businesses is having to chase up overdue payments from clients. Not only is it stressful and frustrating for employees, but it can mean cash stays tied up for longer, lengthening the cash conversion cycle.

Considering how many industries – from retail to construction – extend lines of credit to their customers, it’s essential for businesses to know how to collect their accounts recievable with as little time and hassle as possible.

But what if there was a way to make it easier?

What are terms of trade?

Terms of trade are the agreement between a business and a customer that establishes the conditions on which a good/service is sold and bought. It’s basically a contract, provided by the business and signed by the customer, that outlines the terms and conditions for sale.

Some of the things included in terms of trade are:

- Definitions

- Identification of goods/services

- Pricing (cost, GST, invoices, etc.)

- Payment terms (credit, interest rate, etc.)

- Delivery method of goods/services

- Risk and insurance

- Warranty

- Reservation of title

- Personal guarantee

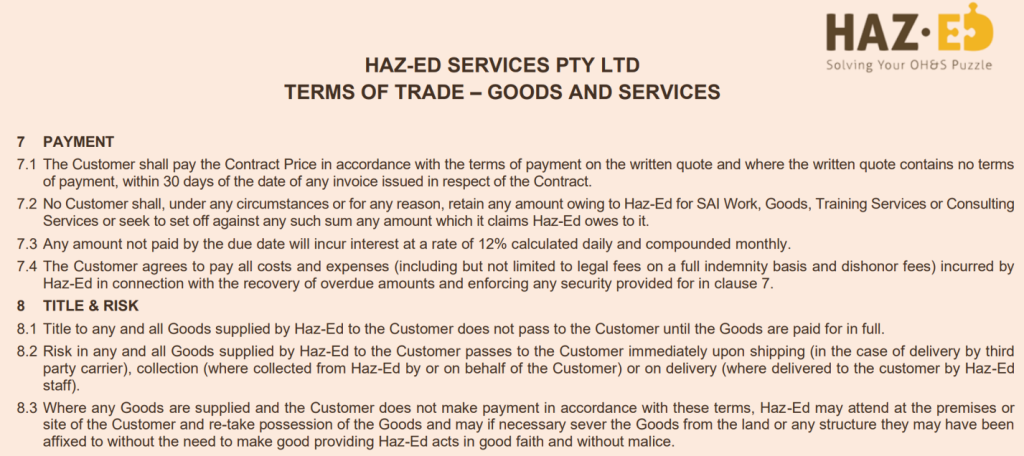

A quick google search will show how many free templates there are for terms of trade. Here is an actual terms of trade from Haz-Ed Services that is available on their website, with the sections on payment and title and risk.

Why are terms of trade important?

Because terms of trade are legally binding, they ensure that the payment and product are delivered according to the needs of both business and customer. Of course, things may go wrong, but the terms of trade will act as the legal document to enforce the conditions.

Often, businesses will put their terms of trade on the back of invoices they send to clients. Whilst this is a good way to remind clients of the conditions of sale, it is not legally binding.

By sitting down with a client and solidifying your agreement with a terms of trade contract, the steps are already in place for you to receive your payment as soon as you need it.

Shorten the cash conversion cycle

You can read more about the cash conversion cycle here, but the important thing to note is that the ‘days sale outstanding’ – which means the average time taken to collect accounts receivable – has a big influence in the length of a business’ cash conversion cycle.

Terms of trade establish, amongst other things, the pricing and payment terms for the good/service. If a customer buys a product with credit, the terms of trade will determine when they need to pay their invoice.

If a business can organise, within their terms of trade, the client to pay as soon as possible, then this can lead to a lower number of days sale outstanding on average…which means a shorter cash conversion cycle!

Chasing late payers

If the unfortunate situation occurs of having to chase up late payments, provisions in the terms of trade can ensure that:

- Your client knows and understands your credit management strategies

- You have clearly outlined when there would be a breach of contract

- The retention of title ensures the client does not legally ‘own’ your product without payment

- You have a legal document to which a debt escalation agency can refer.

Terms of trade can help you save a lot of confusion and delay when chasing unpaid invoices. In fact, you can use them to help avoid it entirely! Options like offering a discounted payment for clients who pay earlier than their invoice date can be included in your terms of trade, and might persuade clients to pay earlier.

The cash conversion cycle is a measurement of how efficiently a business is running, and establishing clear terms of trade with a client can help to collect accounts receivable efficiently.

Learn accounting skills here!

If you want to learn more about small business bookkeeping, including things like daily transactions and the cash conversion cycle, then check out our daily transactions courses for Xero and MYOB.

Or learn more about credit management with the Credit Management & Credit Controllers Training Package.