Someone made contact with us to find out which data entry and office admin courses they need to do to get a job using MYOB. It’s logical to want to know which courses will give you the skills for specific jobs so we put these guides together.

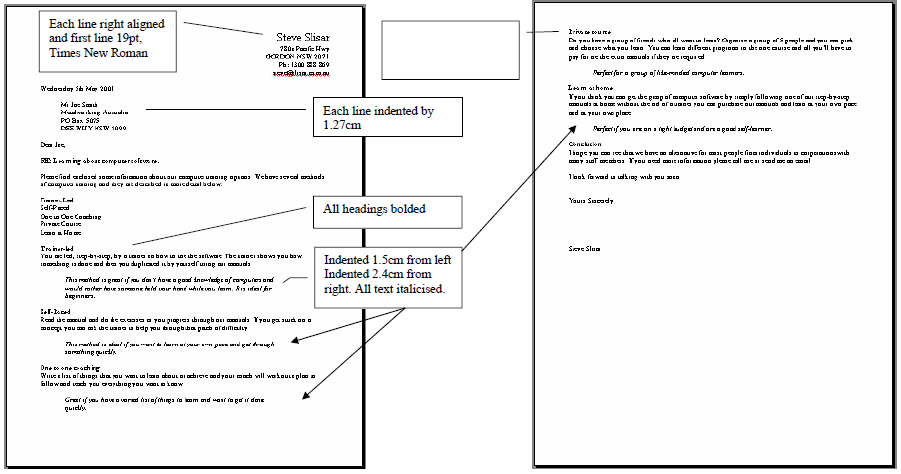

- Data Entry & Word Processing Jobs

- Office Support & Office Administration Jobs

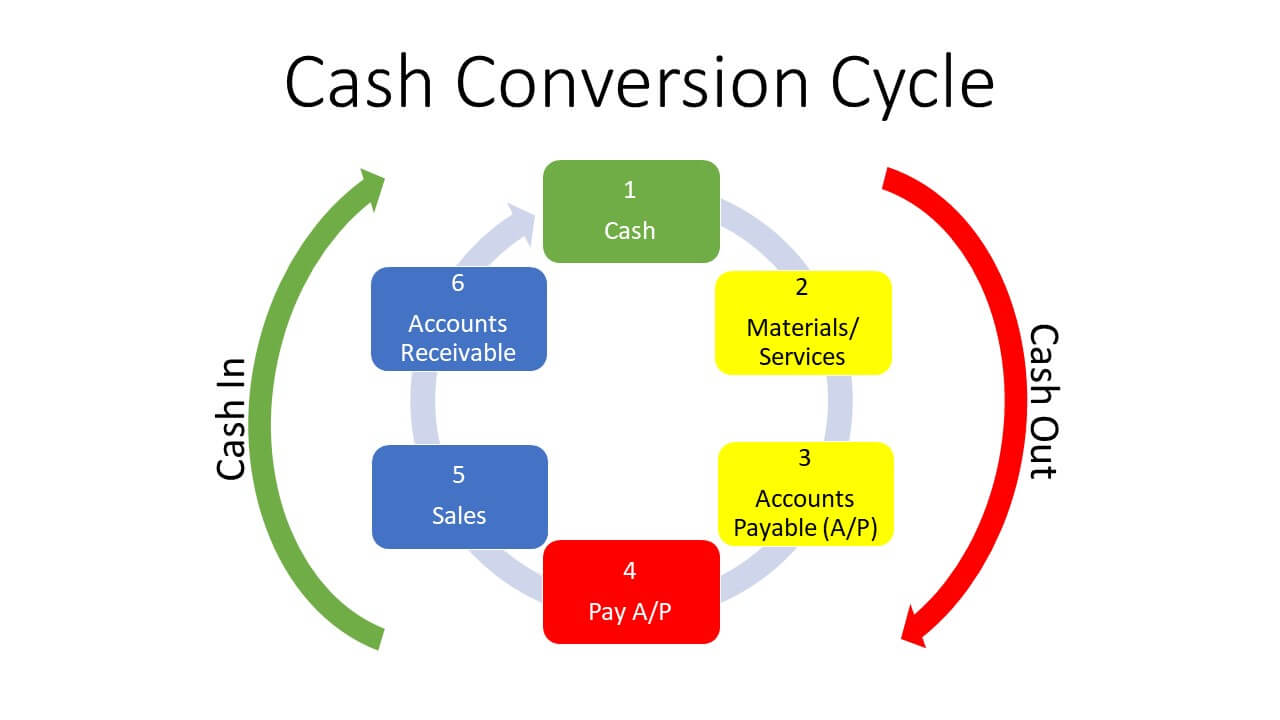

- Accounts Receivable / Accounts Payable Officer Jobs

- Customer Service, Client Support and Sales Administration

- Payroll Officer Jobs

- Accounts Administrator jobs

- Office & Business Administration Jobs

Get the

Get the  Get

Get

As with all startups they are setting up new processes and experience hiccups along the way like all businesses do.

As with all startups they are setting up new processes and experience hiccups along the way like all businesses do.