Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

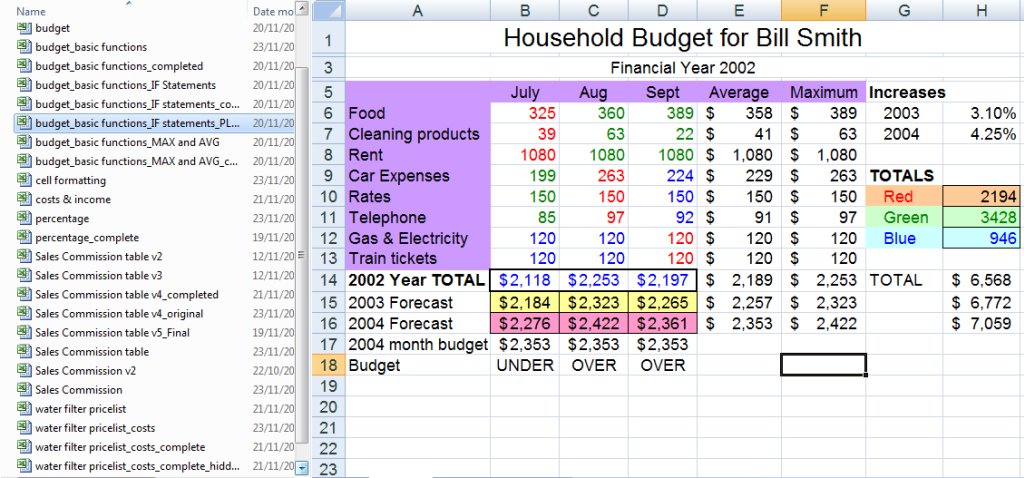

A household budget can keep you sane in times when major expenses are fluctuating. It is a requirement if you are applying for a housing loan and if you want to borrow to invest in an online business but it can also show you very clearly if you need to find new sources of income or get rid of some expenses.

If you have found yourself subscribed to too many online streaming services or software programs that you just don’t need or use your budget can help you identify those expenses.

Same goes with debt repayments for phones, household items or motor vehicles.

There are two budget templates in the Microsoft Excel Intermediate Training Course – one for your personal income and expenses and one for starting a small business.

A household budget usually starts off fairly simple with some basic information that you already know “in your head” but getting it into a Microsoft Excel spreadsheet and using powerful Excel features can really help you manage your cash flow.

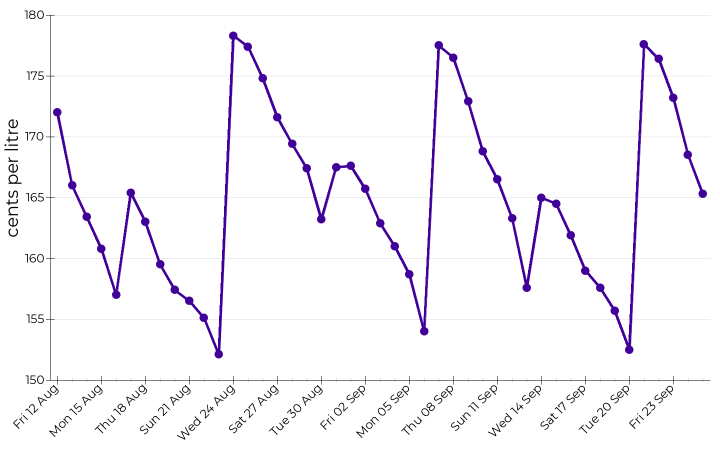

Cash Flow When Petrol & Other Expenses Fluctuate

Cashflow is what enables you to keep making repayment on a loan while also being able to pay for petrol and electricity while prices are very high.

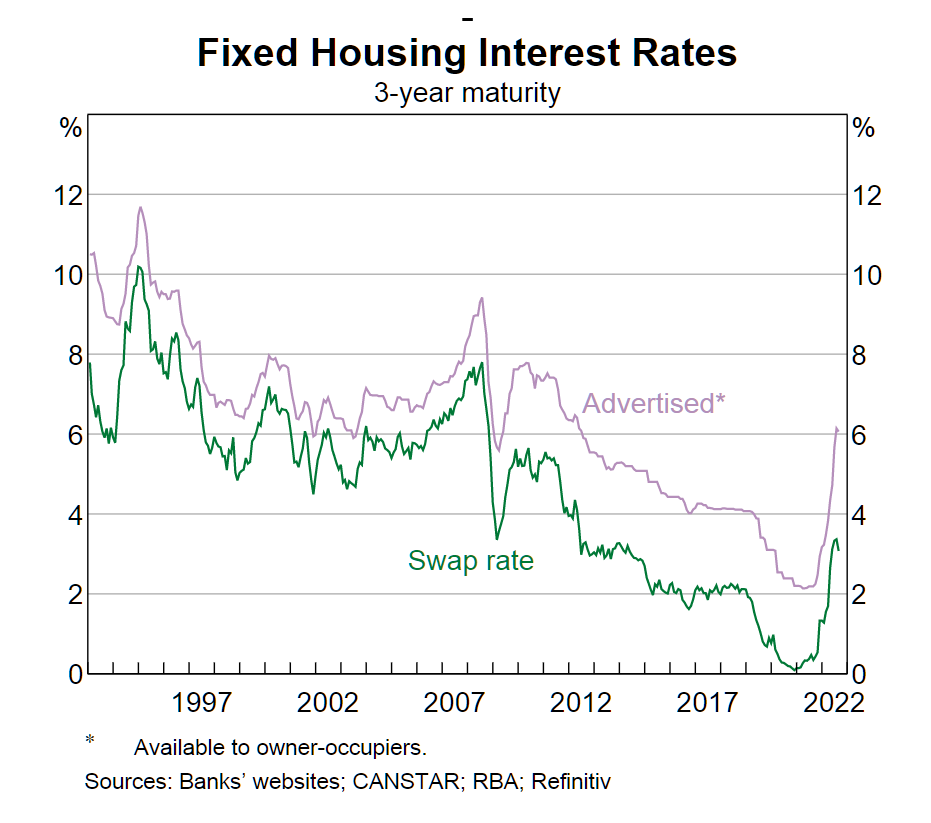

If you currently have a mortgage you’ll find that the Interest cost of your mortgage has probably doubled since a year ago!

The problem with some expenses is that they fluctuate while others rise or decline slowly so it is important to know how your cash flow looks at the worst case scenario using MAXIMUM functions as well as on AVERAGE.

This chart shows the petrol price in Perth over only a short period of time. These charts at the ACCC website are fascinating and show the true “volatility” of petrol prices.

Volatility in financial markets means “risk” and when the large businesses are creating their business budgets using Excel they need to consider these costs too, usually for a worst case scenario.

Is it Worth Paying for Solar Panels Now

The cost of solar panels is an up-front capital cost. There are loans you can get to pay for the panels and installation but they’ll often increase the total cost by 20-30% and add to your monthly expenses. If you don’t have solar panels on your home then the rising price of electricity will probably get you thinking more seriously about it.

If you are starting to pay MUCH higher electricity bills than you expected then it might be worth adding the cost of solar panels to your household budget. If you can figure out the rebates for feeding power back into the grid you can include that information in your income side.

I recently went through the process of getting solar quotes and I must say there are some smart operators out there. It was like watching a master class in digital marketing and sales funnels. More about that in a future blog.

I only went to about 3 websites, entered my details and then got bombarded with emails, text messages and calls. Some solar installers contacted me incessantly while others followed a systemised process of making contact. Some came out and did a physical inspection of my house (but didn’t go up onto the roof).

One Solar Installer climbed up to the roof straight away and made some detailed measurements and then provided a detailed quote which separated the cost of products and installation.

I’m compiling a spreadsheet with the information and we might see that in a future course!

Consider Interest Rates in Long Term Forecasts

If you work for a Government department or a secure long term job you might be able to highlight increases in future income to support your application for finance because of all the wage increase discussions and announcements lately.

Inflation is causing interest rates to rise and the cost of money is a MASSIVE consideration for any financial asset. It’s causing the share price of unprofitable business to plummet and affecting the value of properties and it’s a big factor that you can include in a detailed spreadsheet to do your own calculations about if you can afford to buy a property.

If you are exploring buying an investment property you’ll be able to show future incomes from rent in your household budget – wouldn’t that be a great thing right now!

Rising inflation AND a housing shortage is causing rental price to go up and you need to have a good rental income from an investment property at the moment.

Dual Key Properties are popular for that reason, plus you can claim the cost of depreciation for a new property purchase.

Microsoft Excel Household Budget Templates

The Microsoft Excel Intermediate Training Course includes a couple different exercise files that you can use to manage your own financial affairs. You’ll start learning simple calculations and get to more advanced formulas and functions that you can use for a new business venture if you want.

Combine this with some of your own property lending financial calculations and you’ll present yourself confidently to the banks and lenders. Best of all you’ll be armed with all the information you need to

- be aware of risks,

- understand your current Profit and Loss Statement, and

- make a good decision about buying any financial assets

Oh, and you’ll get better at using Microsoft Excel at the same time.

Microsoft Excel COMPLETE Training Course package includes

- 9 short courses in Excel,

- dozens of exercise files,

- 9 downloadable Excel training workbooks in

- hundreds of video tutorials about how to perform the exercises in the courses

- an Advanced Certificate upon completion

Enrol into Excel Complete or choose between Beginners, Intermediate or Advanced Microsoft Excel Courses.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

[…] household budget exercise file is included in the Excel Intermediate Training Course 306 and a similar exercise file is available in the Excel Intermediate Training Course 305. The goal is […]

[…] you don’t already have solar panels you might find now is a good time to have them installed to help reduce the cost of electricity. This is the type of decision you can make analysing […]