Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Have you spent any time looking at this foundational accounting formula? It’s a formula that shows how wealthy you are – what your worth.

If you are a property owner you would be smiling because of the increase in home values since Covid – and for the last 30 or more years in Australia!

Like most financial reports they don’t tell the full picture by themselves.

I’ve spoken to a few property owners in recent months and here are some common threads:

- They’ve owned property for 10 years or more

- The value of their home (asset) has at least doubled

- Their mortgage has gone down (liability)

- If they sell their home they can buy a smaller cheaper home and have no debt

Similar things happen with businesses but because small businesses are harder to value and sell most people see this situation play out if they invest in shares – the share price must be going up in value.

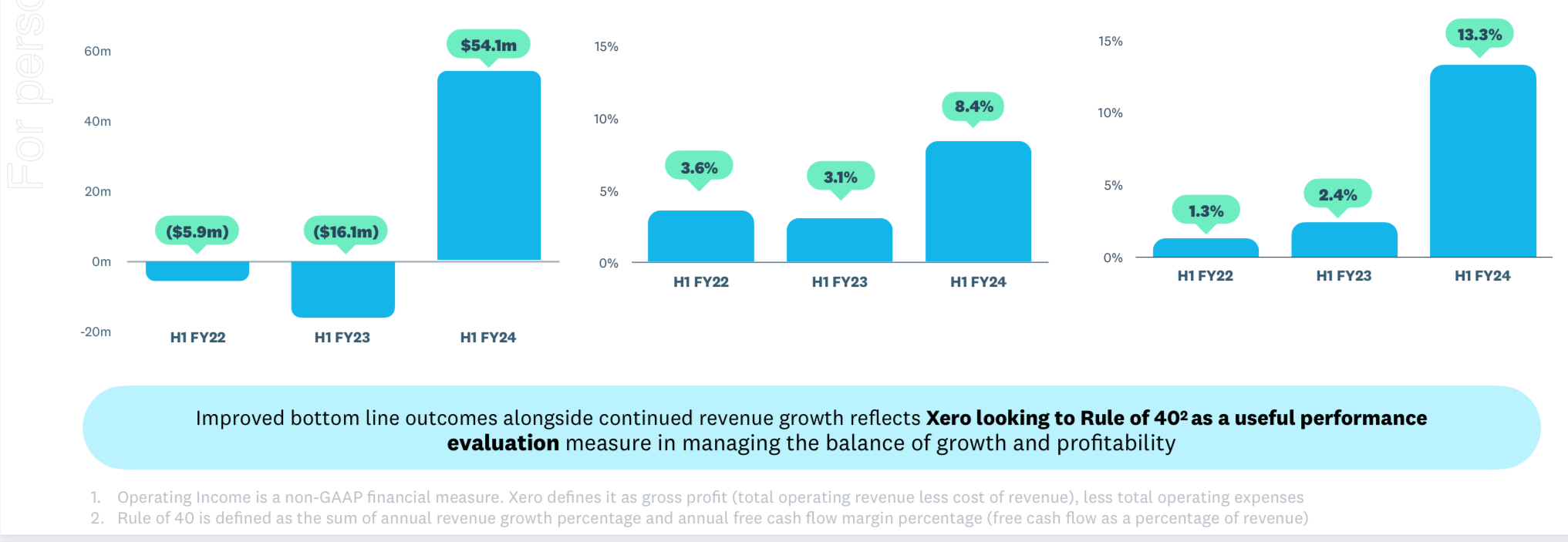

Free Cash Flow is sanity

Although the scenario above looks good what you don’t see from the Assets and Liability report is how much cash they have in their pocket (or bank account).

Those typical home owners mentioned above are probably both working and only see their family at the end of the day or weekends.

The Profit and Loss Reports shows how much revenue is coming into the house and how much money is going out.

The cost to own property is the Interest on your loan and although the loan doesn’t increase with the value of your property, the interest rate can increase – like we’ve seen lately.

In the scenario above our home owner is asset rich but cashflow poor.

Financial Reporting training is included with the Complete Xero Course and MYOB Business Course (Complete).

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.