Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Melio primarily competes with other accounts payable and payment automation platforms, including BILL (Bill.com), Tipalti, Stampli, and Coupa.

These companies all help businesses with the approval process for paying suppliers or Accounts Payable.

It also faces competition from broader financial software companies like Ramp, Sage Intacct, and NetSuite. These organisations are in the accounting software space for mid-sized businesses?

So, why did Xero just buy them?

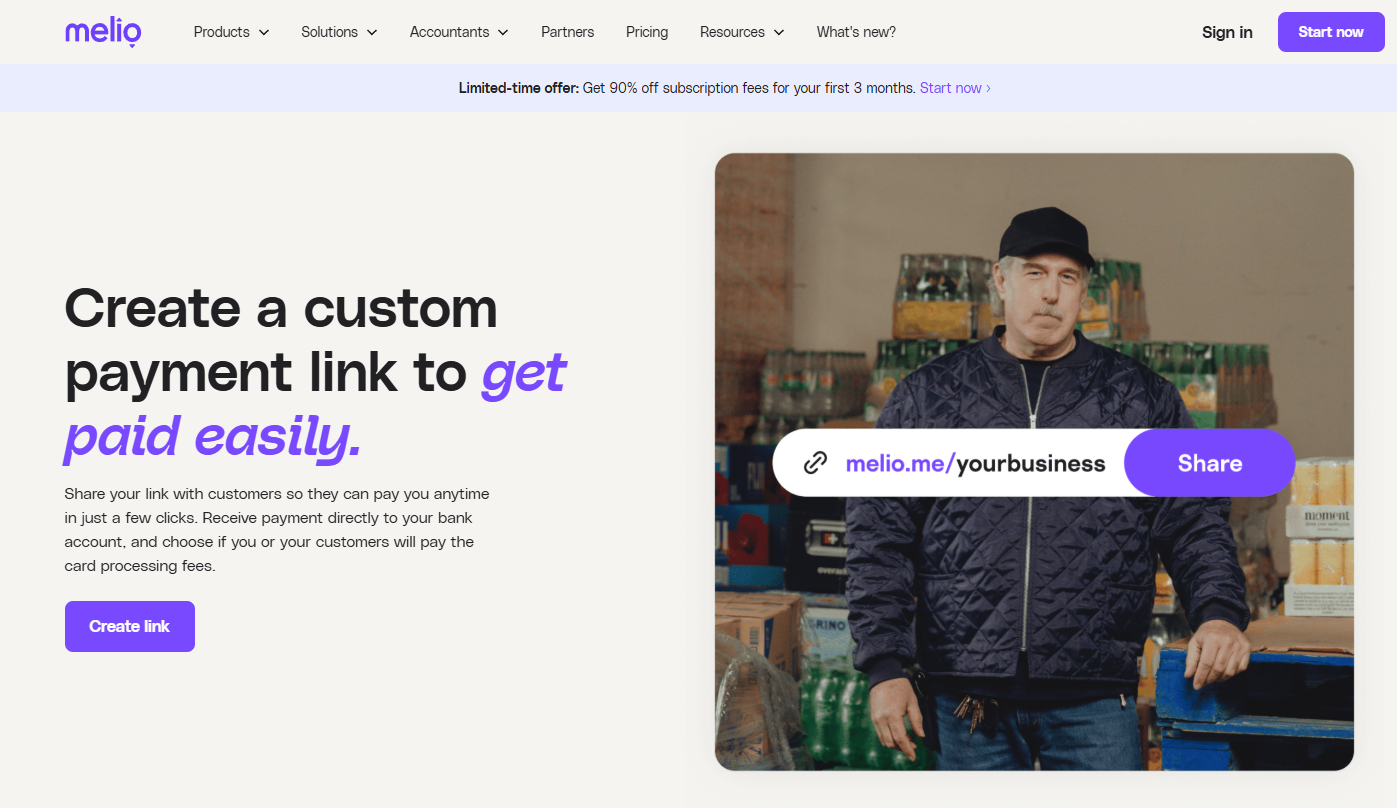

Melio is a U.S.-based fintech company that provides a cloud-based platform designed to simplify accounts payable and receivable for small and medium-sized businesses.

It enables companies to manage outgoing and incoming payments without relying on traditional banking systems.

Users can pay vendors, suppliers, or contractors through bank transfers, credit cards, or even paper checks (US spelling), which Melio processes and mails on their behalf – does anyone still use cheques!?

In June 2025, Xero announced its acquisition of Melio for $2.5 billion. This strategic move aims to enhance Xero’s presence in the U.S. market by integrating Melio’s payments capabilities with Xero’s accounting software, offering U.S. small-to-medium businesses a comprehensive financial platform.

Key Features of Melio:

Flexible Payment Options: Melio allows businesses to pay vendors via ACH bank transfers, debit cards, credit cards, or paper checks.

International Transactions: Supports international transactions to over 80 countries.

Integration with Accounting Software: Melio integrates seamlessly with accounting platforms like Xero, QuickBooks Online, and QuickBooks Desktop, facilitating automatic synchronization of payment data and reducing manual entry.

meliopayments.com

User-Friendly Interface: Designed with an intuitive UI, Melio simplifies the process of managing accounts payable and receivable.

Integration with Accounting Platforms:

Melio’s integration with accounting software is a significant advantage for small businesses.

Xero: The integration between Melio and Xero allows for automatic synchronization of bills, payments, and vendor information, eliminating the need for manual data entry and reducing errors.

QuickBooks: Melio integrates with both QuickBooks Online and QuickBooks Desktop (for Boost and Unlimited users), enabling users to manage payments directly within their accounting software.

MYOB: While specific details about Melio’s integration with MYOB are not provided in the available sources, Melio’s focus on integrating with popular accounting platforms suggests potential compatibility.

Given the recent acquisition by Xero, it’s likely that Melio will promote its integration with Xero more prominently moving forward.

Master your bookkeeping skills with the COMPLETE Xero course or just focus on individual Xero features like Accounts Payable and Accounts Receivable.

Payment Competitors

Melio operates in a competitive landscape with several notable competitors:

Wise (formerly TransferWise)

Offers international money transfers with transparent fees and real exchange rates.

Airwallex

Provides a range of financial services, including online payment acceptance, international payments, multi-currency accounts, and corporate cards.

airwallex.com

Stripe

Known for its comprehensive suite of payment processing services with global reach and robust API support.

joinsecret.com

PayPal

Offers versatile payment solutions widely accepted across various platforms.

Square

Ideal for mobile vendors and physical stores, providing robust analytics and point-of-sale solutions.

youtube.com

Melio vs. Square, Stripe, and PayPal

While Melio, Square, Stripe, and PayPal all offer payment solutions, they cater to different business needs but one thing looks certain – Xero will start earning a percentage of each transaction on top of their monthly subscription!

Melio

Specializes in accounts payable and receivable for small and medium-sized businesses, offering flexible payment options and seamless integration with accounting software.

Square

Focuses on point-of-sale solutions for physical stores and mobile vendors, providing hardware and software for in-person transactions.

Stripe

Offers a comprehensive suite of payment processing services with global reach, suitable for businesses requiring customizable payment solutions.

PayPal

Provides versatile online payment solutions, widely accepted across various platforms, and suitable for businesses of all sizes.

In summary, Melio stands out for its focus on simplifying accounts payable and receivable processes for small and medium-sized businesses which is one of the most time consuming areas of the daily bookkeeping workload.

Master your credit management with a good understanding of accounts payable and accounts receivable using Xero in the Xero Daily Transactions Course.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.