There’s a regular cycle your business goes through every week, month or quarter. It’s a cycle that maybe you pay little attention to—it’s so simple, so entrenched in your business operations you hardly even consider it—but it’s time you took a closer look at what is called: the Cash Conversion Cycle.

What is the Cash and Assets Cycle?

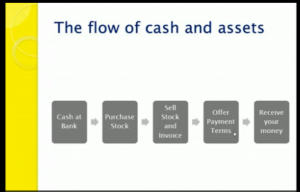

As the name suggests, the “cash and assets cycle” starts with cash in the bank. This 5-step cycle then progresses through to purchasing stock; selling and invoicing that stock; offering payment terms (say 14 days, 30 days or cash-on-delivery) and finally, receiving payment. And so it goes, rinse and repeat.

Monitoring this cycle is vitally important to the success of your business—and your livelihood. But perhaps you’re wondering why.

Isolating the Late Payers

We’ve previously talked about why you need to keep on top of your bookwork so you can isolate any potential late-payers—called debtor management.

By keeping the cash and assets cycle in mind, it’s possible to see the real implication late-payers can have on your business.

With invoices left outstanding, you can’t start the cycle again—that is, purchasing more stock—and without stock, you’re left with nothing to sell and (obviously) no money coming in. You have literally reached a standstill and all because you didn’t monitor where you were in the cash and assets cycle.

Keep an eye on your cash and assets cycle and you’ll come to notice those perpetual late-payers, enabling you to put processes in place to better manage these customers.

These processes could involve things like requiring payment upfront, adding administrative charges, or when everything else has failed, debt collection.

But monitoring your cash and assets cycle, regardless of how easy it is to forget about, is essential to ensuring your cash and assets keep cycling. The setting up of professional invoices and payment terms are just some of the areas covered in our MYOB online training course.