Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

The MYOB Payroll Training Course is in stage two of development. The contents of our existing Payroll course give students an introduction to how to navigate around and get fundamental information about the payroll environment in the sample company file. As part of our constant improvement process we are developing payroll scenarios as exercises for our students. This new content when published will be available for all existing Payroll Students and all those who have enrolled with the LIFETIME training course Access option.

The MYOB Payroll Training Course is in stage two of development. The contents of our existing Payroll course give students an introduction to how to navigate around and get fundamental information about the payroll environment in the sample company file. As part of our constant improvement process we are developing payroll scenarios as exercises for our students. This new content when published will be available for all existing Payroll Students and all those who have enrolled with the LIFETIME training course Access option.

Which table to use?

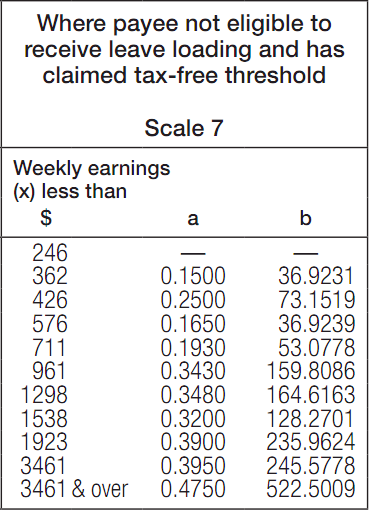

The ATO release papers that provide you with the information you need to perform your calculations regarding PAYG, super etc. In this blog post we look at Schedule 1 Pay as you go (PAYG) withholding NAT 1004. If you take a look at table 7 on page (see diagram on this page) you’ll see the variables or what the Australian Tax Office call coefficients.

New Spreadsheet for Excel and MYOB students

One of our content creators is in the process of creating an Excel spreadsheet as a simple tool to help you work out how much PAYG tax and super you owe at the end of quarterly BAS reporting period. It’s a tool that we will offer both Microsoft Excel and MYOB Training Course students when it’s ready. And no, before you think of asking, it won’t cost you any extra money to receive it. It’s available as part of our LIFETIME student access.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

[…] post we mentioned that one of our course content creators was working on a spreadsheet to help with PAYG and Super calculations for BAS reporting. Well it’s now ready (AND there’s more to […]