Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Conversations amongst business colleagues and business owners appear to suggest that many people are in a rush to spend before June 30. I spoke with someone who feverishly exclaimed that everyone should get private medical insurance! It’s all good and well to get in a panic before the end of the financial year but if you didn’t have the correct information before now and the decisions you make are not based on known facts then why make them?

Conversations amongst business colleagues and business owners appear to suggest that many people are in a rush to spend before June 30. I spoke with someone who feverishly exclaimed that everyone should get private medical insurance! It’s all good and well to get in a panic before the end of the financial year but if you didn’t have the correct information before now and the decisions you make are not based on known facts then why make them?

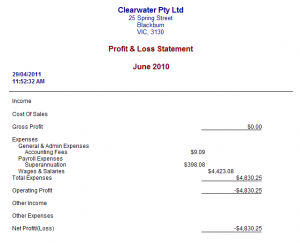

It’s the time of year where all the data entry from Day-to-Day Transactions should be up to date, you should know the value of depreciation for your fixed assets and have a good idea of the value of your tax and GST liabilities. A profit and loss report and balance sheet will provide you with the information you need and if these figures are ready then spending decisions can be made. This is the time for reporting and reconciliation.

If you simply find yourself with money in the bank but don’t want it to go to the tax man think again, you might need it to pay your liabilities next month. For now, enjoy the bulging bank balance.

Remember. Compliance is the measure of success of your business plans so be compliant as soon as possible every month.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.