Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

HNRY aims to take care of everything by taking a percentage of your total revenue. This is GREAT for micro businesses but not good AT ALL as you scale and get larger.

While Xero and HNRY both cater to the financial needs of small businesses, they differ significantly in their approach and offerings.

Xero’s recent acquisition of Melio, a U.S.-based payments platform, brings it a step closer to being a one stop shop like HNRY and taking a percentage of your total transactions.

Understanding Hnry and Xero

Hnry is tailored for sole traders, freelancers, and self-employed individuals, offering an all-in-one solution that combines accounting, tax filing, and financial management.

It automates tax calculations and filings, manages expenses, and provides invoicing tools, effectively acting as both an accountant and a bank account for its users.

Here’s a detailed article about HNRY

Xero, on the other hand, is a comprehensive cloud-based accounting software designed for a broader range of small to medium-sized businesses. It offers features like

- bank reconciliation with bank feeds,

- invoicing – which you can do on the road using your phone,

- payroll, and

- financial reporting.

Unlike Hnry, Xero requires users to manage their own tax filings or collaborate with external accountants.

I wrote an article about how Elon Musk can turn Twitter (now X) into a massive income earner by turning it into a payments provider and earning transaction fees.

Will Xero be doing the same with their new purchase of Melio?

Xero’s Acquisition of Melio: A Strategic Move

In June 2025, Xero announced its acquisition of Melio for $2.5 billion, aiming to integrate Melio’s bill payment capabilities into its accounting platform .

Melio specializes in facilitating payments for small businesses, allowing them to pay bills via bank transfers or credit cards, even if vendors don’t accept card payments .

This acquisition is significant for several reasons:

- Extra Services: By integrating Melio, Xero can combine accounting and bill payment functionalities within a single platform.

- Revenue through transaction fees: Melio’s payment processing capabilities introduce a new revenue stream for Xero through transaction fees, complementing its existing subscription-based model .

- U.S. Market Share: Melio’s strong presence in the U.S. market provides Xero with an opportunity to expand its footprint in North America, a region where it has been seeking growth .

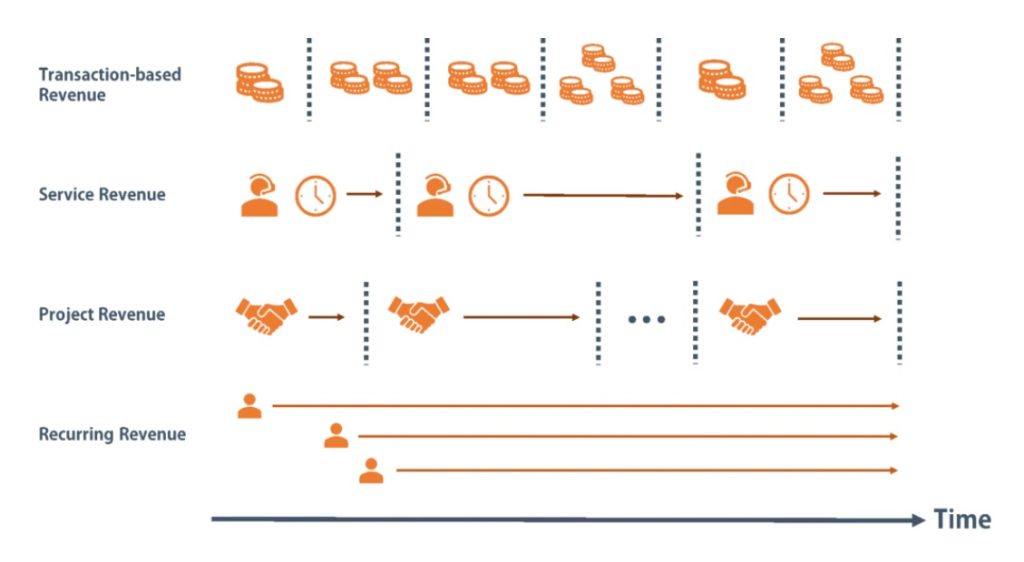

This visual shows different ways that businesses can earn money.

This is what I wrote about Melio in a previous post.

Implications for Small Businesses

For small businesses using Xero, the integration of Melio’s services means accounting and payments functions can be completed within a single platform, improving efficiency and cash flow management.

Xero users will now be able to pay their suppliers through various methods, including credit cards, offers greater flexibility and manage the authentication and approval process for these expenses.

Xero is doubling down on the menial and repetitive tasks associated with the thousands of little transactions businesses need to make every week, month or quarter.

By themselves these tasks are simple but like most things these days the entire process can get very complicated. The best way to learn these skills using Xero is with a step-by-step Xero course that uses real world transactions from small business case studies.

The Complete Xero course includes 7 Xero short courses at a discounted price and is a perfect tool for small businesses who need a resource for new starters or existing employees who need to upskill to take over extra tasks.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.