Earn CPD points to maintain your certification

IT’S THAT TIME OF THE YEAR again and many students are asking us if they can use our courses towards their annual CPD point requirements — the answer is yes and you can see how many points at the links below.

IT’S THAT TIME OF THE YEAR again and many students are asking us if they can use our courses towards their annual CPD point requirements — the answer is yes and you can see how many points at the links below.

When stricter requirements were introduced by the Tax Practitioners Board (TPB) for anyone responsible for signing off the financials that are lodged at BAS time, the bookkeeping industry started to go through the type of regulation that has been in place for financial advisers and accountants for many years already — to continuously maintain their education regarding their industry.

How CPD points are calculated

I originally thought there was a universal method of calculating CPD points, but very soon after exploring how our online courses can help students with their CPD, I realised that the world of continuing professional education is varied. The best explanation I could find was actually from a 2008 document relating to the changing requirements for licenced real estate agents. You can get a copy of it from our “Selling Your Property Guide” Page.

That real estate industry document takes you through the method of calculating how to earn 1 CPD point, 2 CPD points or 3 CPD points and it’s centred around the type of training institution you use for your education. Government events or university courses earn the highest points while ordinary courses earn the lower points — there’s also a significant different in the price of these events 🙂

1 hour equals 1 CPD point

The most common method of calculating the amount of CPD points you’ll earn for an education activity is based on the time you spend learning. A 1 hour webinar will earn 1 CPD point while a one day course may earn you 8 CPD points, so we provide estimates of the time to complete our online courses based on how long they use to take in a classroom environment and you can learn about them at our CPD page.

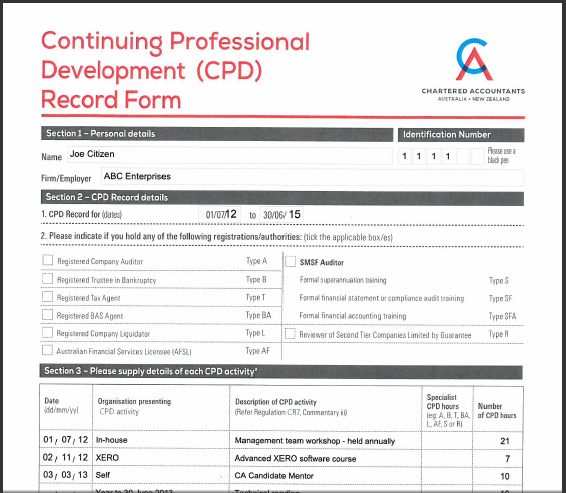

The other interesting thing I learnt was that as long as you can justify that the learning you participated in applies to your industry, you’ll be able to put it on your CPD record form and present it to your industry association to confirm and apply to your CPD register.

Tax Practitioners Board makes the rules for bookkeepers

The TPB as they are fondly know as sets the rules and manage their compliance through Recognised Professional Associations. If you go to their association website you’ll find that there are a number of associations you can join to make certain you are compliant with the TPB requirements.

These are some other interesting links you should probably know about if you’ve reached this far in the blog and are still interested!

- If you are a professional bookkeeper you are required to know about the Tax Agent Services Act 2009 including the Code of Professional Conduct.

- A maximum of 25% of your CPD points can be earned from professional reading and here are their other guidelines on what is acceptable for CPD — they refer to it as CPE (for Education)

- This is how the TPB expect you to keep your records for CPE attendance.

- TPB’s main landing page for Continuing Professional Education.

What about Accountants?

Chartered Accountants also have their CPD requirements and you’ll want to check their CPE pages out:

Chartered Accountants Australia CPD Requirements

Association of Taxation and Management Accountants

CPA Australia CPD requirements

IPA Institute of Public Accountants CPE requirements

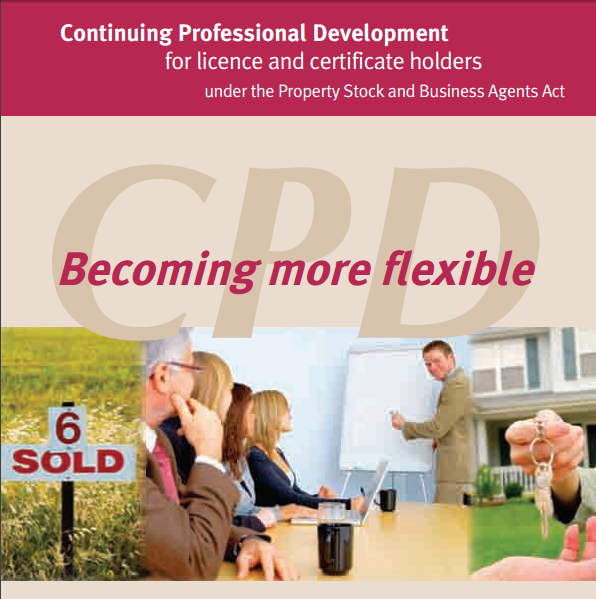

Real estate agents must complete CPD training courses to be compliant

Real estate agents must complete CPD training courses to be compliant

I recently wrote about the similarities between bookkeepers and real estate agents and in doing some research our team came up with the CPD requirements for real estate agents and you can see that, along with a Certificate IV level qualification both professions need to maintain their continual education and keep evidence of it!

CPD Requirements for Real Estate Agents in NSW

Most real estate agents in Australia are sales agents and they must comply with the Property, Stock and Business Agents Act. The regulations for property ownership are different in each state and because sales agents receive deposits in their trust accounts and have a fiduciary responsibility to the people they act as an agent for, they must maintain professional standards just like accountants. Because real estate agents can misappropriate their clients deposits it is important that they maintain a good professional standing and be a person of good character.

Ongoing lifelong education is an important part of that process because it ensures that agents are familiar with the rules and regulations as they change over time but training is important for lots of reasons and one of them is to help real estate agents be better at what they do – even with their digital marketing.

***

We can help with your Accountant, Bookkeeper & Real Estate Agent CPD Points

We can help with your Accountant, Bookkeeper & Real Estate Agent CPD Points

EzyLearn has helped Accountants & Bookkeepers learn about accounting software and spreadsheets and even marketing for their own businesses. We’ve also helped Real Estate Agents stay ahead of their competitors with Google, Facebook and other Digital and Social Media Marketing Courses.

Check out the total hours to complete our CPD courses and include that in your records.