Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

In our educational guide, Bookkeeping Beginner Basics, which you can download from the EzyLearn website for free, you’ll learn how to record journal entries in your accounting software, whether you’re using MYOB, Xero or QuickBooks. Most bookkeeping newbies don’t know what a journal entry is, though, which is what this blog post – the latest in our Bookkeeping Beginner Basics guide companion series – is going to help you to understand.

The journal vs. the general ledger

An accounting journal is the record that keeps accounting transactions in chronological order (i.e., as they occur), while the general ledger is a record that keeps accounting transactions by the account – see our previous post on the chart of accounts [Bookkeeping Beginner Basics: The Chart of Accounts] if you need help understanding what the term ‘account’ means in this context. Before computers, bookkeepers used to log all the financial transactions of a business in paper journals, and then at the end of the month transfer these journal entries into the general ledger, which was divided into various accounts that is now called the chart of accounts, and all the transactions were posted to these accounts using a method called double-entry bookkeeping.

Journal entries using accounting software

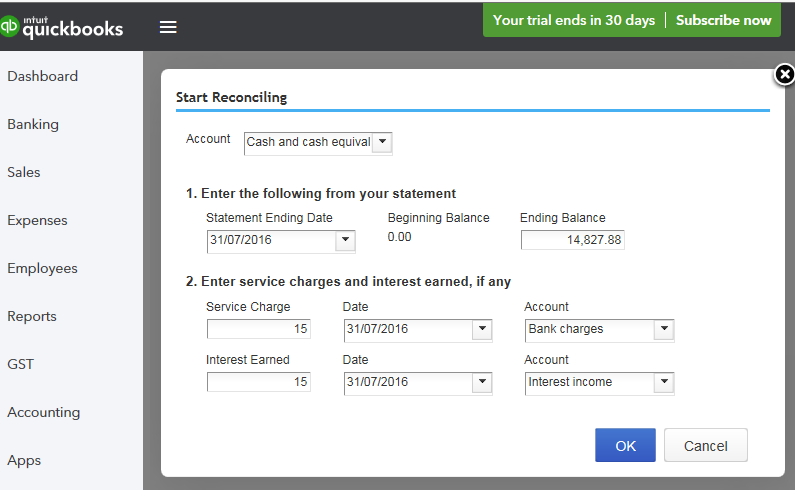

Today, however, accounting systems, such as MYOB, Xero, QuickBooks and the like, will automatically record most business transactions into the ledger immediately after the software prepares sales invoices, issues cheques to creditors, or processes receipts from customers, and as such you don’t have to create journal entries for most of your business’s transactions.

That being said, some journal entries still need to be processed, in order to record transfers between bank accounts and to record adjusting entries. You would need to make a journal entry, for example, at the end of each month to record depreciation or to record interest accrued on a bank loan.

Double-entry bookkeeping

If journal entries and general ledgers and the double entry bookkeeping method sound a bit too much, and you think you’d rather stick to the cash-based accounting method instead, prepare yourself for bad news: all businesses, whether they use the cash-based accounting method or the accrual accounting method, use double-entry bookkeeping to keep their books, and all accounting software applications, by default, are set up to adhere to the double-entry method, too. The double-entry bookkeeping method reduces errors and also ensures that your books balance, so as complicated as it may seem, it’s much easier in the long run.

If you still feel a little out of your depth, however, you can hire a reliable bookkeeper to manage your bookkeeping system and deal with all the journal entries and double-entry business for you, instead. Visit the National Bookkeeping website for to find a highly qualified bookkeeper whose experience and skills suit your business needs.

This blog post is part of our Bookkeeping Basics series, which are being published to complement our new educational guide, also titled Bookkeeping Beginner Basics, which you can download for free from the EzyLearn website.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.