Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

We’re approaching the end of the financial year and everyone will be reading and trying to understand their annual financial reports, particularly if they have outstanding Superannuation to pay (and claim) or they need funding.

I’ve written in the past about how to create a cashflow forecast using Xero and Excel and this post is a summary of good practices and recommendations when it comes to cashflow reporting

The Xero Cash Flow and Reporting training course is an advanced Certificate course that teaches you how to take a messy set of accounts to produce a number of reports that explain the financial position of the business.

In our case study, Jerry is an ex-corporate worker who goes out on his own as a new business owner. He tries a number of different business ideas and splashes out buying assets for his business because they seem like a good investment at the time.

The financial reports that you produce in this course will show what he SHOULD have done and what makes the most financial sense in the future.

Assets and Debts

Cash flow reporting for retail businesses who receive payment immediately are not as crucial as they are for businesses which carry debts and provide credit to their customers.

If you are a products and service business like an electrician, plumber or a phone installation company (like our CloudPBX business case study) you need to watch your cashflow closely and ensure that you manage your payments as well as chase up money owed and improve your credit management systems.

Your Accounts Receivable reports show the money that is owed to your business and this money is categorised as an Asset.

Your goal when pursuing good cash flow management however is to convert that asset to “Money in the Bank!” – which is also an asset.

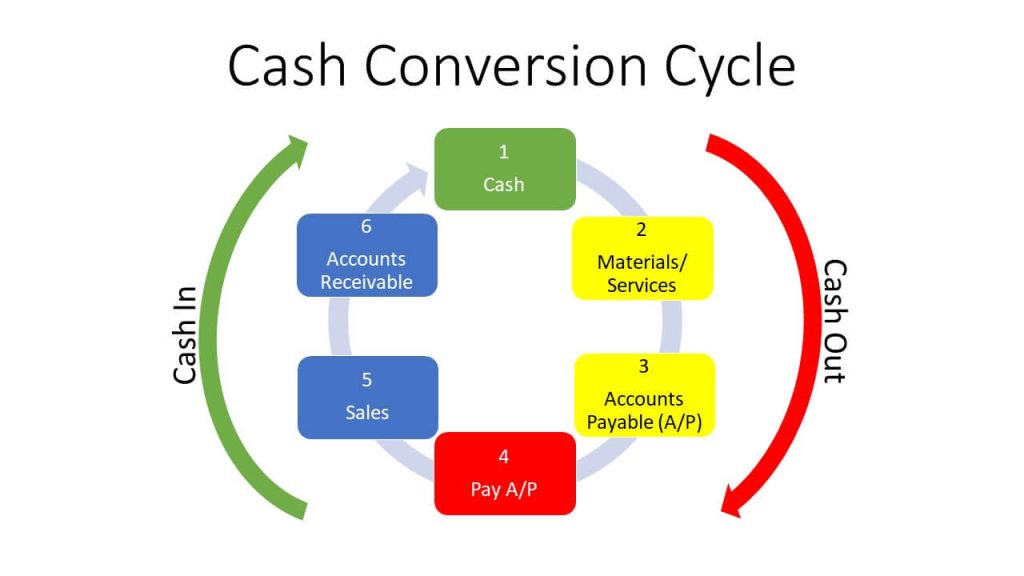

When you understand the cash conversion cycle you realise that one of the MOST important variables is “How long it takes to get paid“.

Tips for Good Cash Flow Management

1. View your Cash Summary Report

The Cash Summary report in Xero shows the movement of cash into and out of your business. The default Cash Summary report shows the data for the current month, but you can change the options to display in the report (e.g. date, period, compare with, include GST, etc.).

You can also export this report to share with your financial advisers or bring it into Microsoft Excel where you can completely customise it to your own requirements. Xero and Excel Training Courses are now available (launched in September 2022) as a Combination Course package because they work so well together.

Xero’s cash summary report provides a backward facing view of your company’s cash flow but you need a forward looking cash flow forecast or budget to make good decisions that can help you grow your business.

2. Include your Cash Summary in your Management Reporting

The Cash Summary is included in the management report, a pack of reports designed to capture the most important information about your business.

Management reports are used to display the financial health of your company and is important for senior staff and managers as well as externally by the Treasurer and investors.

Having your Cash Summary in your regular management reporting will ensure that you are regularly checking the pulse of your cash position.

Learn all about Cash Flow Reporting, Forecasts and Budgets using Xero in our Advanced Certificate in Xero Course

3. Make a financial forecast using Microsoft Excel

Cash flow forecasting is much more flexible when you use a spreadsheet and Microsoft Excel is the global standard, particularly in larger businesses.

The Xero Cash Flow Reporting course shows you how to export the Cash Summary into a spreadsheet and use it to create a forecast for your organisation.

The problem with spreadsheets is that you could end up spending hours updating the numbers yourself and make mistakes in the process. Having said that you can customise it completely to your own requirements.

Learn Xero and Microsoft Excel COMPLETE in the discounted training course Combination

4. Use an add on (Integration) from the Xero marketplace

Reporting apps come with forecasting tools that provide information about the future – well, projections of the future based on historical information. They’re designed to be straightforward to use and produce nice visual projections that are easier to interpret. Popular Reporting and Forecasting apps include:

- Fathom

- Spotlight

- Float

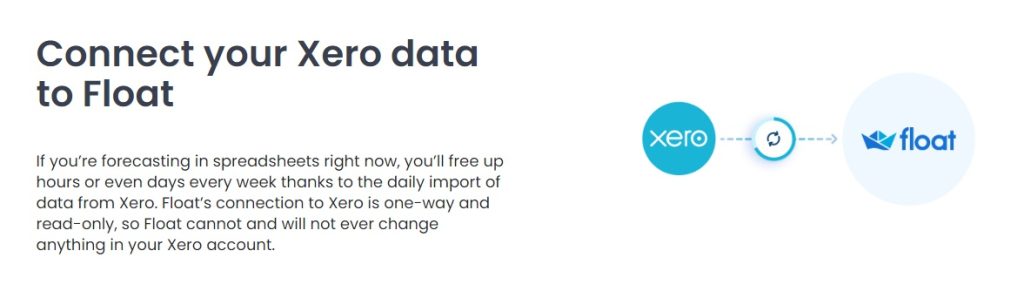

One of the best things about these forecasting and cash flow integrations is that they draw their data directly from within Xero and don’t require any data entry.

They are also purpose built to give business owners and managers the information that they want and need – in a visual format.

5. Know how much you plan to sell and how much you will spend

The basic principles of cash flow forecasting are cash in and cash out. Cash in is the revenue you will generate in a certain time period (e.g. sales) while cash out is the expected costs your business will face (e.g. overhead, salaries, cost of sales, etc.).

If you work for a large organisation these sales forecasts might come from the sales and marketing director and include known seasonal factors for the business. Expense forecasts might come from a non-executive director, treasurer who manages the business from a purely financial perspective.

Knowing the timings of when you will and won’t have cash is one of the most important things to consider when planning for your business’s future.

Companies that need to manage this risk might produce several variations of their cash flow forecast based on different scenarios – Xero integrations can make this task much easier.

While there are other important aspects to consider, understanding the relationship between cash in and cash out is the foundation of building an accurate cash flow forecast.

6. Understand when bills and invoices will be paid

As mentioned above you need to know the number of days it takes to get paid, the age of receivables and the risk profiles of your customers to know this figure. In a larger organisation the Treasure of Chief Financial Officer will need to delegate changes to credit management procedures to affect real change in reducing the time it takes to get paid.

If the business has government clients you’ll want to get your business into eInvoicing because it is a major goal of the Australian Government to pay small businesses quickly.

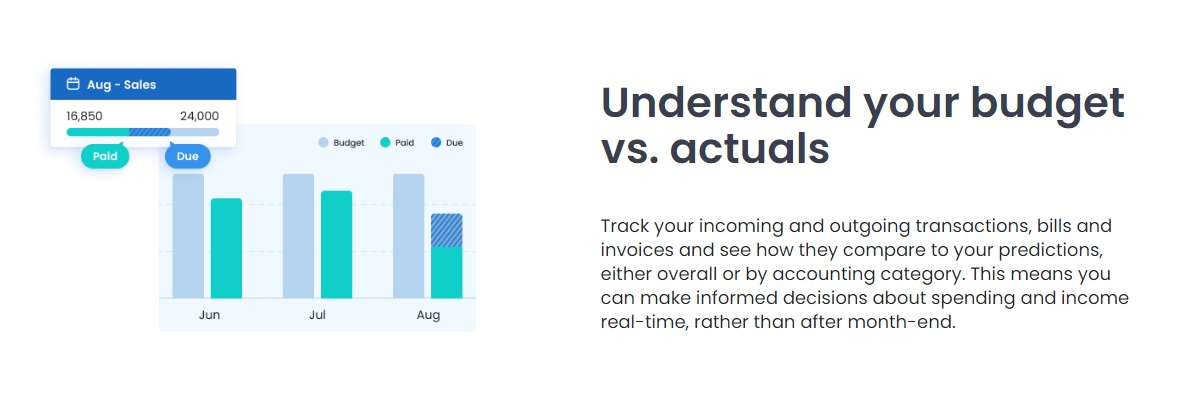

7. Look at your budget vs. actuals

Financial Forecast reports are purely hypothetical and can be very accurate but business is unpredictable sometimes and changes can occur in many different places. Many of these changes you can’t prevent but if you are aware of how the business is performing by comparing budgets to actuals you can make small adjustments regularly to navigate the changes.

Recent interest rates increases caused massive changes to spending habits and debt costs and one surprising change was the value of major software companies. The cost of money obviously has a massive impact for businesses so in times of rapid change you need to make regular checks and changes.

Is Xero Competing Against it’s own Integration partners?

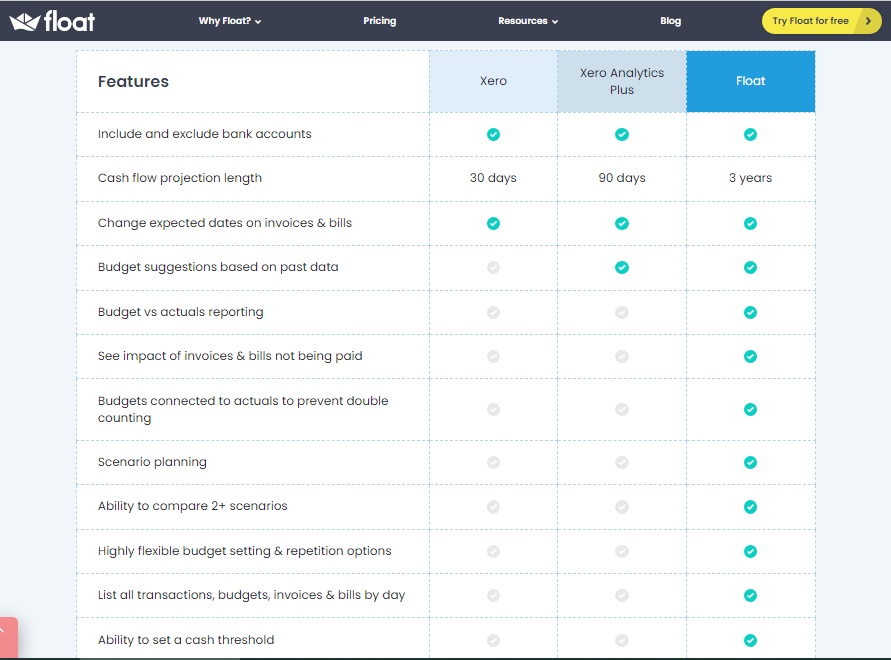

After exploring the Float website in detail it became apparent that there is a fine line between Xero and many of it’s integration partners. I’ve written in the past about the numerous acquisitions that Xero has made to maintain it’s revenue growth and this page at the Float website hints at reasons to use Float rather than just rely on Xero Reports.

Xero made a big announcement this year about upgrades to their Xero Reporting system and even have a subscription that provides more detailed reporting – “if” you’re prepared to pay for it. What will happen next? More to come on Xero reporting soon.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.