Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Would you sign up to a Xero controlled back account? Would you let Xero become your accountant or tax agent to the Australian Taxation Office (ATO)?

Does that sound strange? Imagine if Xero managed your bank account for you and made sure that all your taxes were paid for automatically BEFORE allowing you to receive your pay.

Doesn’t that “sort of” happen already with Single Touch Payroll?

If Xero had their own accountants would you go with a Xero accountant for your own business?

To anyone who has been in business for at least a couple years that concept probably sounds foreign and weird, don’t you think?

I mean the software company that provides your

- core accounting software, PLUS

- some of the integrations for receipt scanning, workforce management and project management, offering a

- bank account and

- your own tax or BAS Agent?

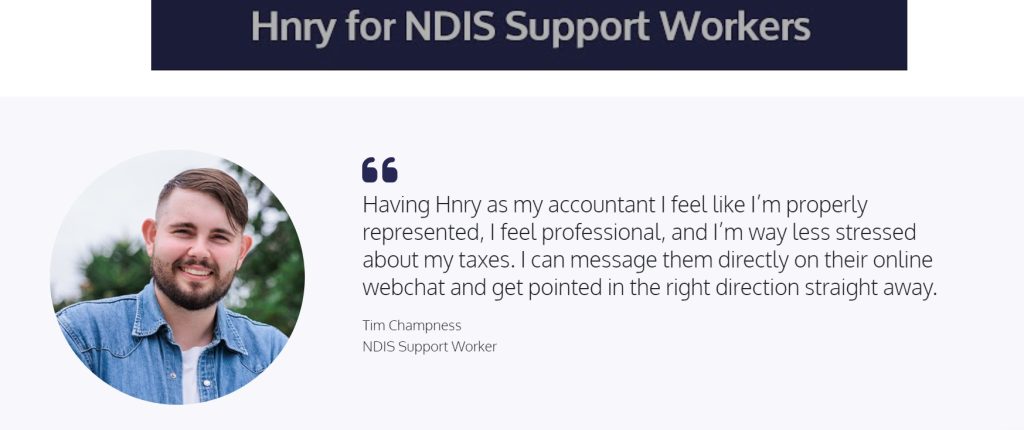

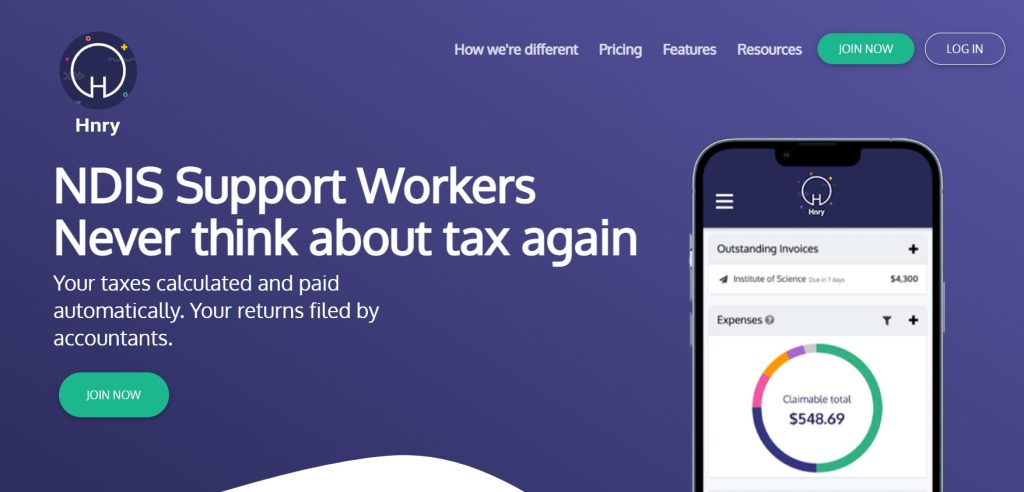

That is what one of Xero’s competitors are offering (from what I’ve seen at their website). The business is called HNRY.

Hnry is another New Zealand startup that is making waves in the accounting industry because they are offering to setup a bank account and be your accountant – ALL for a percentage of your income – 1%.

There are a LOT of other Questions..

The first question that comes to mind is do they take 1% of your revenue or your net income, after tax and although there are a lot of questions the thought is quite compelling for sole traders.

Sole traders have a very simple accounting need because they are acting as individuals but in business for themselves and HNRY appear to be targeting health workers. The NDIS has spawned a massive industry in disability care as NDIS participants have a budget they can spend on the services they need.

Not only do NDIS participants need disability services but there is a demand for bookkeepers to help them manage their financial allocation too.

Health and NDIS Disability Care is a MASSIVE Market

When we explored HNRY in more detail we discovered that they are looking for a partnership manager who has experience in the healthcare sector and it pointed to the NDIS system.

Everyone has an opinion about NDIS so I don’t want to go anywhere near that but I have heard that it has made Disability care one of the big alternatives for students who are also exploring a change in career. The other major market we discovered is childcare and in Victoria they government is offering funding for training in that sector for Nationally Accredited training.

Alternatives to HNRY

If you didn’t even think such a service existed that takes care of your bank account, your accounting software AND your accountant you might be surprised to hear that there are others.

Xero has certainly heard of them and even have a web page dedicated to actively competing against them and getting more customers onto their bookkeeping platform.

Xero actively competes against HNRY

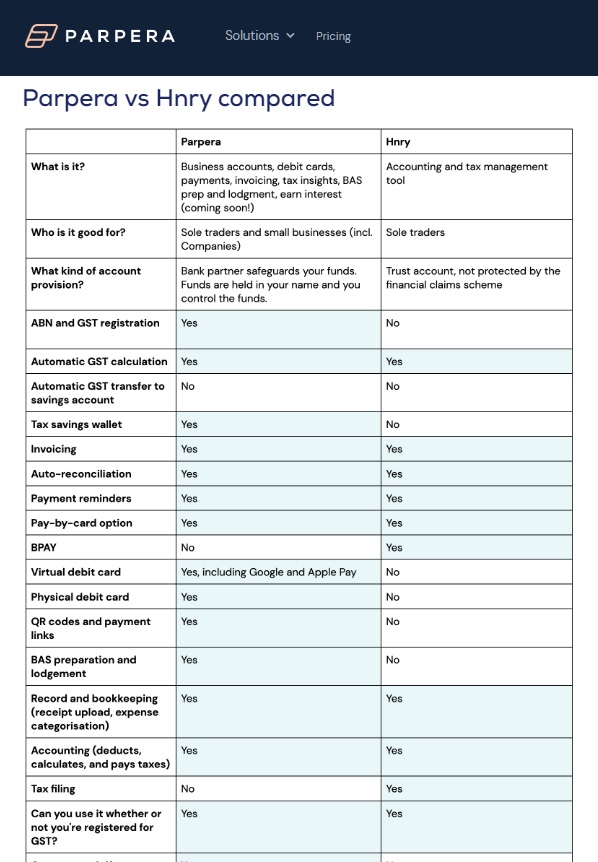

Parpera Competes

Parpera appears to offer very similar services but differentiate themselves in that they offer these things extra:

- ABN and GST Registration

- Physical and Virtual debit card

- BAS Preparation and lodgement

- Also available for companies (not just sole traders)

Here’s their feature comparison table

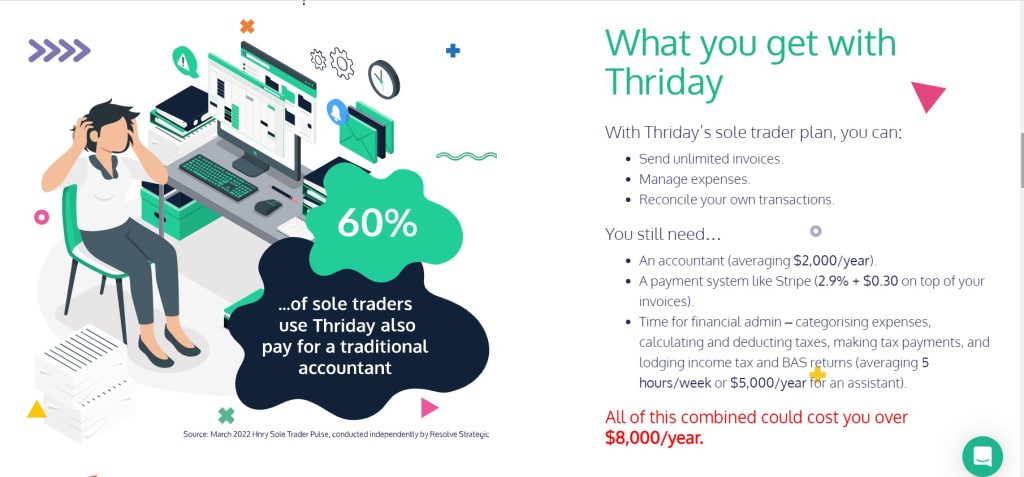

Thriday is in there too

Thriday appear to be more of an Open banking platform and they have a plan that is free (except for normal bank charges). It was interesting to see that Hnry have a landing page dedicated to highlight why they are better thatn Thriday.

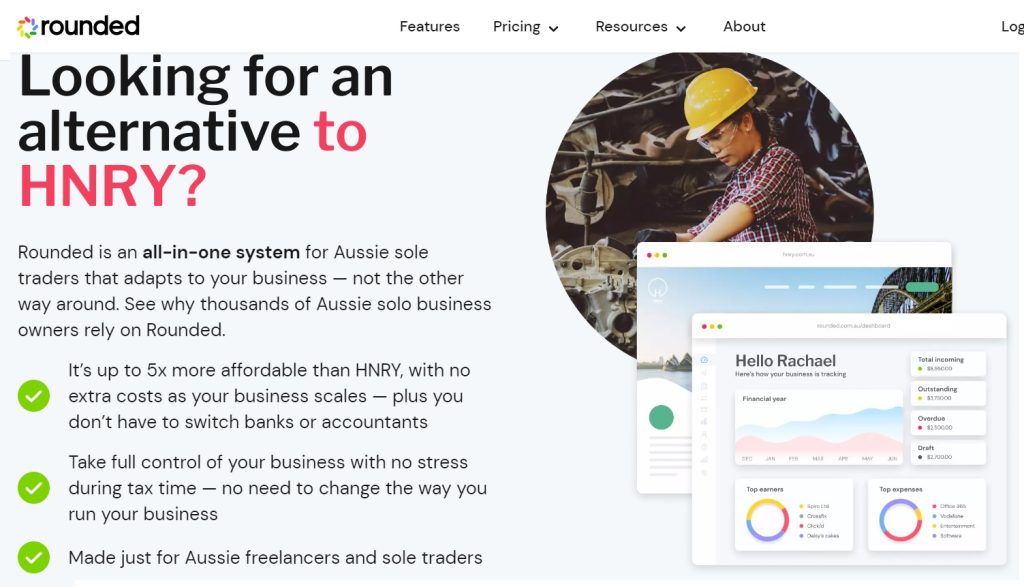

Rounded have a dedicated HNRY comparison page

Some differences with Rounded are:

- Recurring invoices and expenses

- Smart notifications for overdue invoices

- Time tracker

- Multiple currencies

Does HNRY compete more with PayPal or Stripe

Did you read the article I wrote about how Elon Musk will make money turning Twitter into a payment processing company? Those principles apply for HNRY with the potential of “clipping the ticket” on every transaction a sole trader makes as well as the 1%.

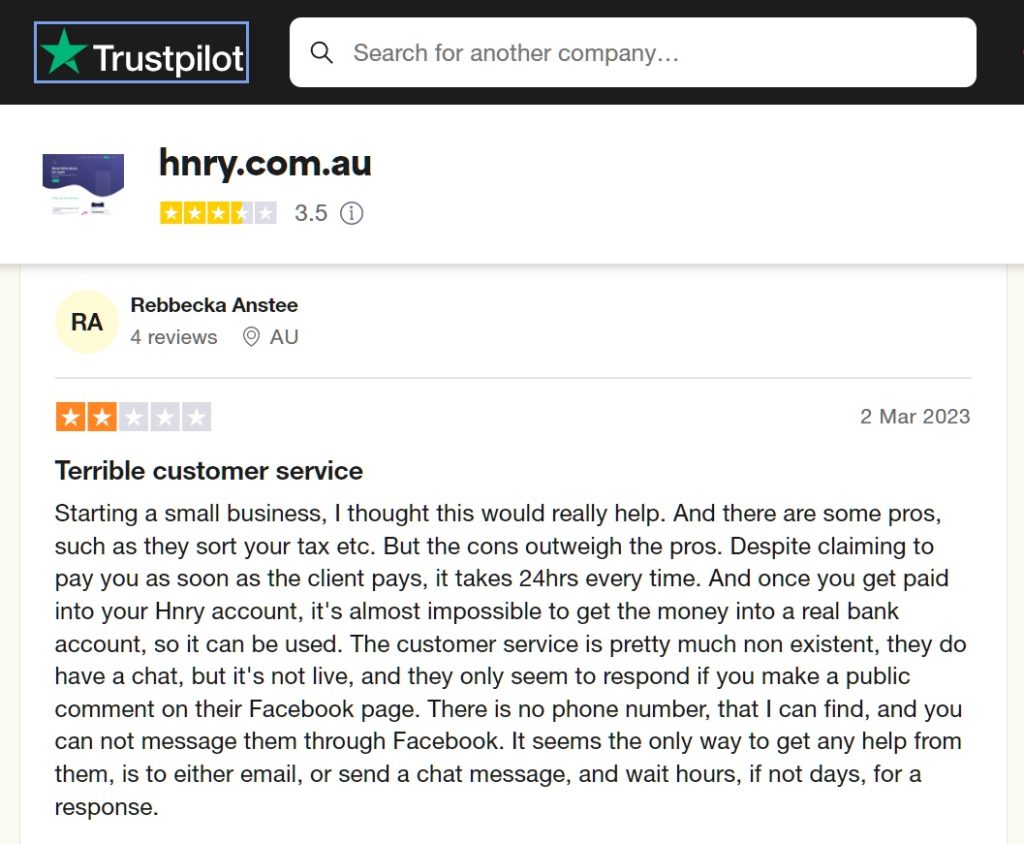

One of the biggest differences appears to relate to the fact that Hnry become your accountant and your bank account so you would expect that their customer service be exceptional. I found a negative review and whether you believe it or not that is your biggest risk when everything is under the phone umbrella – customer service.

What do users think of HNRY?

What’s going to help accounting job seekers?

If you are a job seeker you’re best off learning Xero because more and more businesses are using it and it follows the traditional model that we are all used to. You have a bank and a bank account (and can have a separate one for GST payments if you want), you have an accountant or Bookkeeper and you pay for accounting software.

I think Xero considered trying to change the whole model for accounting but came up against stiff resistance from accountants and bookkeepers.

A change is coming and the story is compelling but this amount of change normally takes a pretty big shift in how people work.

Learn Beginners to Advanced Certificate skills in how to use Xero with the Xero Complete Training Course package.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

[…] we explored the NDIS bookkeeping industry we found that not only are companies like HNRY targeting NDIS businesses in their marketing but they are hiring a Partnerships Specialist to focus […]