Breaking News & Updates

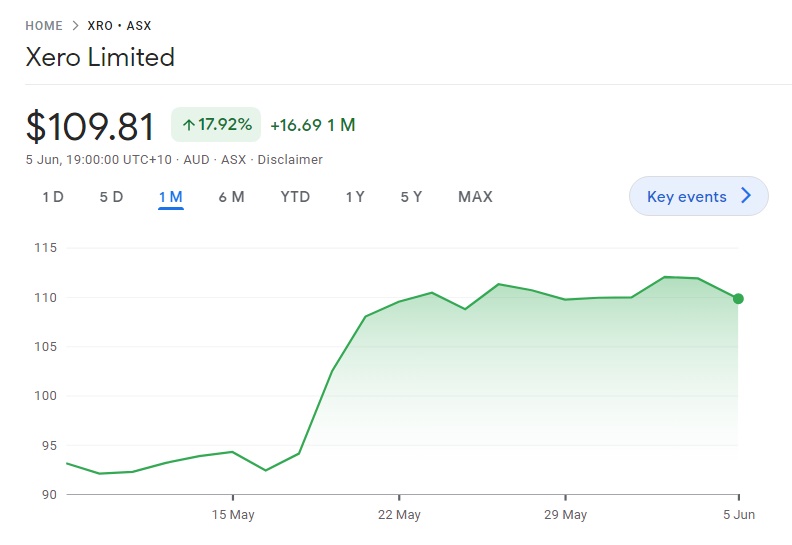

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Financial reports reveal the financial state of a business and there are a bunch of standard reports for very specific parts of a business. The most common ones are the Profit and Loss Report and the Balance Sheet but they are more often referred to as Statement of Financial Position (Balance Sheet) and Statement of Profit or Loss .

If you’re a subscriber to this blog you’ll recall that I wrote about Xero’s 2023 financial report and how they announced a big loss yet their share price sky rocketed. There’s a lot involved in financial reporting and sometimes a business is more valuable if it is growing quickly than if it makes a loss, particularly if that loss is caused by one off items and helps contribute to future growth.

Large US tech companies have been a good example of that and Amazon is the stand out. Amazon is a complex business that involves many capital costs for warehousing and logistics. For a very long time they didn’t make a profit but shareholders noticed more and more customers were shopping online with Amazon and less at large retailers.

The best places to learn about financial reports are from big companies that are listed on the stock market and not-for-profit companies that need to publish their financials. In the Financial Reporting Course you’ll review the financial reports or some well know organisations.

ICB, CPA and Xero

In our Financial Reporting course we’ve included the financials for two consecutive years for the

- Institute of Certified Bookkeepers and

- CPA Australia.

These organisations are both important industry bodies that provide certification of accounting and bookkeeping industry professionals. Having two years of financials give you the chance to make comparisons.

Finance managers use these numbers to create forecasts, write budgets and make strategic decisions about what to do in the coming financial year.

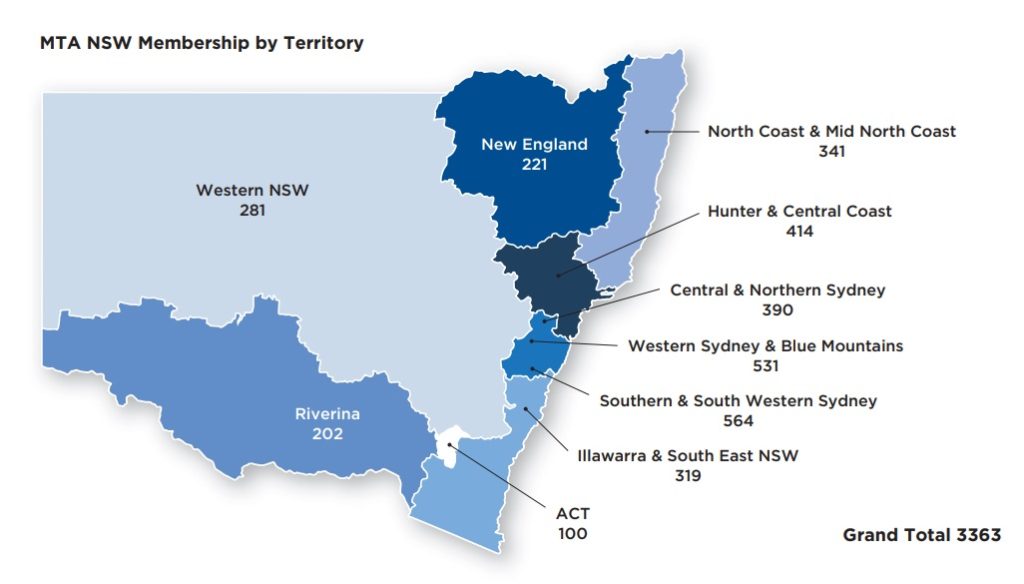

Other organisations included in the Financial Reporting Course include the Motor Traders Association (MTAA) and Xero itself.

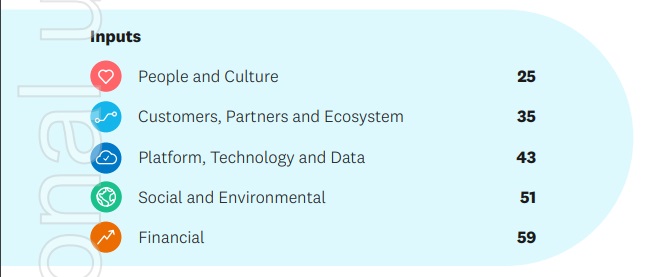

In the financial reports there is sometimes much more valuable information than just the financials and here are some examples.

Xero has been on a aquisition spree in the last decade as they buy up a lot of apps and integrations that add more value to their own core accounting program.

Understanding what they are buying and what their plans are for the future can often help guide your own learning and studies to ensure your knowledge is up to date and relevant, particularly if you need to maintain Continuing Professional Development (CPD) points.

One of the standouts in the Xero Financial Report for the 2023 FY is the size of the write down of the value of the Planday acquisition. It was made while Steve Vamos was CEO and he is no longer with the company. Did he over spend to make the acquisition?

It could be that Christian Brondum (Planday CEO) sold the business at the perfect time and to the perfect buyer. This information might not seem relevant and just speculation but very often a great leader will take a business to new heights and it is worth knowing who is running the business.

Mechanics Need Workforce & Payroll Experts

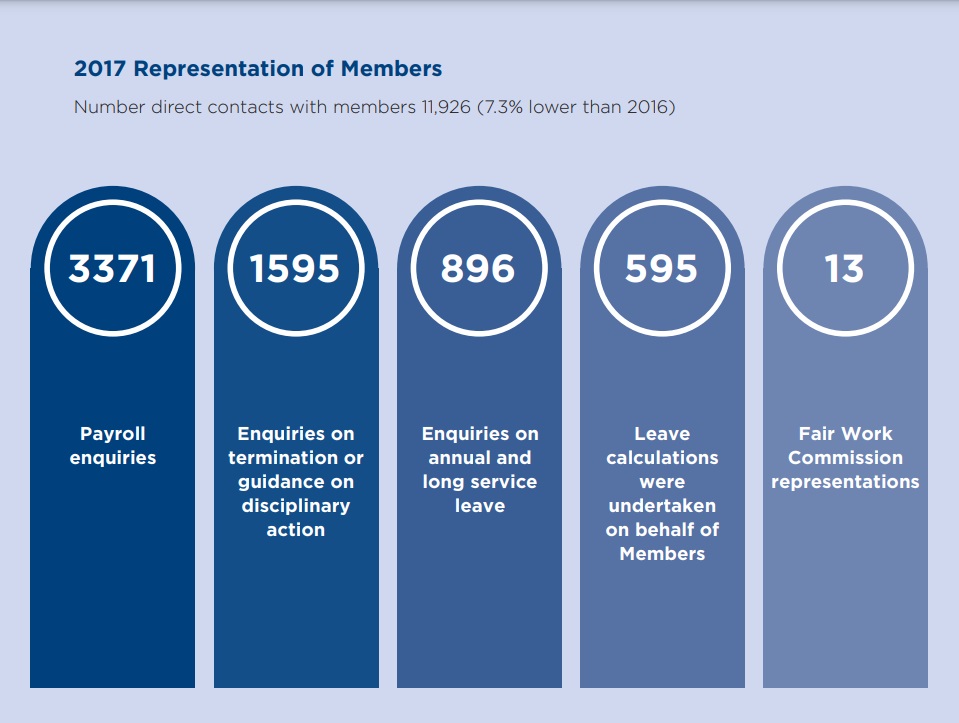

The MTAA annual report included in the financial reporting course reveals what kind of issues their members are facing and you’d be surprised at what we learnt.

Most of the concerns from motor mechanic didn’t relate to fixing cars and replacing parts but about payroll and what to pay their staff! That was a real eye opener.

You would think that workshop practices, safety and something car related would be the biggest concerns but most inquiries were about pay rates, terminations and holidays and sick days.

The biggest outtake I got from reading that annual report was not the financial information at all, it was that there is a big need for payroll managers and bookkeepers’ with payroll experience.

Is now the time to buy shares?

One of the biggest reasons I can think of to understand how to read financial reports is to make decisions about which shares you want to invest in.

Warren Buffet is a long term share investor so he aims to buy shares in a companies that are good value for money with long term prospects to grow, get bigger and become more profitable – AND pay dividends. He reads a lot of financial reports.

I’m hearing from friends about how they are buying shares and making huge gains buying shares in Nvidia while hearing from others that they have been wiped out because the value of their mining shares have dropped to the floor. The key to this is to pick an industry and really get to know their business risks and financial model.

The key to share investing is to use the financial reports to understand the true value of any business. Some businesses like real estate investments trust are worth more based on:

- The more assets they own

- Low vacancy rates

- High rental yields

Other businesses like BHP and Fortescue are affected by “market” prices that they can’t control so it is best to buy them when the commodities they sell are undervalued.

Financial Reporting Course is available to members

This course is currently available to Bookkeeping Academy members and is part of our Academic Development Program so watch this space for announcements and additions as we include more examples.

If you want to learn about understanding financial reports for a small business explore the Xero Training Course in cashflow, Forecasts and Budgeting.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.