Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Does this sound familiar? What does it mean? Is it fair?

This is actually normal terminology when it comes to Payroll Terminations. The ATO has advanced their Single Touch Payroll past Phase 2 which now captures so much more detail around the circumstances around a termination event.

You may recall that several years ago large and respected companies like Bunnings, Woolworths, Celebrity Chefs and even the City of Freemantle were discovered to have underpaid employees and it seemed like some of those under payments were accidental.

The new measures are aimed at helping make sure this doesn’t happen any more.

Detailed Information regarding Payroll

The information required by the ATO for payroll purposes goes into an employees age, relationship status and event and even whether they are a contractor or employee.

Here are some of the things that are now collected:

- Disaggregation of gross income – Paid leave, overtime, allowances and salary sacrifice need to be reported separately

- Employment and taxation conditions – TFN declarations no longer need to be filed as they are reported through STP using tax treatment codes, along with the employee’s start date, employment basis and termination reason

- Income types – Employee payment types and country codes need to be set up

- Transition from another payroll system – Ability to provide the ATO with the previous payroll system’s software ID and payroll ID when changing payroll systems so the information can be linked

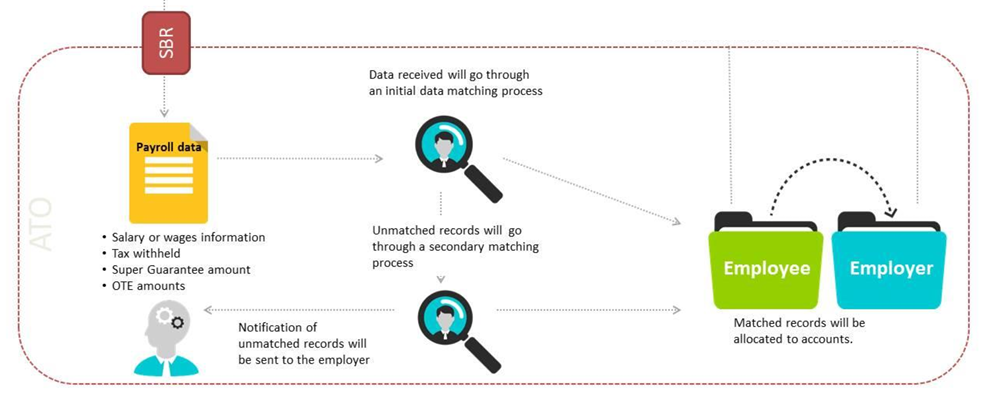

This information is collected as part of the Australian Federal Governments Standard Business Reporting (SBR), an initiative that was started in 2010 to help streamline the collection and use of official data.

SBR is promoted to software companies like MYOB and Xero to enable them to provide online services to their clients that relate to their online business administration.

Read more about our Advanced Payroll Certificate Training Course case study

Payroll Training Courses using QuickBooks, MYOB and Xero

Learn Payroll Administration using MYOB and Xero from beginners to advanced skills online.

Learn each software program individually or as part of the Advanced Certificate in Payroll Administration Training Course BUNDLE (MYOB, Xero, QuickBooks)

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.