Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

MYOB is starting to get their act together providing much desired features in their accounting software.

I’ve written about some of the major receipt scanning programs like Dext/Receipt Bank and Auto Entry in the past and happy to say that we have some new MYOB training course resources in development for our MYOB bank reconciliation Training courses.

MYOB has receipt capture as an inbuilt feature

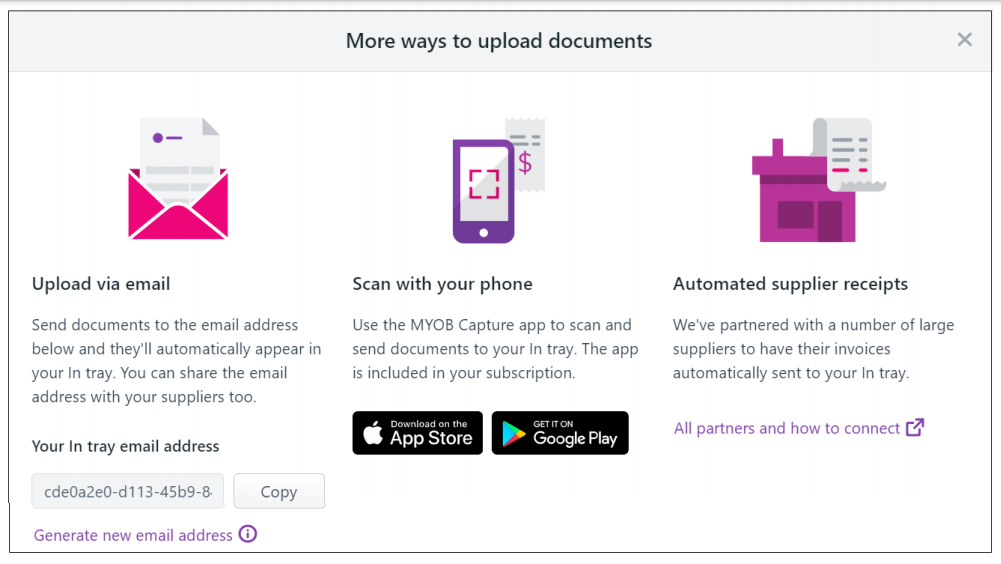

MYOB Intray and Capture are two separate services which when used together provide a service similar to Dext’s ReceiptBank and AutoEntry. The difference is that it’s built into the MYOB software as a feature rather than as an integration like Xero offers with Hubdoc.

It’s now, after the end of financial year, that many small business owners start thinking about the receipts for their expenses through the year so they can justify their expense claims for the ATO.

The biggest problem for these business owners is that this work is considered “catch up” work by many good bookkeepers who charge more money because they know what a nightmare it can be.

No Receipt/Tax Invoice, no expense claim

Some BAS agents will automatically code an expense over $82.50 as drawings or “unmatched” rather than a GST Credit if you don’t produce a tax invoice as evidence of payment. They do this to ensure that they are compliant with the ATO requirements. Read more about GST Credits here.

This can result in that expense not being deducted from your income for that year and results in the business paying more tax than it needs to – all because there is no evidence of payment.

Source documents are a HUGE frustration for accounts staff

Capturing and keeping receipts is one of the most

- frustrating,

- time-consuming, and

- inaccurate parts of a bookkeepers job.

It’s not just a problem for accounting staff though because many sales people and onsite support staff need to buy things from time to time while they perform their work and getting them to keep, produce and categorise these receipts is a nightmare. That is where receipt scanning software aims to help.

Reece Plumbing is a massive company with local branches across Australia and with an advanced Accounting system of their own called Max, they can integrate with Xero to send through copies of all tax invoices/Receipts but many small businesses are not so technologically advanced. This is where MYOB Intray and the Capture App come in.

Smart phones, with great cameras, app market places and excellent broadband plans now make it possible for every tradie to take a picture of their receipts with MYOB Capture and have that receipt available for their bookkeeper.

MYOB In Tray and Capture App Training available soon

I was speaking with a Melbourne based bookkeeper who doesn’t particularly like using MYOB accounting software and she said that MYOB In Tray and Capture app are two of the best features about MYOB because:

- There’s no need to go to another program

- You can change between spend money and bill when coding the expense

Training materials on how to use these features will soon be available in the MYOB Essentials Bank Reconciliation Course and the MYOB Essentials COMPLETE training course package.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

[…] announced in July 2021 that we were creating training materials for MYOB In Tray and Capture and If you are a current MYOB Essentials course student or Bookkeeping Academy member these […]

[…] built some receipt capture and scanning into their core software (and made massive updates to MYOB […]