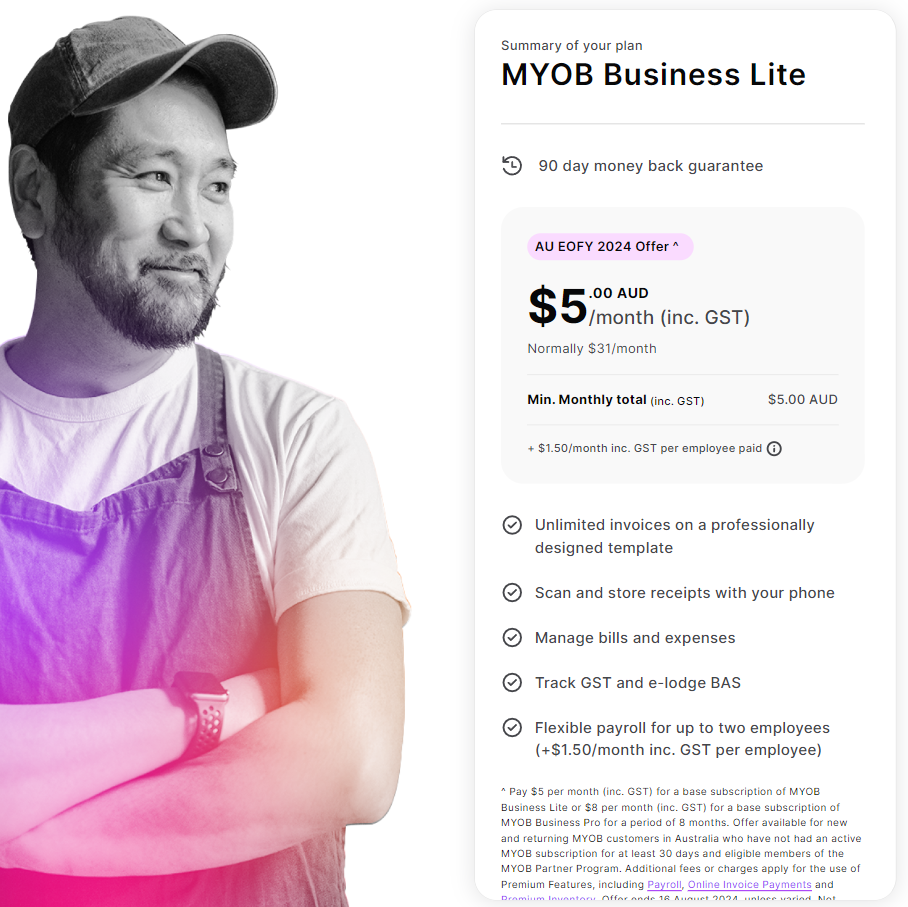

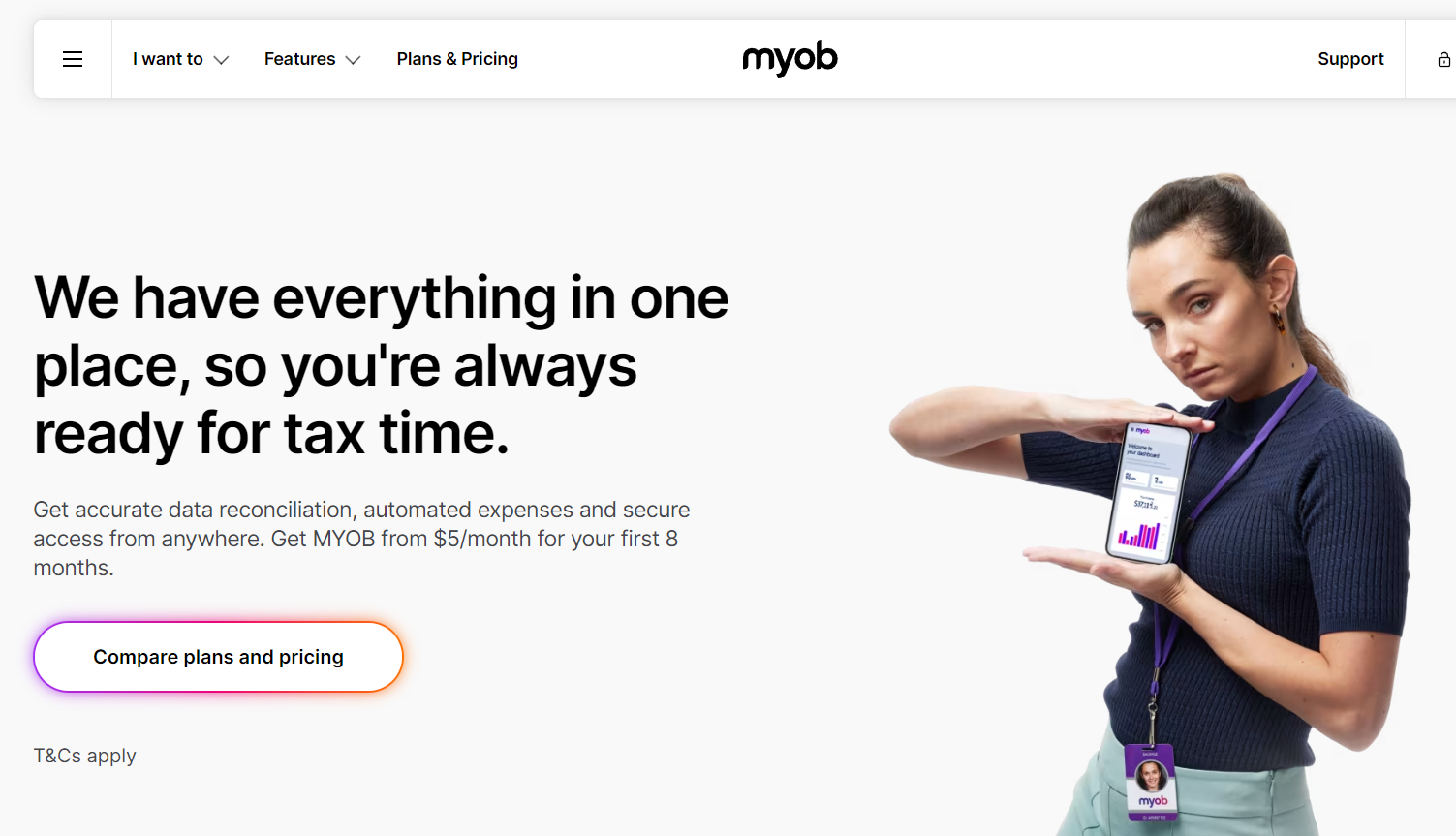

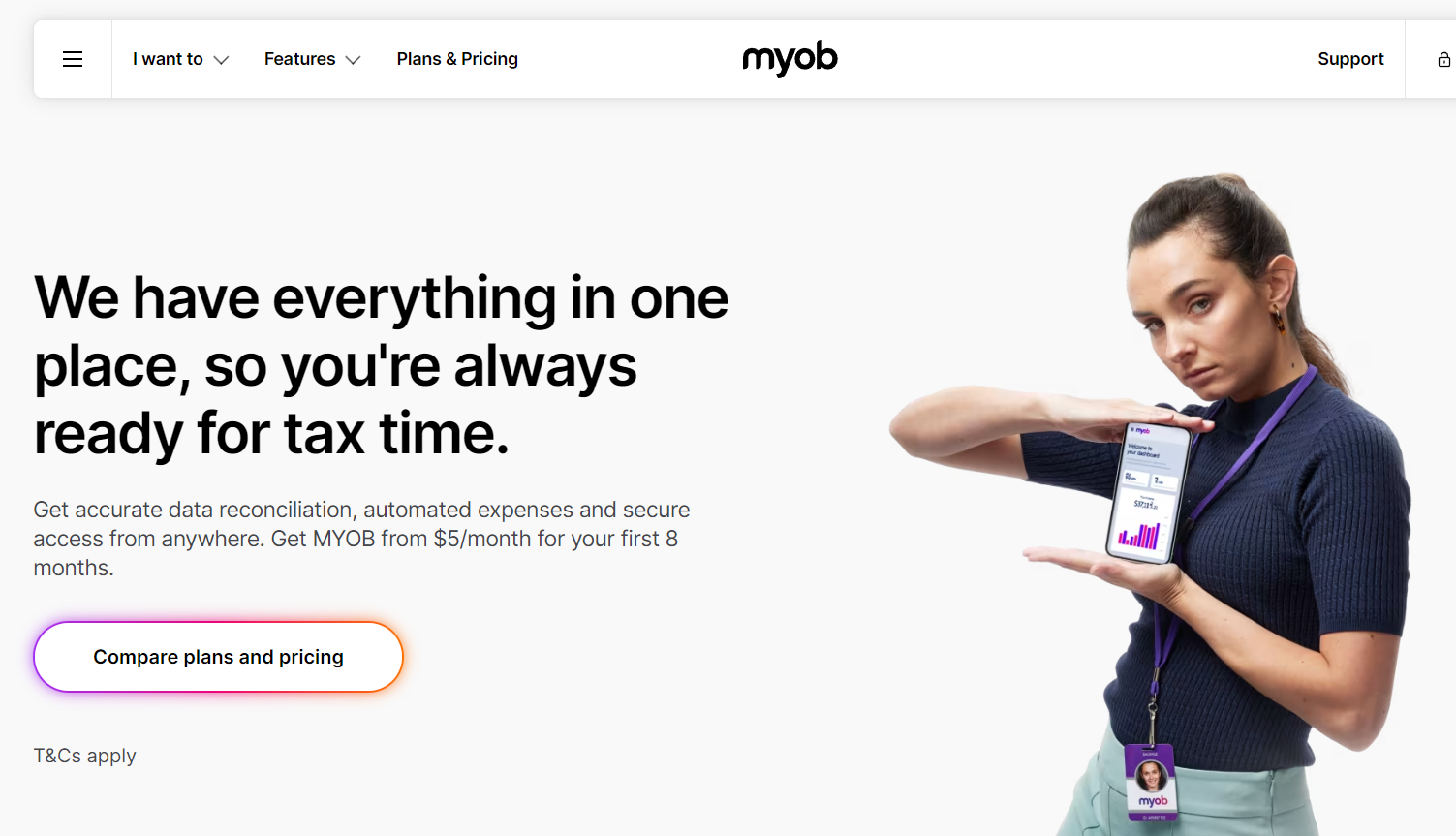

MYOB has struggled for a long time against Xero but now seems to be in a sweet spot for price vs features.

MYOB is used by more than 1,000,000 users in Australia so it is a very good skill to have if you are looking for bookkeeping jobs or business admin jobs.

When we started delivering MYOB courses in a classroom in Dee Why in the late 1990’s I realised early that learning bookkeeping skills is best to do one step at a time. When I say 1 step I mean in training sessions that last no more than about 2-3 hours.

That’s why we created Micro courses in MYOB.

Visit the MYOB Training Course information page and see each of these different skill levels. You’ll see that it is based on the case studies I’ve written recently about like Flockana Cafe and Trim and Styles Hairdressing Salon.

See the MYOB Courses separately

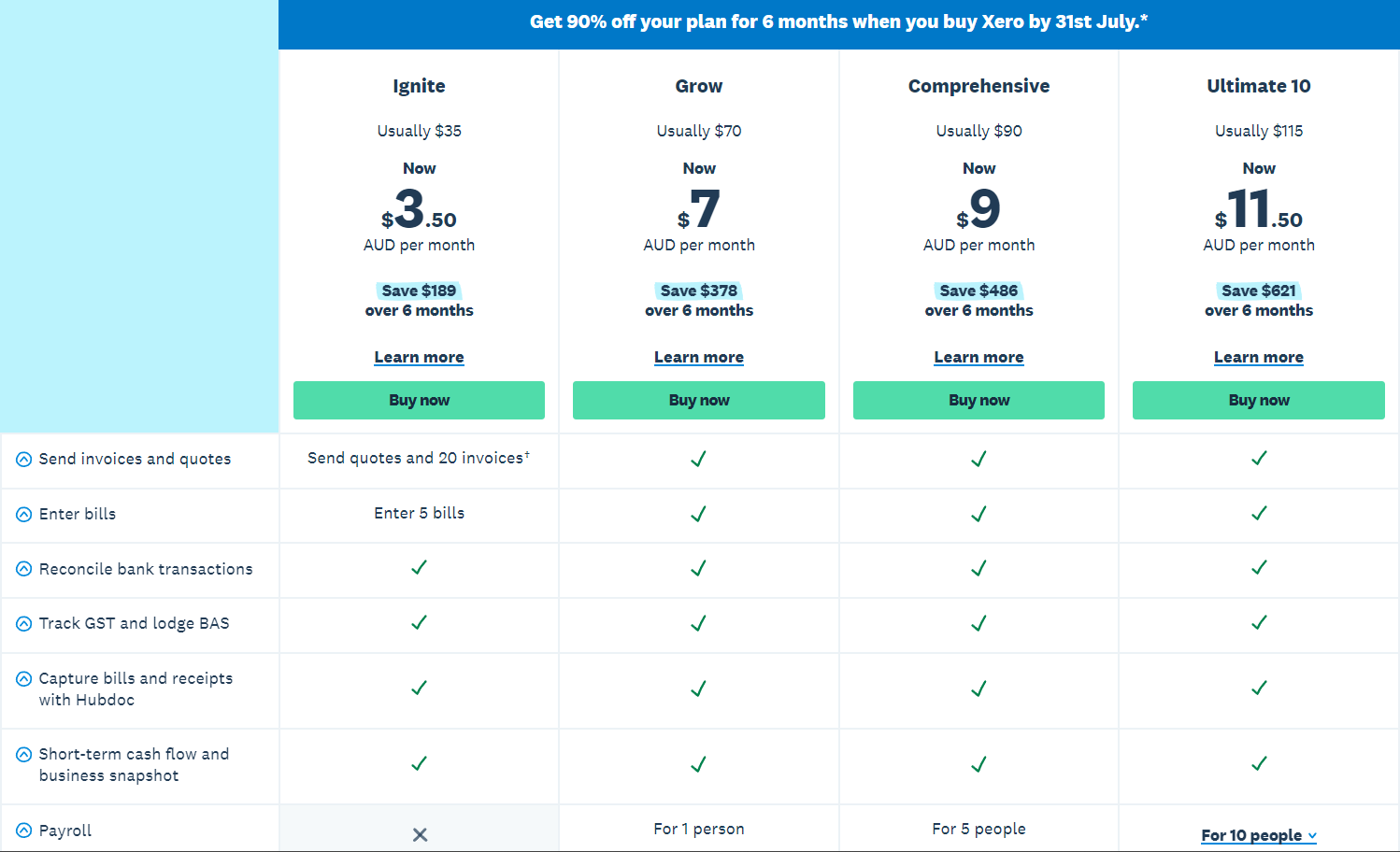

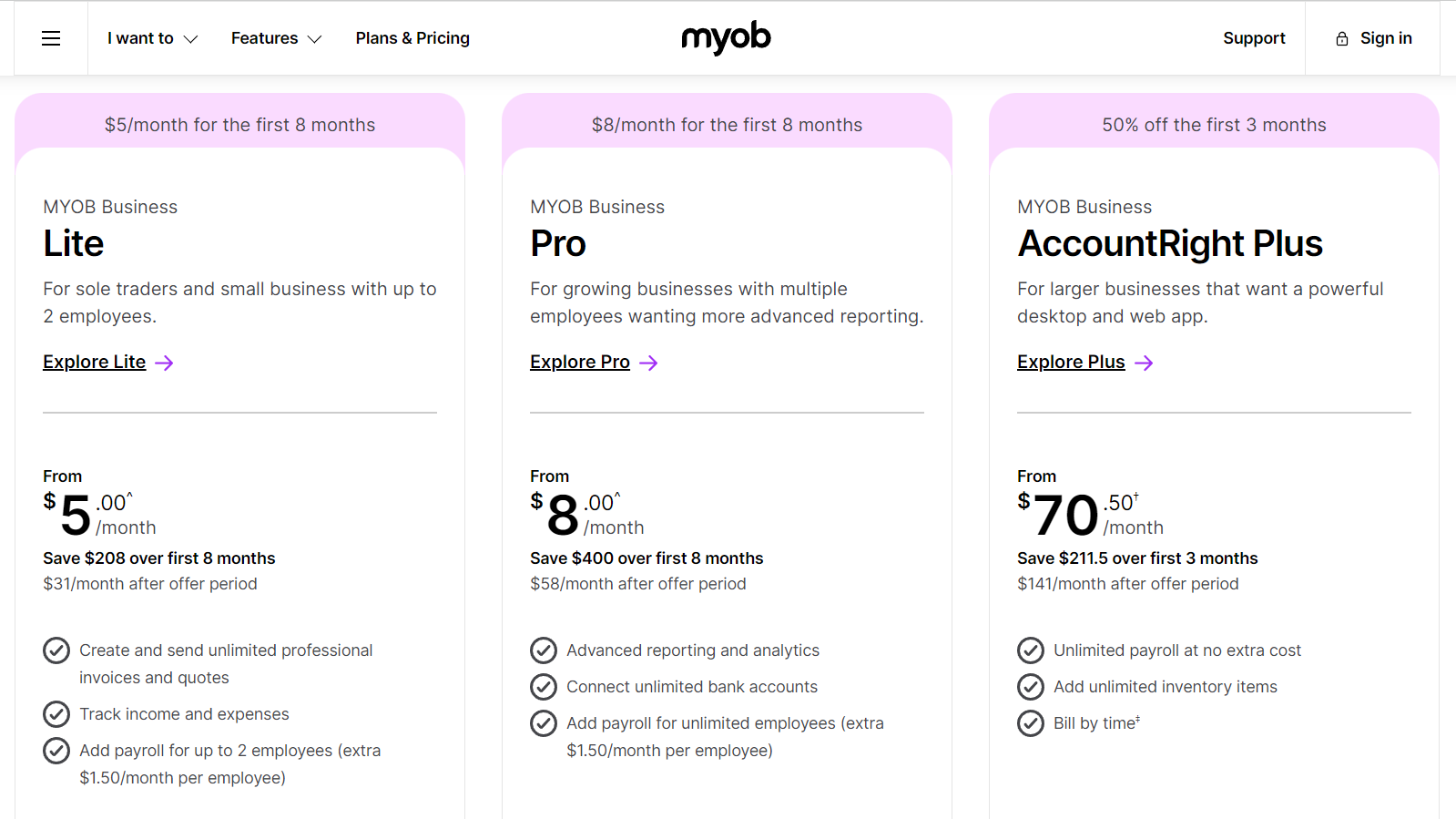

MYOB costs less than Xero but now have similar features and that makes it an attractive choice of accounting software.

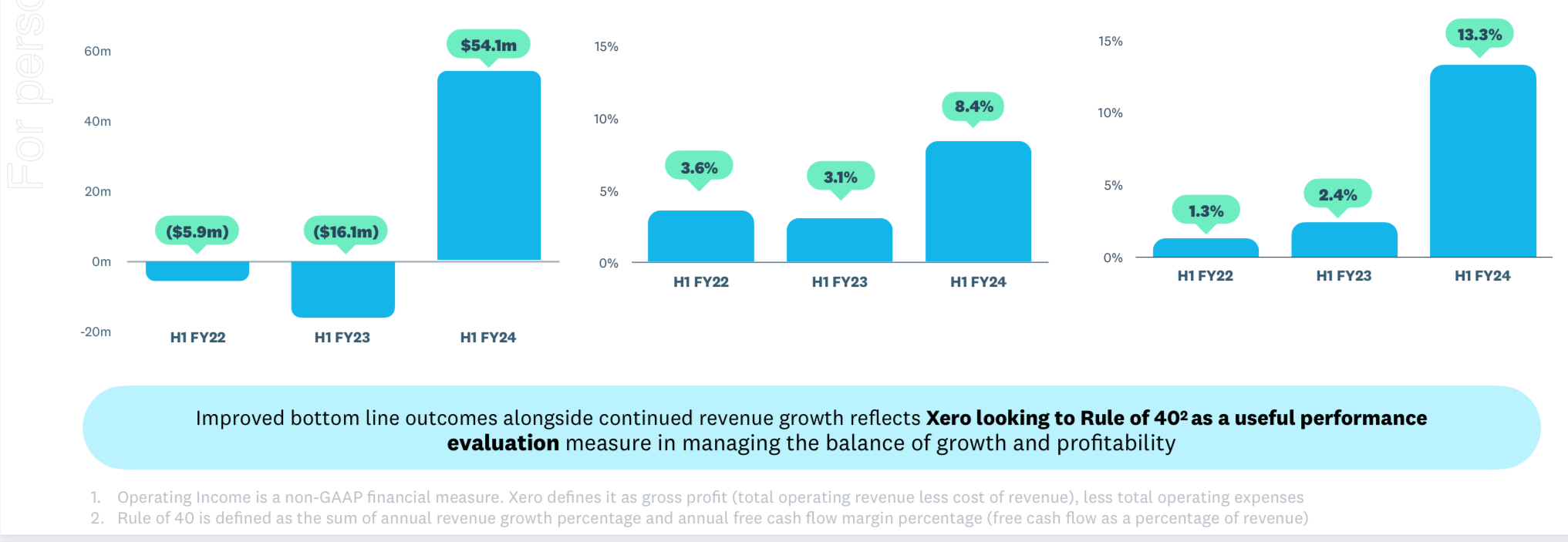

Xero on the other hand are constantly increasing their monthly subscriptions and that has caused a bit of an up cry for some users.

Bookkeeping Academy course packages are discounted courses which include MYOB & Xero Courses as well as combinations of Xero and Microsoft Excel.

Explore the Bookkeeping Academy courses and current specials.