Some of the most challenging bookkeeping work is catchup or rescue bookkeeping. When there are 3 months worth of transactions of all different types and you need to

- enter the data,

- reconcile the bank accounts and

- make sure that the tax, GST and payroll data is accurate –

Welcome to Jerry’s Messy Startup Case Study.

This course is designed for students or workers who already have an understanding about data entry for daily financial transactions, credit management and bank reconciliation.

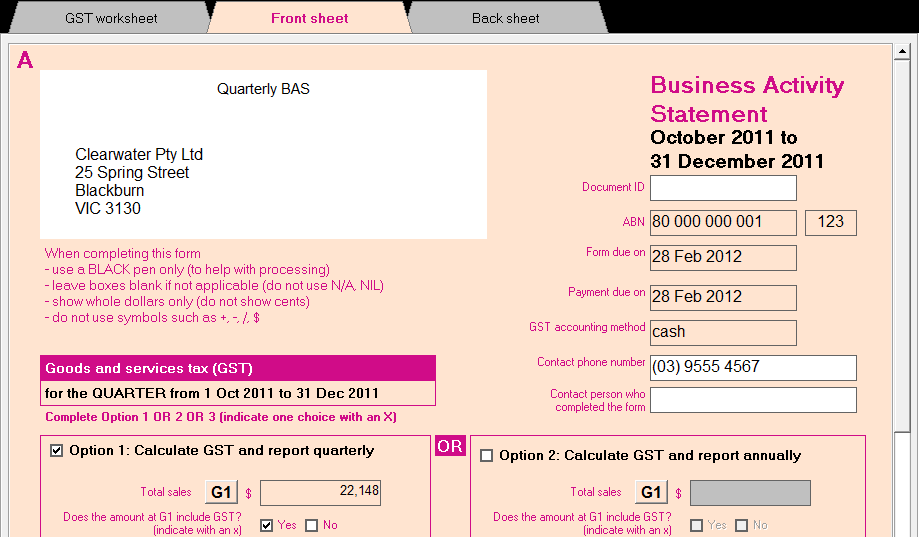

You’ll work with 3 months of data and end up producing financial reports to help Jerry be compliant with the ATO for GST as well as his payroll PAYG obligations.

You’ll also give Jerry some useful insights into his messy business using financial reporting.

This BAS Course case study is available to help you learn BAS and Financial Reporting using QuickBooks, MYOB and Xero.

Information about these BAS Courses

- BAS course in QuickBooks Online, MYOB and Xero takes approx 5 hours to complete

- You are legally permitted to provide BAS services provided you are under instruction from the Business Owner, the business accountant or a registered BAS Agent.

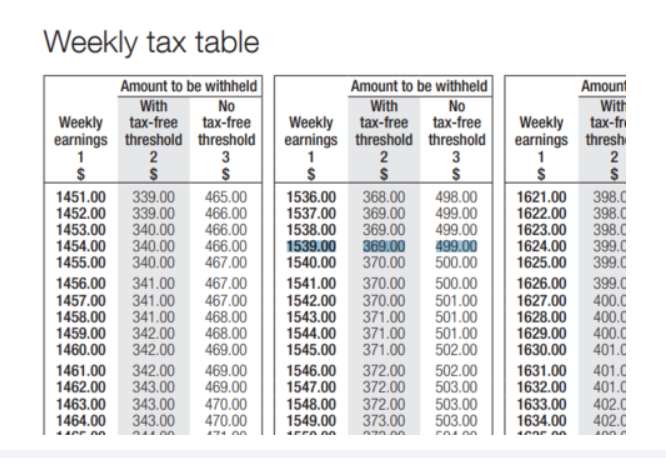

- BAS Services include Payroll and Superannuation calculations

- Completing your BAS gets tricky with partial GST expenses

- Data entry for historical transactions is what takes the most time when completing the BAS

- Catchup or Rescue Bookkeeping is hard when the business owner can’t find copies of receipts

- Business owners get stressed at BAS lodgement time because there are penalties for being late