I’ve been reviewing our Payroll courses and the practical case studies included in them and thought I’d take the opportunity to share some details about it with you.

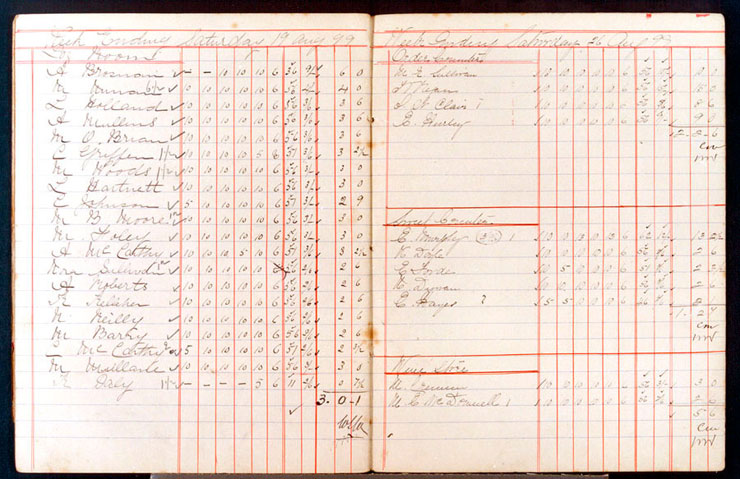

The advanced payroll training course topic uses some typical payroll scenarios that go above and beyond the basic payroll tasks in a small business.

Payroll can get messy when it comes down to

- employment awards,

- deductions,

- HECS repayments and

- other obligations that employers have

In Australia small businesses are agents of the Australian Taxation Office. They act on behalf of the ATO to collect taxes and pay superannuation relating to their employees and these transactions are entered in their bookkeeping systems as liabilities until they are paid.

Learn more about our Advanced Payroll Course Case Study