BAS Service, compliance anxiety and cash-flow

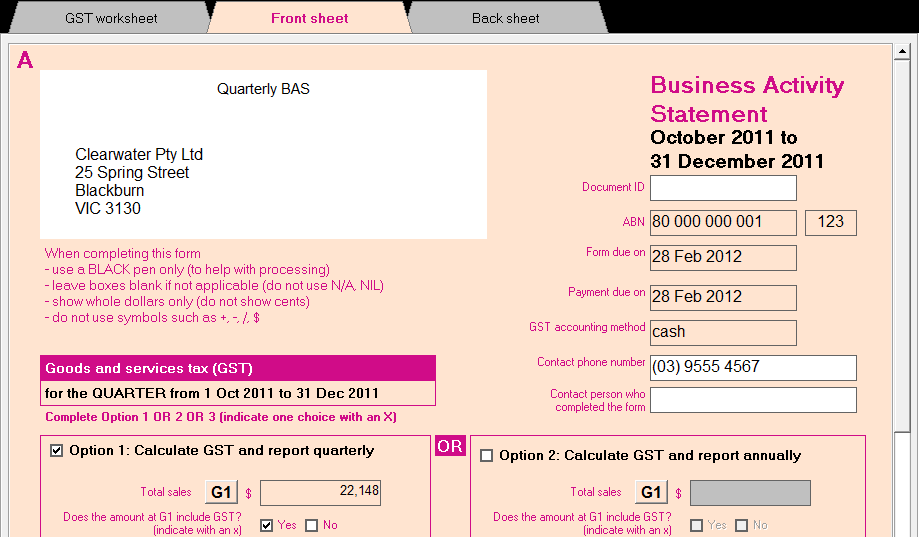

It’s that crazy time when the end of financial year TAX and quarterly BAS periods combine to cause compliance anxiety for business owners and managers if they don’t have a handle on their bookkeeping processes and accounts. This is often caused by not having the best team available for all the tasks required and I spent some time during the week speaking with Tracey our MYOB, Xero and Quickbooks Trainer from Rockingham in WA about the different levels of bookkeepers and whether they could complete tasks relating to a BAS Service. Here’s some of the information that I thought you’d find useful.

It’s that crazy time when the end of financial year TAX and quarterly BAS periods combine to cause compliance anxiety for business owners and managers if they don’t have a handle on their bookkeeping processes and accounts. This is often caused by not having the best team available for all the tasks required and I spent some time during the week speaking with Tracey our MYOB, Xero and Quickbooks Trainer from Rockingham in WA about the different levels of bookkeepers and whether they could complete tasks relating to a BAS Service. Here’s some of the information that I thought you’d find useful.

Getting receipts as evidence

The biggest issue that many bookkeepers experience is getting information from business owners, particularly small businesses that are stretched between:

- the work they need to do every day

- Keeping and filing the financial records like receipts

- Getting the financial records to a bookkeeper or accountant

I’ve written in the past about the ways that small businesses file their receipts as well as cloud technology like Shoeboxed (who now seem to prefer selling their services to accountants and bookkeepers and have removed the educational video that demonstrated how the software works!), but Quickbooks Online has a downloadable app that enables business owners to capture a photo of each receipt for each transaction and if business owners utilise this function they can save a lot of money in data entry and evidence of expenses that could be expected as part of a BAS audit by a BAS agent.

BAS Audits, red flags and tricky GST codes

I’ve mentioned in a previous blog that you can hire a cheap bookkeeper to take care of your data entry and only use the services of a more expensive bookkeeper (ie. BAS agent) for purposes of confirmation of expenses and the GST components of these expenses. In this case a simple BAS audit involves witnessing these source documents to confirm that there is no error in calculating the money owed to the ATO. If you’ve had any of the following transactions you’ll probably need to pay close attention to the information in your BAS lodgement and mention them to your bookkeeper:

- Purchasing a motor vehicle

- Motor vehicle expenses

- Real property purchase

- Any purchase coded as a GST-Free transaction

- Low value purchases (under $82.50) that are coded as GST free

- Purchase of second hand trading stock

- Hire Purchase contracts

- Local fees and handling charges for imp

Learn more about BAS Audits by BAS Agents and the benchmarking and self assessment that ATO use and recommend

TIP!: Bank feeds can cause more work!

I’ve written a lot about bank feeds in the past and included a blog post about how bank feeds work in MYOB and Xero. Bank feeds can be a real time saver because they automatically bring your bank transaction records into your accounting software, but Tracey mentioned that in MYOB you should bring them in BEFORE you do any reconciliation tasks otherwise you may need to undo any reconciliation work you’ve already done so watch out for that!

Need One-to-One training or a QuickFix on MYOB, Xero or Quickbooks?

We did a lot of one-to-one training when we operated our physical training centres in Sydney and the training was often completed at our training centre (because we had it!). Now I’m thrilled to advise that we’re helping local bookkeepers in your area deliver MYOB and Xero training according to our profession course structures! To learn more visit the National Bookkeeping training page. You’ll also discover that our bookkeepers area also available to fix problems or lack of knowledge with the QuickFix service so check that out.

Coming up..

Here is what we are currently working on and what will soon be published or made available at our LMS.

- Guide to Credit Management (aspects of a business and your accounting software where you can tighten your credit management processes). We’re creating this guide in conjunction with the local bookkeeper at National Bookkeeping

- Xero Course training material update (workbooks and videos are being updated and added as we speak so stay tuned for more announcements soon

- Wholesale training course and partner offer – we’ve beefed up our Enrolment Voucher system to help more business buy cheap courses