Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Sales tax might not be high on the list of concerns for Aussie businesses since the introduction of the GST in 2000, but if you’re selling to the US it’s a whole different story.

The US doesn’t have a GST, so each state (and sometimes locality) has its own sales tax rate – which makes it difficult for online businesses to keep track of what they owe and when its due.

Whilst Xero organises all your e-commerce sales and transactions into an accounting system, it doesn’t account for how much of your income is money collected from your buyers as sales tax – which is money you must remit to the government.

TaxJar is a sales tax automation platform that is just one of the many software programs integrated with Xero, and it’s helping Aussie businesses navigate the complex world of sales tax.

What is sales tax?

Sales tax is often called a “transactional” or “pass-through” tax. It is money collected by sellers from their customers through an additional charge on the product, which is then given by the seller to the government. In this sense, the seller acts as a sort of tax collector for the government.

Australia has a GST of 10% for most goods, but the US is different. 45 out of the 50 US states levy a sales tax, and they are all different; for example:

- California: 7.25%

- New York: 4%

- Texas: 6.25%

Some states, like Delaware, don’t have a sales tax, instead imposing corporate and personal income taxes. Delaware’s flat corporate income tax of 8.7% leads to some of the highest tax collections in the country, but with no sales tax shoppers don’t have to pay those extra pennies at the checkout.

38 states also levy additional local sales taxes, which can further complicate keeping track of liabilities. This map below shows each state sales tax rate combined with the average local sales tax rate:

How do you know if you need to collect sales tax in the US?

If you are an online business selling to the US, chances are you will need to collect a sales tax. There are two aspects that will determine how you will collect this sales tax:

1. Do you have “sales tax nexus” in a levying state/locality?

“Nexus” basically means your business has a “presence” in a state or locality. Your business will have one or both of the following:

- Physical nexus: you have an office, employees, affiliates, and/or a warehouse in a state/locality

- Economic nexus: you make a certain amount of sales or conduct a certain amount of transactions in a state/locality

Once again, each state has different laws determining whether you have nexus – particularly economic nexus. For example, California law states that if you have made over $500,000 in sales within the state you qualify for nexus. Florida, however, requires only $100,000 in sales.

Check out TaxJar’s interactive map of nexus requirements for each state to find out more.

2. Are you collecting origin or destination based sales tax?

This is yet another hurdle to jump over when figuring out US sales tax, and unsurprisingly, each state has different regulations surrounding this too!

Basically, the state/s you have nexus in might want you to collect sales tax at the rate of that particular state (origin based sales tax) or they will want you to collect sales tax based on the rate wherever your buyer is located (destination based).

For an Aussie-based online business, most US states would treat you as a “remote seller”, which means it is more than likely that you will need to collect destination based sales tax.

If that sounds like a whole lot of work, that’s because it is! Luckily, TaxJar can simplify the process.

How TaxJar works with Xero

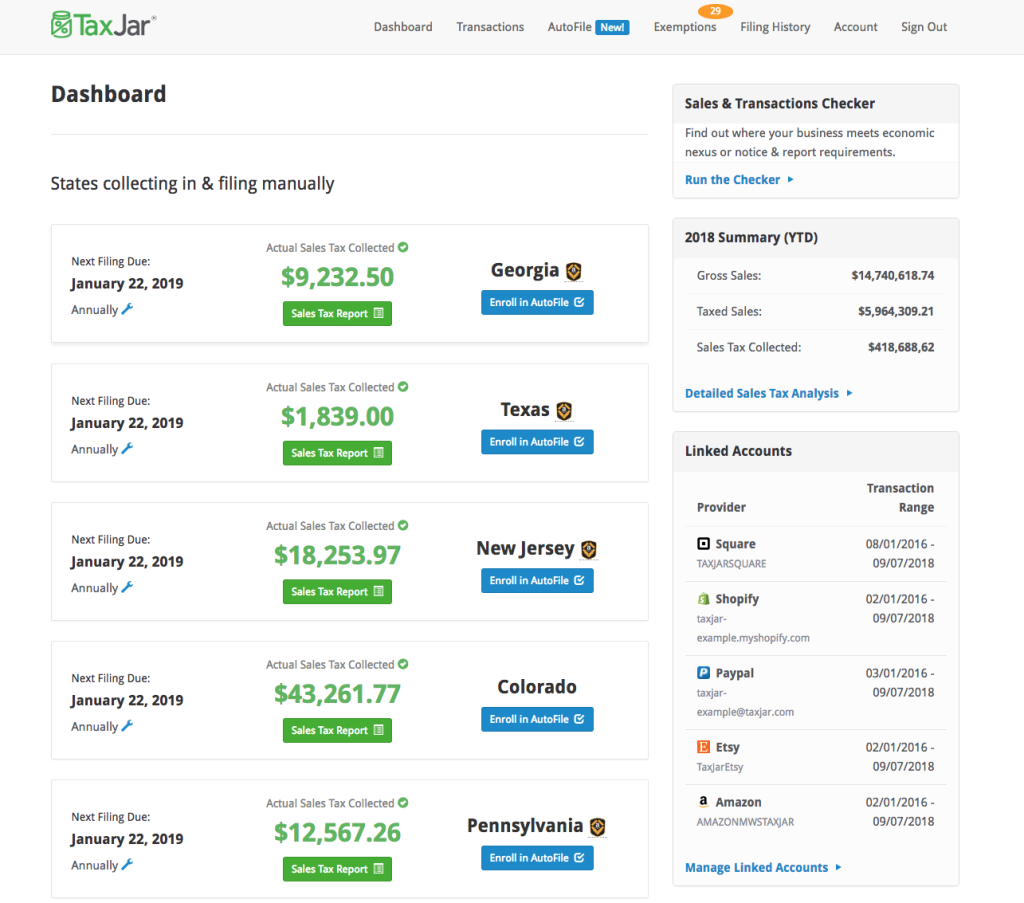

TaxJar automates the sales tax collection process from beginning to end. Some of its features include:

- Tracking your nexus in different states, providing alerts when you might need to register in a new state

- Organising sales data into state reports and (for an additional fee) automatically submitting your returns to the state/s where you have nexus at the due date

- Providing accurate sales tax rates at checkout

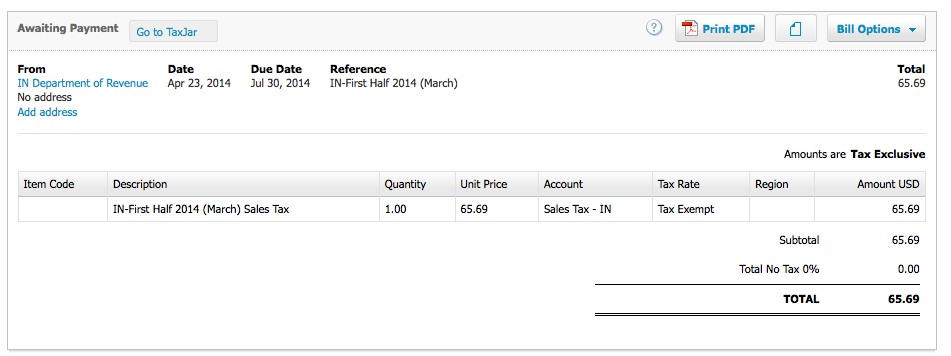

And with a click of a few buttons you can link your TaxJar account with your Xero account. TaxJar creates within your Xero account Charts of Account for each state in which you have nexus, also creating the actual bills for each sales tax remittance.

TaxJar exports your sales tax data as a liability, not a credit, on a monthly basis rather than per transaction. You will also need to manually record your remittance payments in Xero and TaxJar – this is not automatic or exported.

At this stage, data can only be exported from TaxJar to Xero – it doesn’t work the other way. You can, however, contact support@taxjar.com to submit an integration request. You can read more about Xero’s integrations here.

“TaxJar for Xero is easy to use sales tax automation software that’s designed specifically for small businesses using Xero for accounting.”

Xero App Store

Xero’s integration with TaxJar further cements it as a leading administration system for small businesses. Coupled with its recent acquisition of US inventory company LOCATE, Xero is becoming a one-stop shop for small businesses looking to break into the US market.

What other integrations does TaxJar have?

TaxJar is also integrated with QuickBooks Online and, unlike with Xero, you can sync paid invoices from QuickBooks Online to TaxJar. It doesn’t support QuickBooks for Desktop, however, and has no integration with MYOB Essentials.

TaxJar is also integrated with WooCommerce – a WordPress e-commerce plugin – as well as Amazon, eBay, Etsy, Shopify, and more.

Learn About Xero integrations and running an online business here!

It’s obviously no easy feat to run an online business, but we’ve got you covered with the Online Business & Startup Course.

As Xero continues to branch out and integrate with more services, there’s no better time to take the Online Accounting Integrations Introduction Course, or start with the fundamentals in the Xero Online Training Courses.