Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Xero led the way in online cloud accounting software that enables anyone to access their accounting software from anywhere. This means that small business owners, staff and their bookkeeping advisors can all access different parts of the software at anytime to perform their work. A far cry from the clunky way that MYOB AccountRight managed multiple users in an office environment a decade ago.

This amazing flexibility enables contract bookkeepers to perform credit control and end of month bank reconciliation tasks working from home, will office support staff are working on quotes, invoices and payments to suppliers. All of these transactions can add up very quickly and soon you can have hundreds of transactions. What if you had to find something, fix something that was entered incorrectly? That’s when you need an audit trail.

Xero just announced Payroll History and it’s designed to keep track of what happens with your payroll records.

Xero Payroll History is a Single Source of Truth

So far we’ve written about the PEOPLE who have access to and use the bookkeeping features of accounting software but what about the APPS that make changes to Xero or QuickBooks?

I’ve written lots about the “Integrations” that work with Xero to make it so powerful (and gave it a head start against MYOB) and the well known payroll integrations for Xero include:

- Deputy

- Planday

- Keypay,

- TSheets, and

- ADI Insights

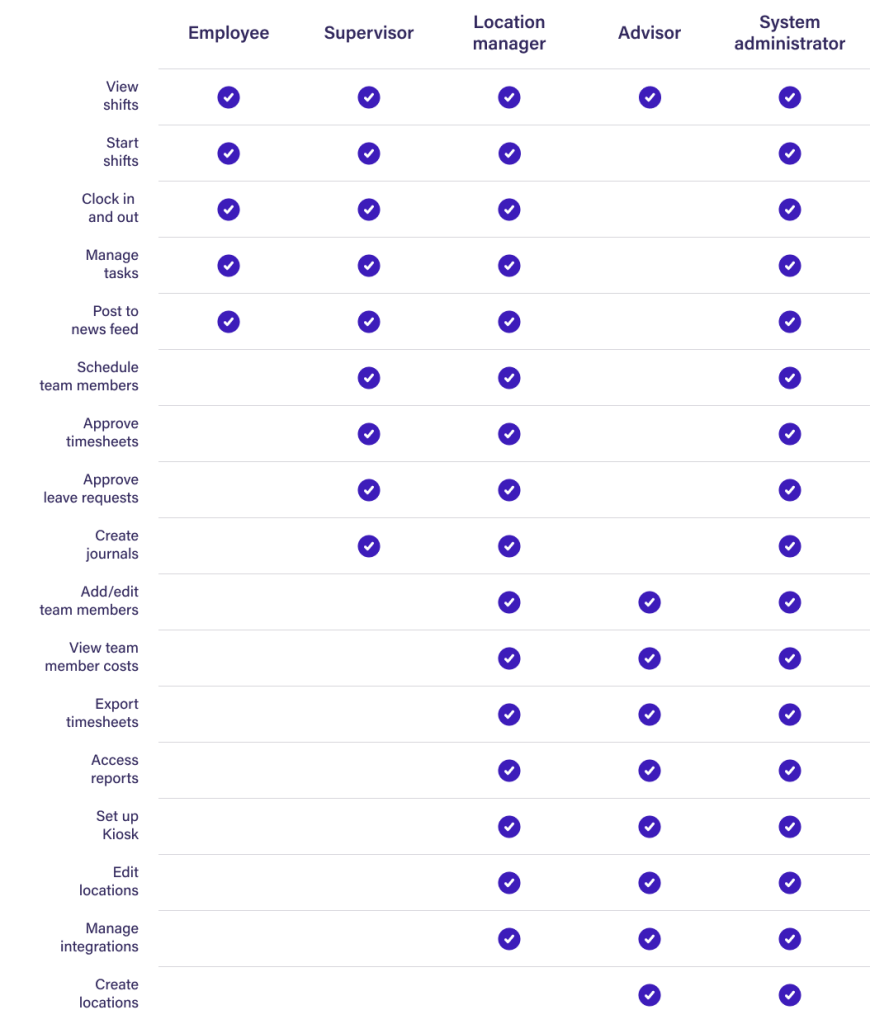

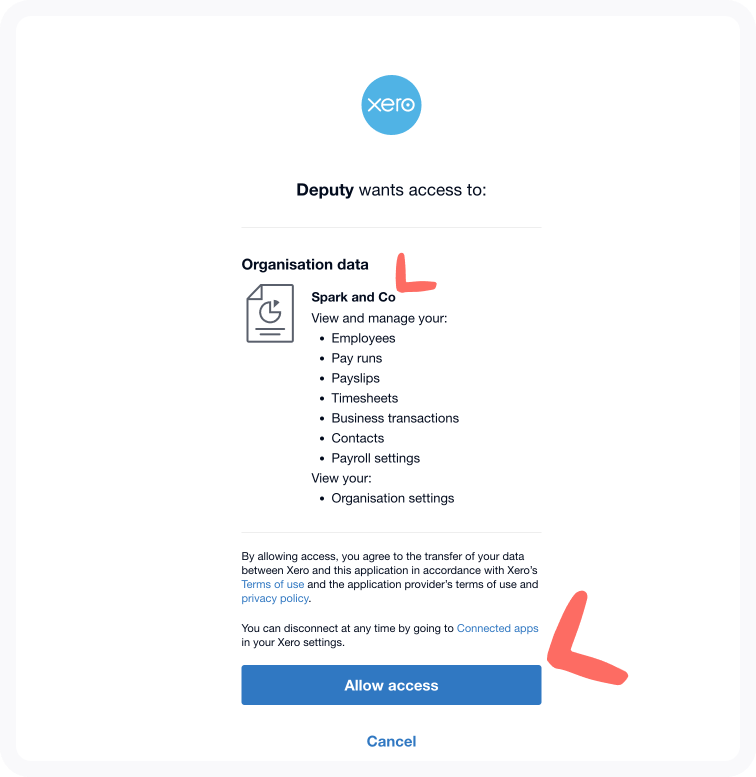

These are also included in our Online Accounting Software Integrations Introduction Course. These integrations are just like some of the apps you can download onto your iPhone or Android smart phone. They can access, and make changes to your Xero accounting file.

APPS make changes to your Xero file

We are so used to sharing information between programs that it can be hard to realise just how much one application can control and make changes to another app. From logging into almost any and every app using Microsoft, Google, Apple or Facebook logins to Workforce Management Apps like Deputy managing every aspects of your staffs timesheets, clocking in and out, shifts and pays.

One of the most powerful features that Xero could boast when it first started competing against Windows and PC installed accounting software was the power of Integrations. Most online software programs have an API (Application Programmable Interface) that defines how data and information can be sent back and forth. Sometimes the data flow is only one way and other times it is completely synchronous such as the case with Deputy.

Yes, HUMANS like bookkeepers, staff and advisors (accountants) can make make mistakes but a special mention was made in Xero’s announcement about this new feature about Payroll apps such as Deputy and TSheets that can change Xero’s Payroll records.

Some third-party apps make changes to employee profiles in Xero on your behalf, like Deputy or Tanda. No matter who makes a change to the employee data, the new payroll history feature will capture it.

Xero Payroll History Announcement

Learn how to make changes in Xero Payroll Training Courses

The Xero Payroll Certificate Training Course includes two Payroll training courses in one – Beginners and Advanced. We use several case studies including one for a hair dressing salon and the other for a fast food shop and in these case studies you’ll create employee records and make all of these changes we’re talking about.

The Beginners Payroll Training Course introduces you to all the major steps in the Payroll Cycle in a small business that uses mainly full-time and part-time staff. The Advanced Payroll Training Course includes the more complex tasks like:

- Award wages

- Superannuation

- Casual employees

- Deductions

- Penalty rates

- Time sheet templates

- Annual leave

- Sick pay

- Terminations

NOTE: We’ve created some new Xero Payroll Course content to show how to use the new Payroll History feature and more is in planning to show you evidence of the changes you’ll make in the Advanced Certificate in Payroll Training course.

Cloud Accounting Integrations Training Course included for FREE

When you enrol into Xero Complete you’ll see that Payroll Training is just one of the 7 individual short courses included. You’ll also get access to the Integrations Introduction course and learn about the powerful and popular integrations I’m writing about in this blog.

The most interesting thing I have noticed over the past decade or two is how the major accounting software companies started providing core accounting feature to manage accounts payable, accounts receivable, invoicing, payments, bank recs etc but are now buying many of the popular integrations that make them more useful.

This is most evident in the recent purchase of Planday which competes with Deputy and TSheets. We are now seeing the likes of Xero and QuickBooks Online compete with ERP type accounting systems like NetSuite.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.