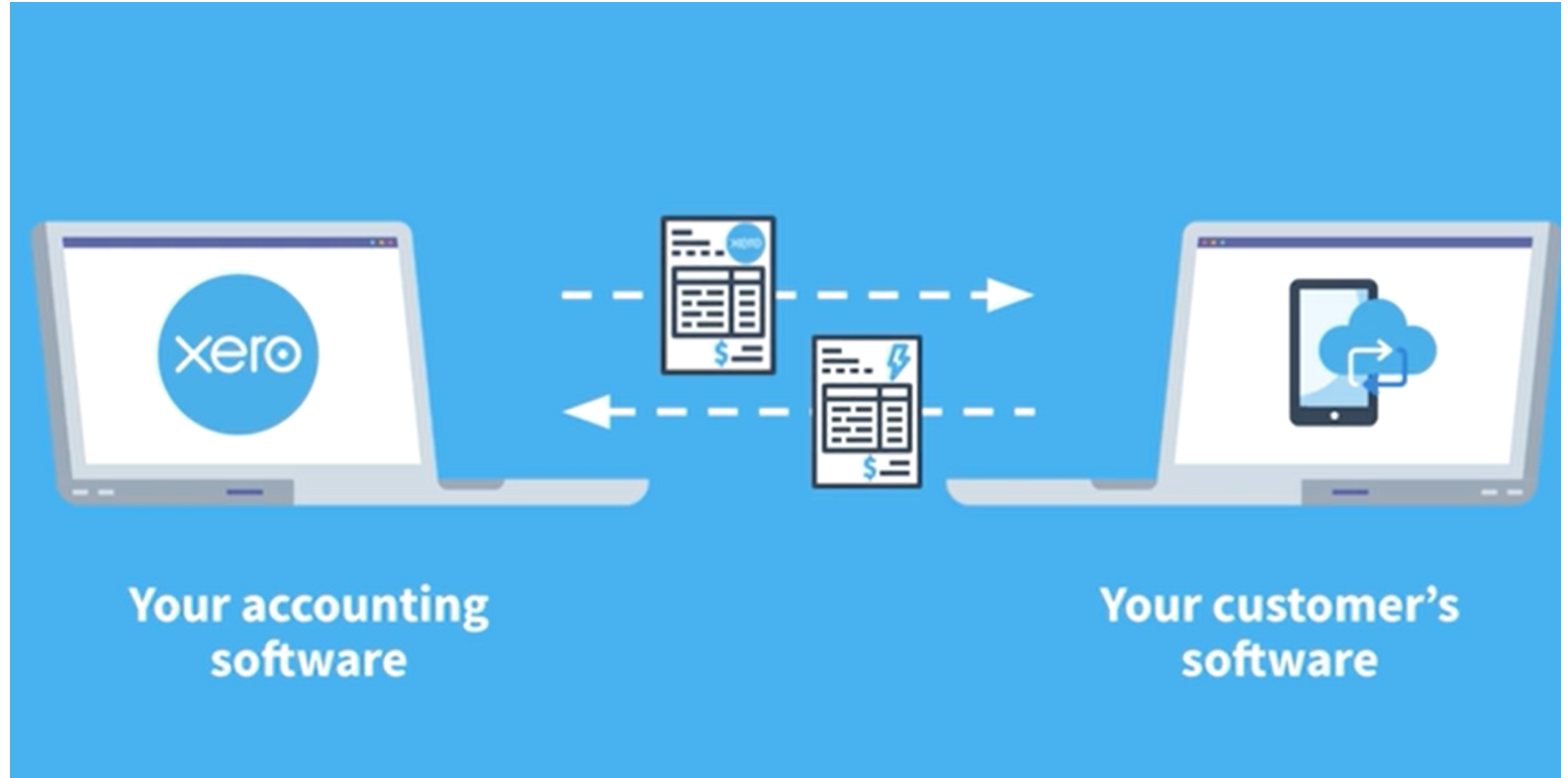

When I see this comment I wonder if it’s not just based on the fear some students have about learning by themselves.

They’re worried about what happens if they get stuck on something, what happens if they don’t understand the instructions and wanting to know that someone will be available to help them.

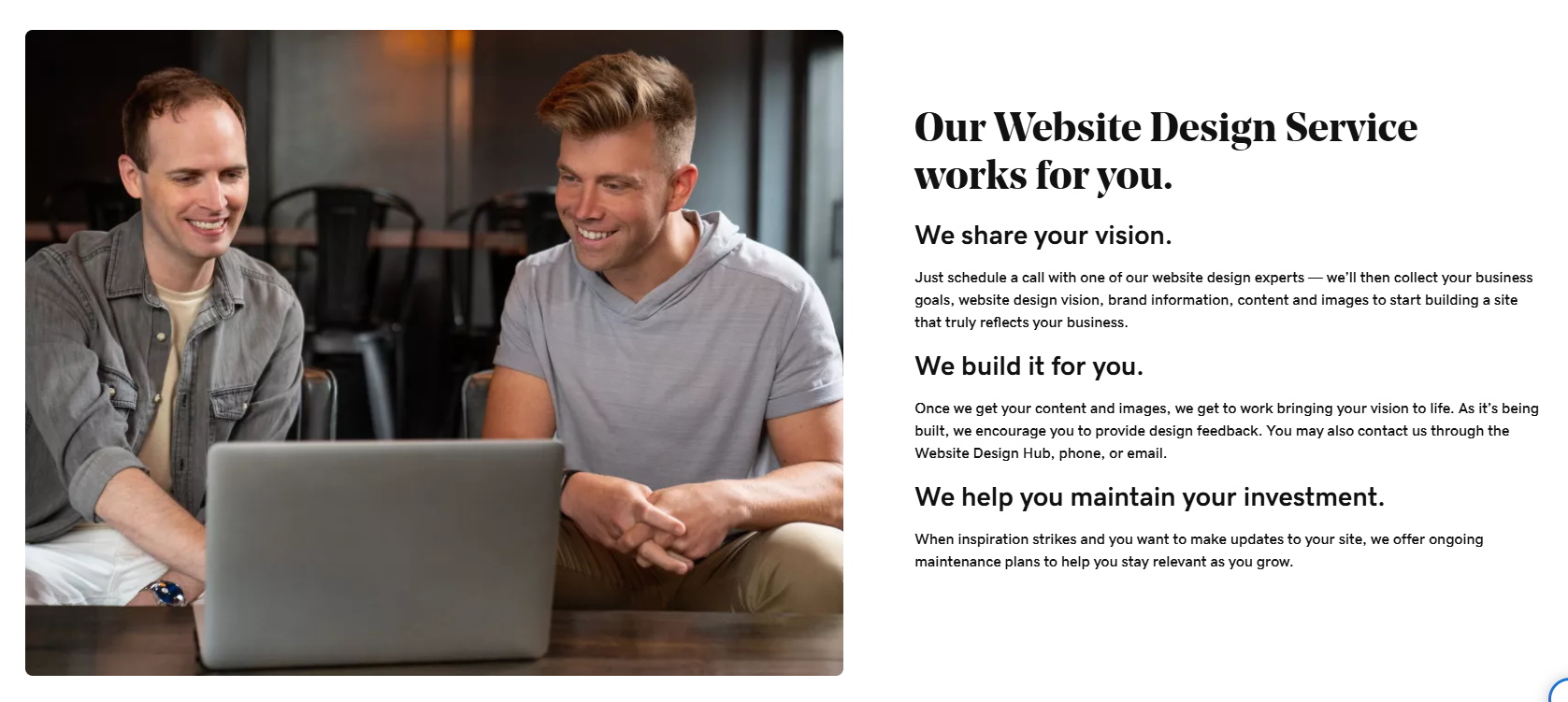

I started teaching students how to use computer software on a one to one basis and thought to myself,

“these people are all spending a lot of money to go through the same basic steps”.

The problem with a lot of courses is that they just dump you with information and then get you to answer some questions in an assessment or test – not EzyLearn, we guide you through learning journeys.

Continue reading Do I need one to one training to learn MYOB and Xero?