Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Credit Management is an Extra Job

I’ve always believed that as soon as you offer credit you’ve got yourself another business – a credit management business.

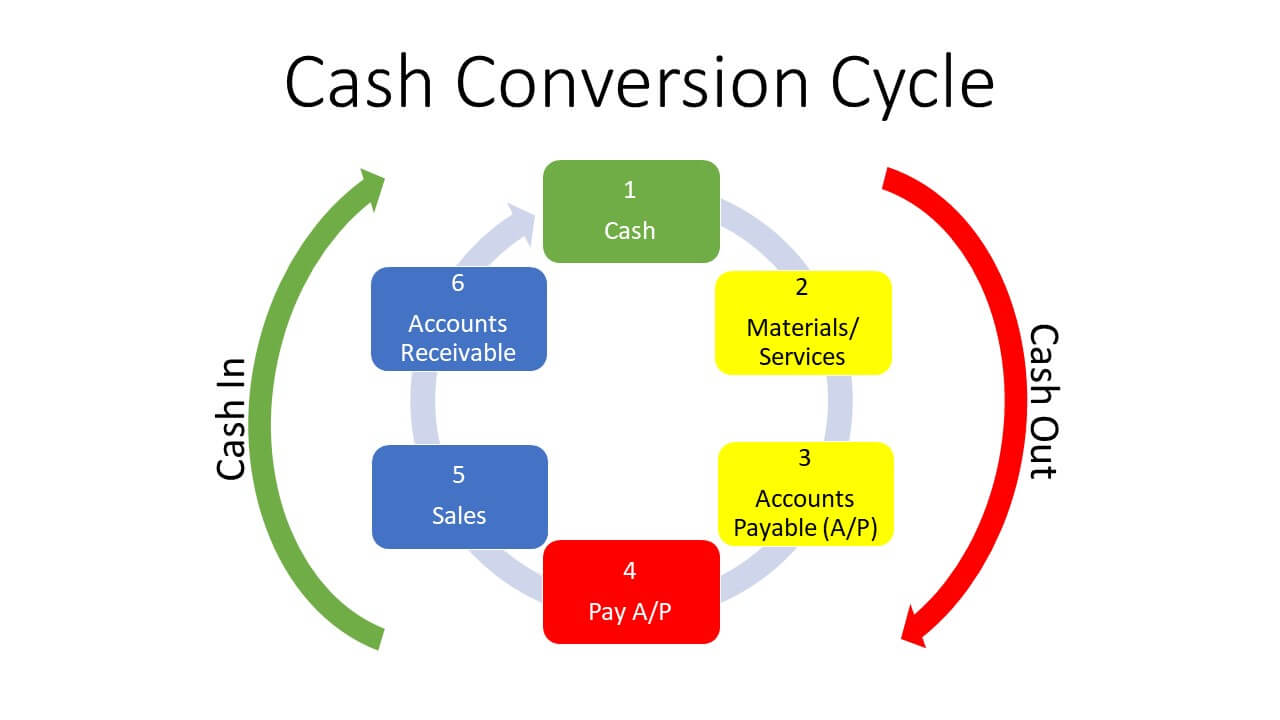

When we first created our MYOB Daily Transactions course we designed it to take students through the cashflow process of where money goes when it first leaves your bank account and these are the main steps:

- Money in the bank (cash asset)

- Buy stock (inventory asset)

- Products sold on account (accounts receivable asset – Trade Debtors)

- Customer pays their account (cash asset)

The interesting part of this business process to me is the marketing (choosing the products, pricing, marketing message and advertising) and the credit management to get the money back.

Each of these stages and their tasks carry a certain amount of risk but the credit risk part is actually something you can manage to try to eliminate altogether, but it takes work and a system.

Well the good news is that we’ve created a Credit Management Training Guide that goes through the different parts of your business where you can put measures in place to reduce this risk significantly – even if you are in the trades or building industry.

Credit Management is a Job for Contractors

Many tasks in businesses these days is actually contracted out to independent contractors because of the flexibility and credit management is a great example because it can be performed a day a week (for smaller businesses) and it can even be performed by a remote contractor (virtual assistant) working from their own home office. See Credit Management Services at Natbooks!

Since we’ve started working with local bookkeepers at National Bookkeeping we’ve realised that credit management and daily transactions type work is by far the most common form of task performed by a bookkeeper.

The rate of pay for bookkeepers performing this work is generally lower, but it’s a great option for people like working mums or dads who want to fit their work into their children’s school schedules as well as corporate accountants who want to make a start on their own bookkeeping business in their local area.

The corporate accountants or accounts managers we speak with often start performing this work in their new bookkeeping business but as their business grows they fill this position with a contractor of their own. Pre Qualify to join National Bookkeeping

Paypal and Quickbooks

Last year I wrote about the joint venture between Quickbooks (Intuit) and Paypal and how they want to help businesses get paid faster. They commissioned a study last year found that Australian small businesses are owed a collective $26 million in unpaid invoices. That’s roughly $13,200 owed to each business at any given time, for which business owners will spend an average of 12 days chasing them each year.

It’s a lot of time and effort to earn that kind of money particularly if you’ve actually already earned it by supplying your products and services!

Check out our Credit Management information page and watch out for the announcement when we include it as a student inclusion for ALL students. We created this guide to help businesses use their accounting software to better manage the credit risk in their business. We’ve included information for builders and contractors about the Security of Payments Act.

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.

[…] mismanaged; the other most common reason is because the business failed to implement appropriate credit management processes. In both cases, businesses fail because the owners, directors, partners or managers lacked the […]