Excel’s 3D Formulas Work Across Worksheets

We’ve recently updated our Microsoft Excel Training Course content, because it remains one of the most indispensable tools for small businesses — and we’ve included a new exercise workbook which takes you through all the steps involved in developing a financial forecast for an investment.

We’ve recently updated our Microsoft Excel Training Course content, because it remains one of the most indispensable tools for small businesses — and we’ve included a new exercise workbook which takes you through all the steps involved in developing a financial forecast for an investment.

We used a granny flat project as the case study in our financial forecasting workbook, but the beauty of Excel is that, once you get the formulas right, they can be replicated for any kind of investment, not just one for building a granny flat.

The wonderful 3D formula

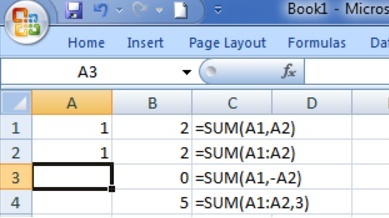

3D formulas are one of the other many wonders of Excel. A 3D formula is basically a reference to the same cell or a range of cells within multiple Excel sheets. They’re a convenient way to reference several worksheets that follow the same pattern, with cells that contain the same type of data.

All functions work with 3D formulas

3D formulas can be used with all Excel functions — SUM, AVERAGE, PRODUCT, etc — which means that, using a 3D formula, you can easily create a financial forecasting sheet for any stage of an investment, and easily reference that data in another financial forecasting sheet. This is invaluable because there are very few projects or investments that can be contained in just one Excel worksheet.

A project like the granny flat case study in our online Excel Training Course, contains many moving parts — there’s the initial construction, then there’s the ongoing maintenance, and the rental income to manage. It would be impractical to keep all of this information contained within the one Excel worksheet.

3D formulas can be modified with time

The best part about using 3D formulas is that you only need to specify the start and end sheets (which for ease-of-use, you could just label ‘start’ and ‘end’) and the formula will reference all the worksheets between the start and end sheets, including those two sheets.

This means that, as your investment or project grows, once you’ve got the 3D formulas set up correctly, you can just add and subtract worksheets as necessary, and the calculations will update automatically.

***

Once you understand how to create and work with 3D formulas, you can use them for any project or investment that you create a financial forecast for — be it for a granny flat project, business investment or anything else that requires you to make a financial decision.

Visit our website for more information on our Microsoft Excel Training Course, which covers 3D formulas.

***

EzyLearn Excel, MYOB and Xero online training courses count towards Continuing Professional Development (CPD) for bookkeepers and accountants. We’ve been an accredited training provider of the Institute of Certified Bookkeepers ever since the organisation started in Australia. Find out how CPD points can be of benefit to you.

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.

Before computers and Microsoft Excel came along, accountants used a pen and paper to keep track of their clients’ business financials. And before that, before the numeral system was invented, the abacus was the main accounting tool used by merchants and traders to keep track of their finances.  EzyLearn Excel, MYOB and Xero online training courses count towards

EzyLearn Excel, MYOB and Xero online training courses count towards