Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

We recently announced our updated MYOB Payroll Course videos and training workbook and were asked to explain PAYG tax tables in a bit more detail. We’ll explain tax tables using the data from the ATO website relating to tax tables for the 2013 financial year.

We recently announced our updated MYOB Payroll Course videos and training workbook and were asked to explain PAYG tax tables in a bit more detail. We’ll explain tax tables using the data from the ATO website relating to tax tables for the 2013 financial year.

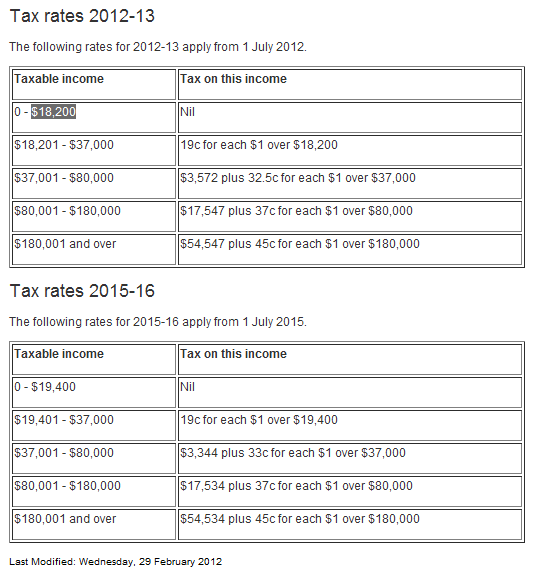

We recently witness a federal budget and there are usually some changes in each budget that relate to tax tables or tax thresholds. These tax tables simply define how much tax you pay for each threshold and the simplest way to describe it is to define the first category. This category is called the tax-free threshold and it is the level at which you don’t pay any tax. The annual pay for this level will be $18,200 from 1st July 2012 (the beginning of the next financial year). Any money you earn up to this level you don’t pay any income tax on.

Any money you earn over this tax-free threshold amount but less than $37,000 will be taxed at 19c per dollar.

The most important thing to note is that just because you earn $50,000 doesn’t mean you will be taxed at 32.5c in every dollar you earn. You’ll be charged

- zero for the first $18,200,

- 19% from $18,200 to $37,000 and then

- 32.50% for each dollar over $37,000.

[…] of their software most years and usually at the beginning of each new tax year to coincide with new PAYG tax tables and they are currently going through a race to the cloud to compete with many new startups like […]