Breaking News & Updates

Xero’s financial report reveals BIG loss but share price pop. - eepurl.com/isNmKQ

Do you provide your employees with gym memberships or concert tickets? Or maybe you work for a company that provides you with a vehicle or accommodation? There are lots of perks that business can provide to their employees outside of salaries and wages – and these are called fringe benefits and they may apply to you if you worked at home due to COVID-19.

FBT is not as simple as handing out freebies. Employers have to pay tax on these benefits they provide, and the amount can depend on the type of fringe benefit they’re providing.

We’ve written before about how fringe benefits tax is important to consider when you engage a new worker, but let’s look more in-depth into what fringe benefits are all about, and how to ensure you comply with your liabilities:

What are fringe benefits?

Fringe benefits are sort of like payments made to employees, except they are different to salary and wages. There are lots of different fringe benefits, the most popular of which we’ll go through in this blog, but they range from providing personal use of a company car to providing tickets to events.

Employers need to pay a fringe benefits tax (FBT) on the fringe benefits they provide to employees. It’s different to something like income tax, as FBT is calculated at the highest tax bracket regardless of the employee’s tax bracket.

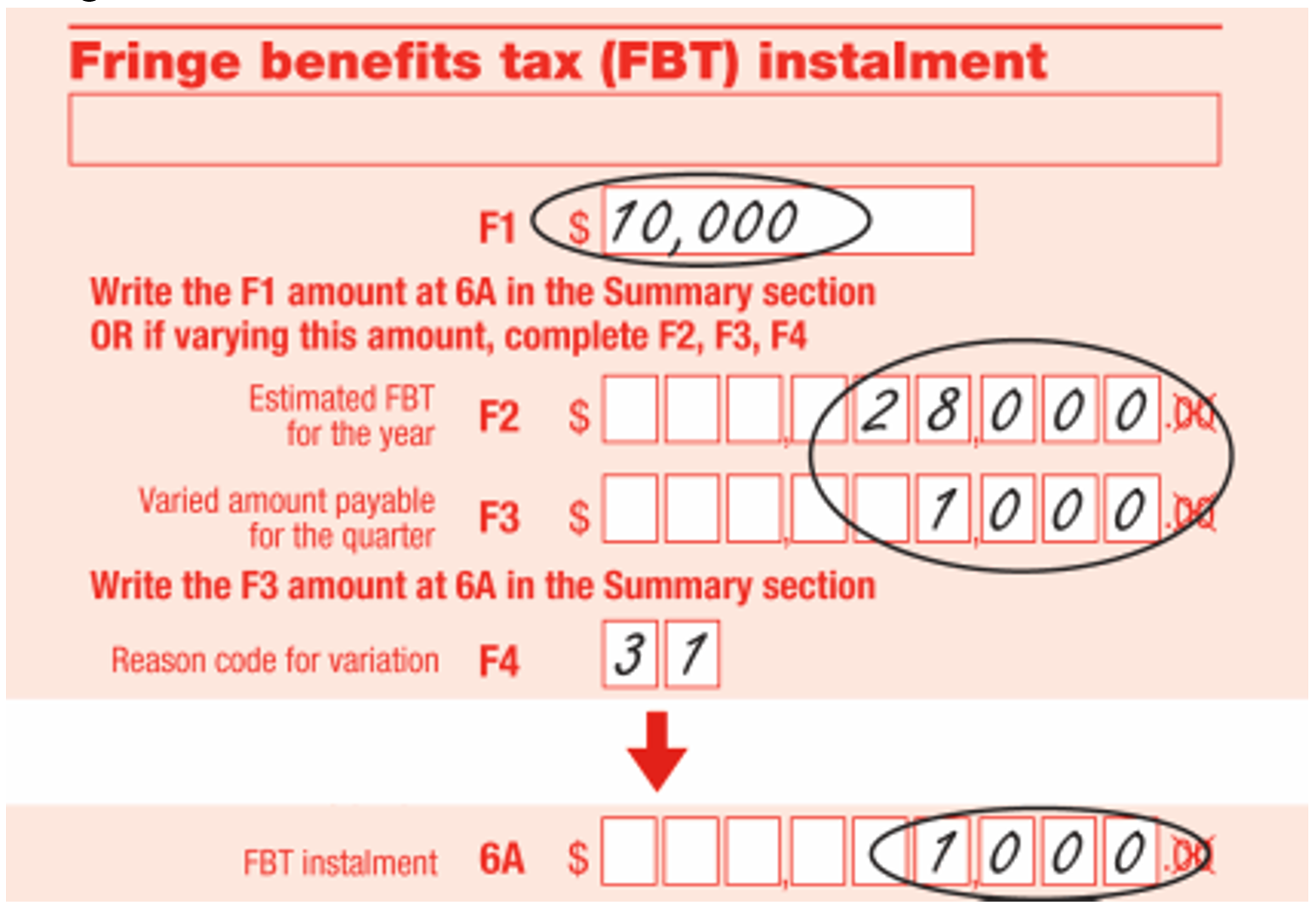

You’ll need to report the fringe benefits you provide if the total taxable value of the benefits for one year exceeds $2000. You can pay FBT quarterly instalments with your activity statements or annually.

This is the general formula for FBT:

FBT Payable = Taxable value of benefit x gross up factor x FBT rate

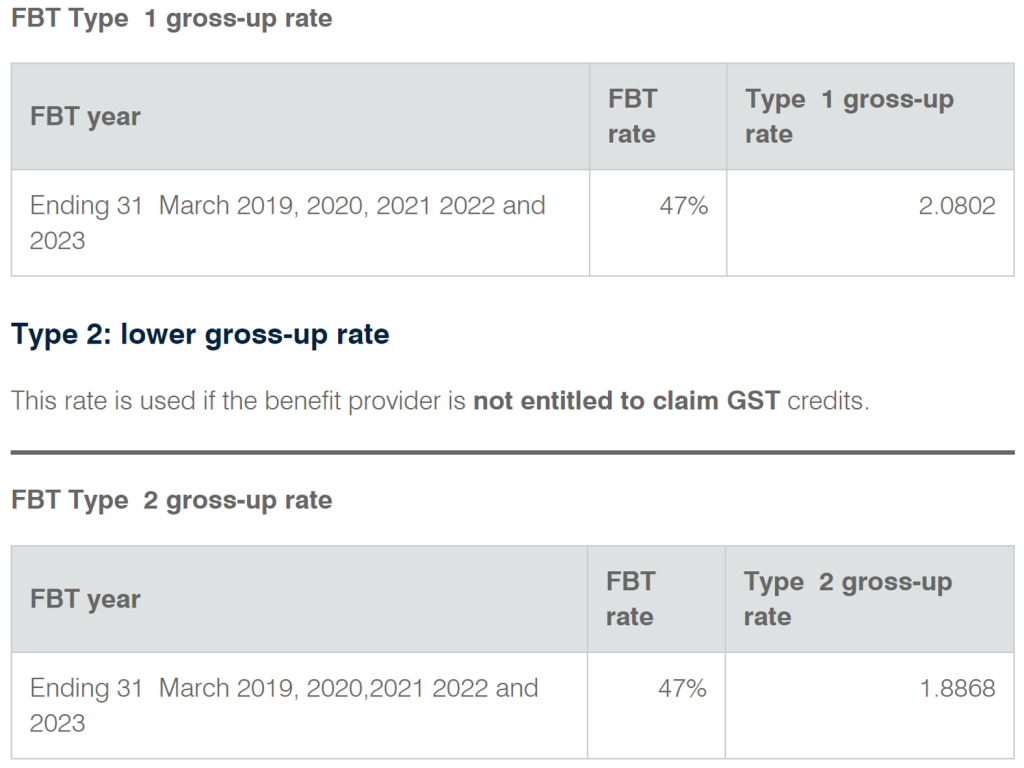

The current FBT rate is 47%, but the taxable value of the benefit depends on the type of fringe benefit, since each has their own rules. The gross up factor is also conditional on whether the employer can claim GST credits.

The FBT year is the 12 months beginning 1 April and ending 31 March, but the ATO requests businesses submit their FBT returns by 21 May.

So record keeping is obviously really important, so that the taxable value of each fringe benefit is evident, and also so employers can take advantage of concessions and exemption that reduce FBT liability.

Let’s break down some of the most popular fringe benefits:

Car fringe benefits

What does ‘private use’ mean? It’s a pretty broad term, so basically if the car is parked at the employee’s residence, and they use it for non-business related travel (including travel to and form work) then it’s considered private use.

To calculate the FBT for car fringe benefits, there are actually two formulas – and you can use whichever will yield the lowest taxable value, just make sure you clearly state which you’ve used in your FBT return.

Statutory Formula Method

Taxable value = ((A × B × C) ÷ D) – E

Where:

A is the base value of the car

B is the applicable statutory percentage (20%)

C is the number of days in the FBT year when the car was used or available for private use of employees

D is the number of days in the FBT year

E is the employee contribution.

Operating Cost Method

Taxable value = (A × B) – C

Where:

A is the total operating costs

B is the percentage of private use

C is the employee contribution

This means you have to calculate the percentage of business and private use of the car, and keep records that substantiate this percentage. To get an accurate calculation, the ATO recommends keep a diary or logbook for 12 continuous weeks, and at the end of each trip record the date, odometer readings, kilometres travelled and the purpose of the journey.

There’s a lot of details regarding car fringe benefits and their tax, so check out the full employers’ guide for car fringe benefits from the ATO to make sure you’re meeting all the requirements.

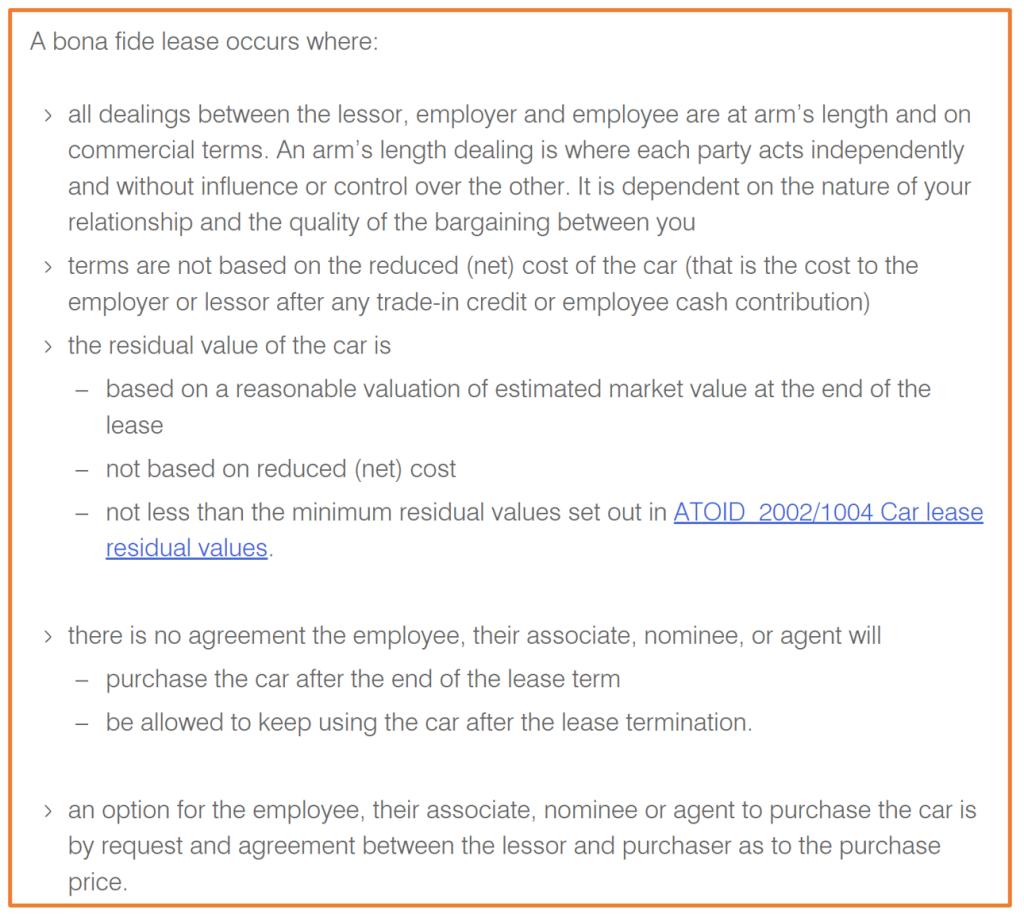

There are also car leasing benefits and car parking benefits. For car leasing, there are only car fringe benefit tax implications if the lease is bona fide – if it’s a non-bona fide lease, it may instead be a property or residual fringe benefit, which could result in a higher FBT liability.

A bona fide lease has a pretty lengthy definition, so here’s what the ATO has to say:

Car parking fringe benefits occur when an employer provides parking to an employee and all of the following conditions are met:

- the car is parked at premises owned or leased by, or otherwise under the control of, the provider (usually the employer)

- the car is parked for a total of more than four hours between 7am and 7pm on any day of the week

- the car is owned by, leased to, or otherwise under the control of, an employee, or is provided by the employer

- the parking is provided in respect of the employee’s employment

- the car is parked at or near the employee’s primary place of employment on that day

- the car is used by the employee to travel between home and work (or work and home) at least once on that day

- there is a commercial parking station that charges a fee for all-day parking within one kilometre of the premises on which the car is parked and

- the commercial parking station fee for all-day parking is more than the car parking threshold, and

- at the beginning of the fringe benefits tax (FBT) year, the commercial parking station fee for all-day parking was more than the car parking threshold.

If it doesn’t meet these requirements, it is exempt from FBT. Parking is also exempt if provided by a small business.

Entertainment fringe benefits

There’s not a specific entertainment category for FBT, so items provided in this area are instead reported as either expense payment, property, residual or tax-exempt body entertainment fringe benefits.

Generally speaking, entertainment fringe benefits are food/drink and recreation provided to employees. This includes a catered Christmas party, concerts, providing a resort holiday for employees and clients, gym memberships, etc.

For food and drink, there is a distinction as to whether they are fringe benefits depending on the purpose and location of where they’re provided. In most cases, the meal must be provided outside of a work environment (yet still for employees) for the purposes of recreation and enjoyment.

For instance, buying food for your team so you can have a lunch meeting would not be considered a fringe benefit, since it is for the purpose of completing work and is provided on location at the company.

Getting a cake for a farewell party that’s held at a venue, however, could be a fringe benefit, as it’s for employees’ recreation outside of the workplace.

To calculate the taxable value of the entertainment, you’ll need to first classify it under a fringe benefit category:

- expense payment: an employee incurs an expense their employer reimburses/directly pays to a third party

- property: providing an employee with property, either at a discount or no cost

- residual: any benefit (including a right, privilege, service or facility) not otherwise fitting in other fringe benefit categories

- tax-exempt body entertainment: employer incurring entertainment expense is exempt from income tax (i.e. charities)

If one of these fringe benefits gives way to meal entertainment, you can elect this expense as ‘meal entertainment’, which is a set fringe benefit category. From here, you can use one of two methods to find the taxable value:

- 50:50 split method: taxable value is 50% of total meal expenditure

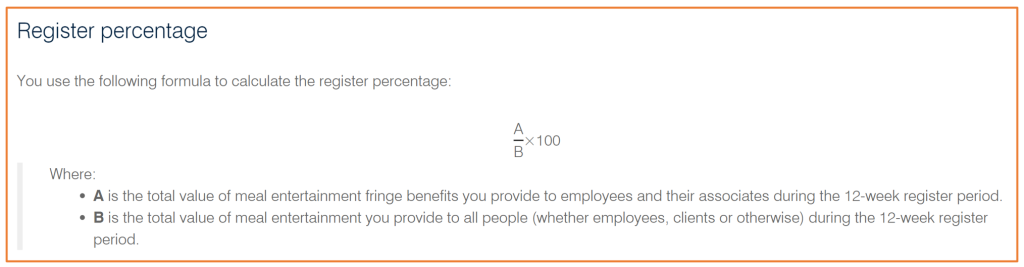

- 12-week register method: total meal expenditure x register percentage

Housing fringe benefits

This type of fringe benefit occurs when an employer provides accommodation for an employee that is their regular residence. A unit of accommodation includes:

- a house, flat or home unit

- accommodation in a house, flat or home unit

- accommodation in a hotel, motel, guesthouse, bunkhouse or other living quarters

- a caravan or mobile home

- accommodation in a ship or other floating structure.

To calculate the taxable value, housing fringe benefits are divided into two sub-categories: where the employee providing the accommodation is also in the businesses of providing this same accommodation to the public, and then all other types of accommodation.

For example, if an employee of a caravan park is provided with a caravan as accommodation, then the taxable value of this accommodation would be 75% of the market rental value, minus any rental payments made by the employee.

However, if the employee was provided with a house within the grounds of the caravan park, then the taxable value would be the market rental value, minus any rental payments made by the employee.

If you have an employee staying in accommodation for multiple years, you can use the market rental value for the first FBT year and use it for the subsequent years, provided its adjusted for inflation.

Alternatively, if the employee occupies the accommodation for less than one year, you’ll need to annualise the market rental value by applying the inflation factor.

If the employee is also provided with meals at this accommodation, then a board fringe benefit tax will also apply. For example, a teacher at a boarding school is provided with a room and two meals a day. The taxable value is $2 per meal per person, minus any payments made by the employee.

COVID-19 fringe tax benefits

Since the pandemic, businesses have been providing benefits for employees relating to vaccinations, working from home, emergency accommodation, etc.

The ATO has made some concessions for these instances, but also added some rules. For instance, if you provided incentives for employees to get vaccinated, especially if it’s a non-cash payment, you might need to pay FBT on it.

It might qualify for an exemption, but you will certainly need to report the payment via Single Touch Payroll (STP) as part of salaries/wages, withhold tax from the amount as part of PAYG withholding, and include it in your employee’s ordinary time earnings so your super contributions for your employee can be determined.

Speaking of exemptions, the minor benefits exemption applies to irregular and infrequent benefits of under $300 – this could cover a vaccination incentive. Alternatively, the otherwise deductible rule means you can reduce taxable amount on benefits by the amount that an employee claims a once only deduction.

This could include providing employees with laptops, printers, phones, etc. to use as they work from home.

Another thing to consider is that if the office/parking garage are closed due to stay-home orders or other related reasons, there will be days where you have not provided parking fringe benefits. This is important to note when it comes to reporting and keeping records.

Furthermore, emergency food, transportation, or accommodation provided by employers to employees for COVID-impact reasons will not be subject to FBT.

Learn about FBT, STP & Payroll Administration

Want to make sure you’re complying with your FBT liability? We’ve got you covered. Our GST, BAS, and Reporting Short Courses are available for Xero, MYOB AccountRight and Essentials, and QuickBooks. These courses also cover other essential transactions and reporting for businesses.

Fringe Benefits tax is also included in our Payroll Administration Training Courses on MYOB, Xero & QuickBooks.

Explore the job description of payroll related tasks and If you’re looking to become confident in using accounting software as a whole, this course is included in the complete training course packages for each software!

-- Did you like what you read? Want to receive these posts via email when they are published? Subscribe below.